$0 swaps on crypto CFDs

Trade all crypto CFDs with $0 overnight costs.

24/7 access, 39 crypto CFDs.

Available for a limited time only.

For beginners

Just getting

started?

Explore the basics and build your confidence.

For intermediate traders

Take your

strategy further

Access advanced tools for deeper insights than ever before.

Professionals

For professional

traders

Discover our dedicated offering for professionals and sophisticated investors.

Trusted by traders worldwide

Since 2006, GO Markets has helped hundreds of thousands of traders to pursue their trading goals with confidence and precision, supported by robust regulation, client-first service, and award-winning education.

Explore more from GO Markets

Platforms & tools

Trading accounts with seamless technology, award-winning client support, and easy access to flexible funding options.

Accounts & pricing

Compare account types, view spreads, and choose the option that fits your goals.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

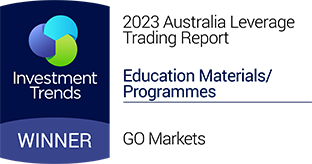

The Federal Reserve delivered its third consecutive rate cut this morning, lowering rates 25 basis points to 3.5%-3.75% after a 9-3 vote in favour.

The three dissents were the most seen since September 2019. Governor Stephen Miran pushed for a steeper 50bp cut while regional presidents Jeff Schmid and Austan Goolsbee wanted to hold steady.

Four additional non-voting participants also preferred no cut at all, exposing deep disalignment on the best policy path going forward.

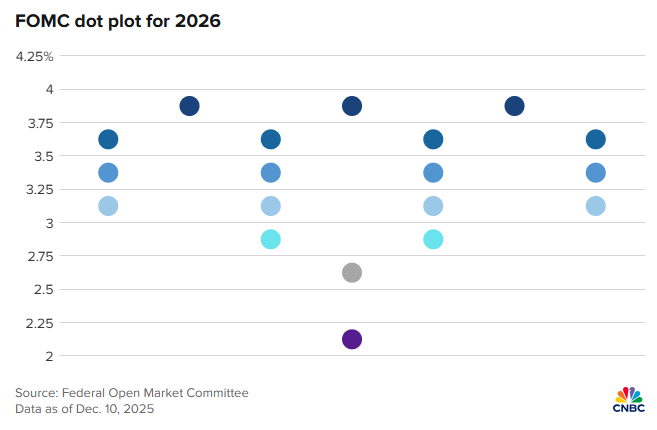

The updated Federal Reserve dot plot maintained projections for just one cut in 2026 and another in 2027, unchanged from September despite three cuts delivered since then.

Seven officials now see no cuts needed next year, while three believe rates are already too low, suggesting the divide between members is set to continue growing in 2026.

In his post-meeting press conference, Fed chair Jerome Powell explicitly stated, "We are well positioned to wait and see how the economy evolves." — phrasing last used when the Fed paused cuts for nine months.

However, with Powell's tenure ending in January and Trump publicly demanding deeper cuts, the Fed continues to face mounting pressure, further clouding 2026 projections.

Markets are currently pricing Kevin Hassett as the next chair, thanks to his apparent accommodation to Trump’s preferences.

Oracle Stock Plummets as Revenue Falls Short of Estimates

Oracle Corporation suffered a 10%+ after-hours selloff today, following fiscal second-quarter results that exposed mounting risks beneath its ambitious AI infrastructure buildout.

Revenue of $16.06 billion fell short of the $16.21 billion Wall Street consensus, triggering a sharp reassessment of one of the most leveraged bets in the AI sector.

The company's total debt now exceeds $105 billion, and the cost of insuring Oracle's debt against default reached its highest level since March 2009, rising to about 1.28 percentage points per year.

Further investor anxiety lies in Oracle's dependence on its contract with OpenAI, which is estimated to account for about 58% of Oracle's future order backlog.

The contract requires OpenAI to pay approximately $60 billion annually to Oracle starting in 2027. However, OpenAI currently only generates around $20 billion in annualised revenue, exposing Oracle to massive counterparty risk if OpenAI doesn’t meet its revenue projections.

