市场资讯及洞察

本周市场进入时将面临密集的美国数据以及月初的亚太地区增长支票。由于美国股市仍相对较高,黄金价格保持在5,000美元以上,短期价格走势可能对任何数据驱动的利率、美元走势和风险情绪的变化特别敏感。

- 美国数据集群: 预计本周将公布ISM制造业、ISM服务业和ADP、非农就业人数(NFP)和零售销售数据。

- 亚太地区增长脉搏: 中国官方采购经理人指数和日本采购经理人指数、澳大利亚国内生产总值和中国财新采购经理人指数提供了区域活动数据。

- 股票: 尽管本周末出现了暂停,但美国主要指数总体上仍相对较高,这可能会增加对负面意外情绪的敏感度。

- 金牌: 已回落至5,000美元以上,使实际收益率和风险情绪成为焦点。

- 地缘政治: 中东地缘政治仍然是背景波动风险。

美国:增长和就业人数

美国周是由一系列紧张的活动、就业和消费者信号所塑造的,这些信号可能会迅速改变短期的利率预期。

市场通常从制造业情绪中获得第一线索,然后将目光投向服务业和私人就业人数,以获得更广泛的需求和招聘势头。

焦点是劳工报告,零售销售在同一窗口中增加了消费者交叉检查。

这种组合可能与美国国债收益率、美元定价和股票情绪有关,尤其是在指数仍处于相对较高水平的情况下。

关键日期

- 美国ISM制造业采购经理人指数: 3 月 3 日凌晨 2:00(澳大利亚东部夏令时间)

- 美国ISM服务业采购经理人指数: 3 月 5 日凌晨 2:00(澳大利亚东部夏令时间)

- 美国 ADP 就业人数: 3 月 5 日上午 12:15(澳大利亚东部夏令时间)

- 美国就业情况(NFP): 3 月 7 日上午 12:30(澳大利亚东部夏令时间)

- 美国每月预付零售额(零售贸易): 3 月 7 日上午 12:30(澳大利亚东部夏令时间)

监视器

- 美国国债收益率对ISM和工资意外情况的反应。

- 美元对利率重新定价的敏感度。

- 股票指数表现,尤其是大盘股的表现。

- 贸易政策的变化,关税的不确定性可能会产生影响。

亚太地区:早期增长信号

亚太地区月初的日历可以快速了解区域活动是稳定还是疲软。

中国的采购经理人指数(官方和财新)为国有企业和私营部门企业提供了互补的视角,而日本的采购经理人指数可以通过增长预期直接影响日元的情绪。

澳大利亚的GDP增加了更广泛的宏观检查,可以影响当地的收益率定价和澳元的走向。总而言之,该集群为区域风险偏好定下了基调,并可能蔓延到大宗商品和基本金属。

关键日期

- 日本采购经理人指数: 3月2日上午11点30分(澳大利亚东部夏令时间)

- 澳大利亚国内生产总值: 3月4日上午11点30分(澳大利亚东部夏令时间)

- 中国官方采购经理人指数: 3 月 4 日下午 12:30(澳大利亚东部夏令时间)

- 中国财新采购经理人指数: 3 月 4 日下午 12:45(澳大利亚东部夏令时间)

监视器

- 澳元和当地对GDP的收益率敏感度。

- 日元对采购经理人指数数据的回应。

- 区域股市和大宗商品对中国活动趋势的反应。

黄金和跨资产敏感度

由于黄金保持在5,000美元以上,它可能会对实际收益率、美元走势和更广泛的风险偏好的变化产生高度反应。

前端利率变动的宏观意外会迅速转化为黄金的波动,而影响石油和通胀预期的地缘政治事态发展也可能放大走势。

实际上,黄金可能充当本周市场如何消化增长、通货膨胀和政策不确定性的实时晴雨表。

监视器

- 美国实际收益率走势。

- 美元方向。

- 股票波动和避险流动。

欢迎来到 2026 年。通货膨胀仍然很棘手,实际收益率仍然很重要,当政策、地缘政治和风险情绪发生变化时,市场可以快速重新定价。

随着澳洲联储下一次决定的临近,澳大利亚证券交易所可能不再是本地故事,而更像是通往更广泛宏观制度的窗口。

- 下一个利率决定是平衡通胀控制、增长风险以及澳元(AUD)如何应对收益率差异和风险情绪。

- 随着融资成本和竞争的转移,贷款人可以充当家庭和中小型企业(SME)信贷条件的实时信号。

- 像MQG和GMG这样的名称可能对全球流动性、风险偏好和贴现率的变化高度敏感。当条件发生变化时,这可以放大动作。

1。联邦银行 (ASX: CBA)