Bitcoin Price Narratives Get Murkier

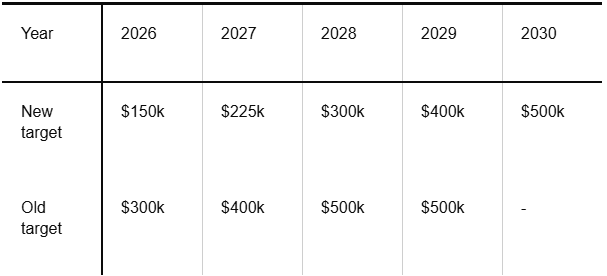

Standard Chartered slashed its 2026 Bitcoin price target from $300,000 to $150,000 yesterday.

Attributed to the apparent end of aggressive corporate Bitcoin accumulation and slower-than-expected institutional adoption through ETFs, it is one of the most dramatic forecast reductions this year.

The bank's updated forecasts project $100,000 by end-2025, $150,000 for end-2026, $225,000 for end-2027, $300,000 for end-2028, and $400,000 for end-2029.

Despite the revision, Standard Chartered explicitly rejects the notion that we have entered a new crypto winter, characterising the current phase as "a cold breeze" rather than structural weakness.

Broader market predictions for 2026 suggest a bearish scenario at $95,241, an average estimate of $111,187, and a bullish case of $142,049.

InvestingHaven forecasts Bitcoin trading between a minimum of $99,910 and a maximum of $200,000 in 2026.

And some bullish analysts like Cardano founder Charles Hoskinson have suggested Bitcoin could reach $250,000 in 2026 if tech giants increase their crypto exposure, indicating considerable divergence in expectations.

.jpg)

US markets are eyeing all-time highs following strong data and earnings reports. Whether these records are achieved will depend on the news flow over the coming days, particularly from the Federal Reserve.

Fed Decision Incoming

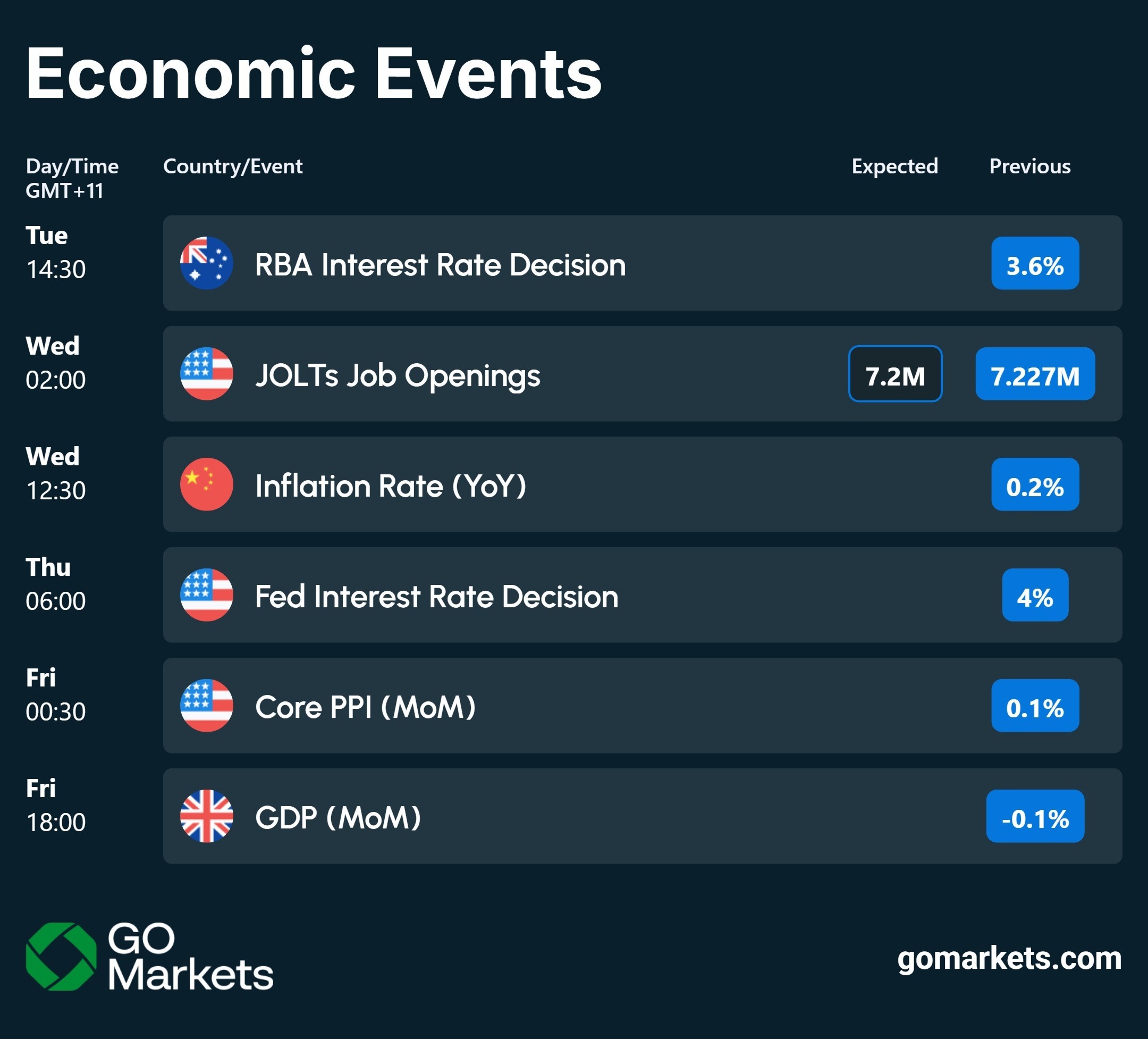

The Federal Reserve's two-day meeting will end this Wednesday with a 0.25% rate cut widely expected. But following Friday's encouraging PCE numbers, the bigger question is “Will there be a January cut?” The Fed press conference post-decision will likely the highest signal event for the rest of 2025.

Central Bank Decisions Everywhere

Beyond the Fed, the Reserve Bank of Australia meets tomorrow with a pause expected, as recent data hasn't provided sufficient incentive for another cut. The ECB, Bank of England, and Bank of Japan will also all announce decisions within the next ten days, creating potential volatility across both equity and FX markets.

Big Tech Earnings

Two major AI infrastructure players report earnings this week: Broadcom and Oracle. These reports come at a time when AI valuations are under heavy public scrutiny, however, they will likely take a backseat to whatever the Fed signals about its 2026 path.

Copper Breaks Out

Copper has rallied to a four-month high and is now testing the $5.50 level. After breaching the key $5.25 support level, the market is showing some hesitation in Asia ahead of major data releases and the Fed decision. The July record highs of $5.50 are now within reach, though it is still to be seen if this level holds or if we pull back toward $5.25 support.

Market Insights

Watch Mike Smith's analysis of the week ahead in markets.

Key Economic Events

Stay up to date with the key economic events for the week.

.jpg)

Bitcoin rebounded 7% to touch $94,000 this week as two of the world's largest asset managers doubled down on their conviction that this cycle could break from crypto's boom-bust past.

BlackRock CEO Larry Fink and COO Rob Goldstein declared tokenisation "the next major evolution in market infrastructure,” comparing its potential to the introduction of electronic messaging systems in the 1970s.

Tokenised real-world assets have exploded from $7 billion to $24 billion in just one year, with certain projections expecting tokenised instruments to comprise 10-24% of portfolios by 2030.

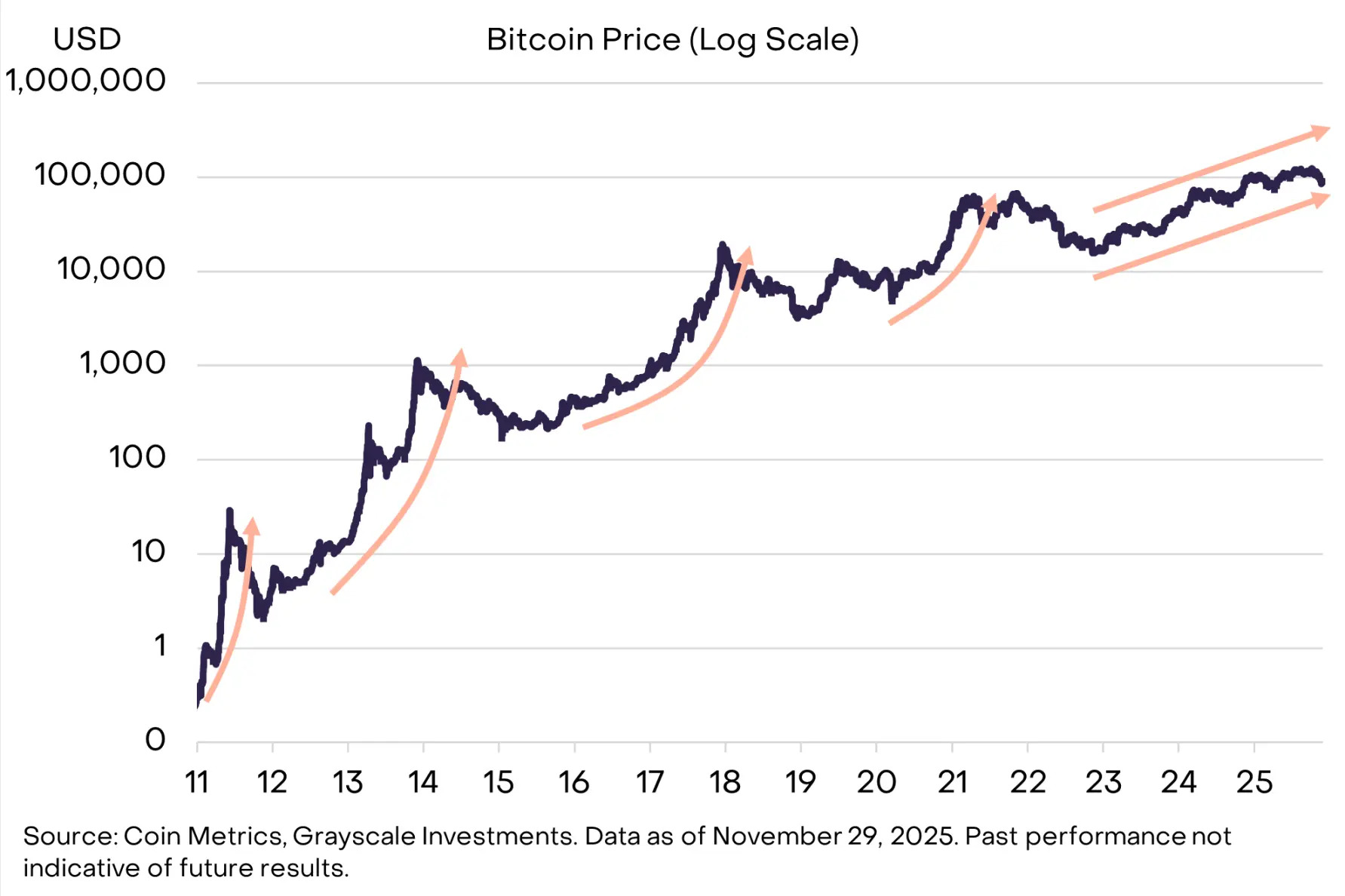

Grayscale's latest research also put forward the case that this cycle will not follow Bitcoin’s predictable four-year pattern. Their analysis shows this cycle has had no parabolic price surge like previous cycles, and capital is flowing through regulated ETPs and corporate treasuries rather than retail speculation.

Grayscale has boldly predicted Bitcoin will reach new all-time highs next year based on this data, with near-term catalysts including a likely Federal Reserve rate cut and advancing crypto legislation.

AI Boom Creating a Memory Chip Supply Crisis

The AI revolution has had an unexpected ripple effect on conventional memory chips (DRAM).

Post-ChatGPT launch in 2022, chipmakers pivoted aggressively toward high-bandwidth memory (HBM) chips — the components that power AI data centres.

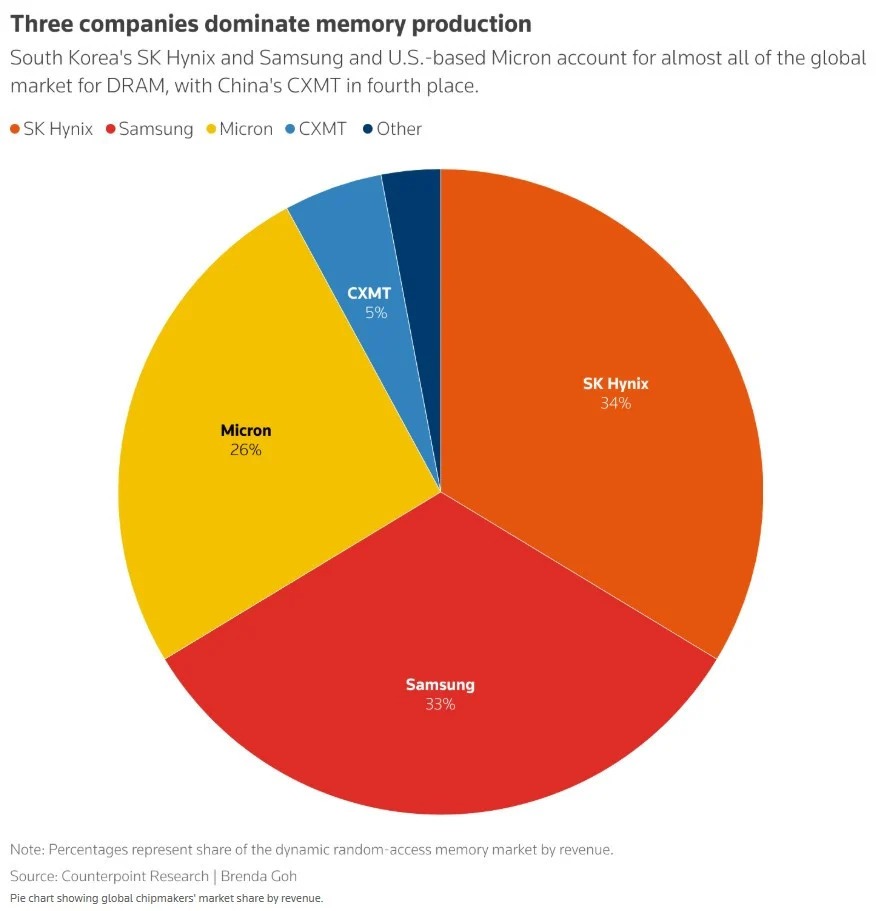

Samsung and SK Hynix, who control roughly 70% of the global DRAM market, transitioned large portions of their production away from conventional chips.

This worked in the short term, but data centre operators are now replacing old servers, and PC and smartphone sales have exceeded expectations (all of which require DRAM).

This saw DRAM supplier inventories fall to just two to four weeks in October, down from 13 to 17 weeks in late 2024.

DRAM spot prices nearly tripled in September this year, while in Tokyo's electronics district, popular gaming memory modules have surged from 17,000 yen to over 47,000 yen in recent weeks.

Google, Amazon, Microsoft, and Meta have all approached Micron with open-ended orders, agreeing to purchase whatever the company can deliver, regardless of price.

Samsung, Micron, and SK Hynix shares have rallied 96%, 168%, and 213% YTD, respectively, thanks to the increased DRAM demand.

Ironically, this recent price surge has seen DRAM chip margins approach those of the advanced HBM chips, meaning non-AI memory could now become equally profitable to produce.