CBA通常被视为国内抵押贷款和融资条件的领头羊。它可以对融资成本和任何拖欠压力的早期迹象做出反应,而不仅仅是 “加息/降息” 的触发因素。

交易者追踪收益率曲线和银行融资利差,因为当故事从净利率(NIM)转变为信贷(坏账)时,这通常是第一个讲述收益率曲线和银行融资利差。

在长期利润率较高的格局中,银行可能首先以 “更高的利润率” 反弹,直到市场开始对信用风险进行定价。

过去,CBA在2026年初创下历史新高,今年迄今为止(YTD)上涨了约11%,之后在更广泛的市场波动下,2月中旬出现回调。

交易者在看什么

- 经纪人处理: 列出的每个经纪商看涨期权都处于看跌一面:4次卖出,1次表现不佳,1次减持。

- 目标和隐含动作: 目标价格从120澳元到140澳元不等。使用 “达到目标的百分比” 一栏,这意味着最后收盘价约为178.68澳元,与显示的目标相比,下跌幅度约为22%至33%(目标是估计值,通常以12个月为基础设定,不能保证)。

- 经纪人语气: 花旗保持卖出(“季度内/有限修订”),而摩根士丹利则认为,该股表现跑赢大盘后,障碍更高,因为 “良好” 可能已不够好。

风险: 下午 2:30(澳大利亚东部夏令时间)事件间隙、急剧逆转以及过多交易者站在同一边时快速抛售。

2。澳大利亚国民银行 (ASX: NAB)

当你试图弄清楚经济的引擎室是呼吸声还是悄悄地过热时,澳大利亚国民银行就是你关注的地方。

当政策保持紧张时,贷款人可以一直保持良好状态,直到他们不这样做。利润率可以捍卫,存款竞争可能会激烈,而 “违约得到遏制” 的舒适线则会受到现实的压力考验。

澳大利亚国民银行倾向于更像发票进行交易:企业在支付什么,他们在拖延什么,以及信心转变时条件变化的速度有多快。

交易者在看什么

澳大利亚国民银行年初至今上涨了约15.46%,该股最近上涨了约49澳元。在最新的报告中,交易员正在关注澳大利亚国民银行第一季度20.2亿澳元的现金利润如何表现出弹性,尽管支出通胀开始蔓延。

- 经纪人处理: 涨跌互现,但偏向谨慎。3次卖出(摩根、花旗、Ord Minnett),1次等权重(摩根士丹利),1次跑赢大盘(麦格理),1次买入(瑞银)。

- 目标和隐含动作: 目标价格从35.00澳元到50.50澳元不等,隐含的最后价格约为49.10澳元,因此大多数目标价格低于市场,瑞银是温和的上行看涨期权。

- 经纪人语气: 瑞银是唯一一个目标为50.50澳元(约+2.85%)的买入。麦格理跑赢大盘,但其47.00澳元的目标仍低于最后的隐含目标。花旗、摩根和Ord Minnett保持卖出,目标股价为35.00澳元至39.25澳元。摩根士丹利持平,为43.50澳元。

风险: 存款竞争、商业信贷质量的转变以及如果 “控制性违约” 不再可信则会快速重新定价,从而挤压利润。

3.麦格理集团 (ASX: MQG)

当你将市场、资产管理、交易和全球对波动性的需求融为一体... 然后交给它一套非常昂贵的西装时,你就会得到麦格理。

麦格理不只是听澳洲联储的话;它还倾听整个房间的心声。全球利率、风险偏好和市场走势通常与马丁广场所说的一切一样重要。

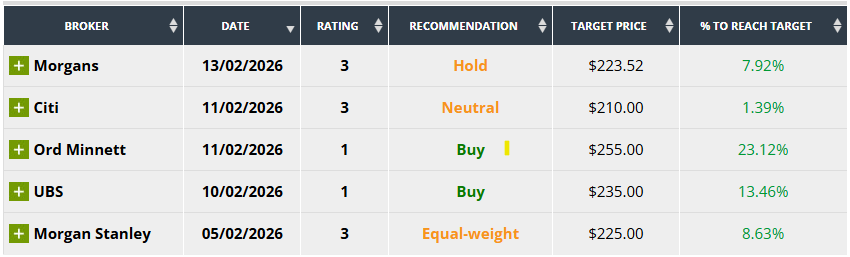

交易者在看什么

尽管自1月1日以来,麦格理的涨幅约为+1.93%,但交易者正在关注全球收益率、波动率机制的变化以及对交易流程和交易条件的深入了解。

- 经纪人处理: 该表显示的组合主要是支撑性组合,没有直接卖出。

- 目标和隐含动作: 隐含的最后价格约为207.12澳元。所示经纪商的平均目标约为229.70澳元(约合10.9%),目标在210.00澳元至255.00澳元之间。

- 经纪人语气: Ord Minnett和瑞银持有,花旗持有,摩根士丹利持有,摩根士丹利持有。支持,但不一致。

风险: 流动性冲击、波动性 “气囊”,以及如果全球条件恶化,则会出现快速的降级周期。

4。昆士兰银行保险集团 (ASX: QBE)

在较高利率的制度中,保险公司可能会显得异常 “干净”,因为他们的上市量终于可以再次获得收益。当收益率上升时,投资收入可以开始实际发挥作用,并且可以抵消很多... 直到世界提醒所有人为什么保险存在。

昆士兰银行是一场拉锯战,介于更高的利率帮助投资组合和灾难风险加上试图收回利息的索赔通货膨胀。

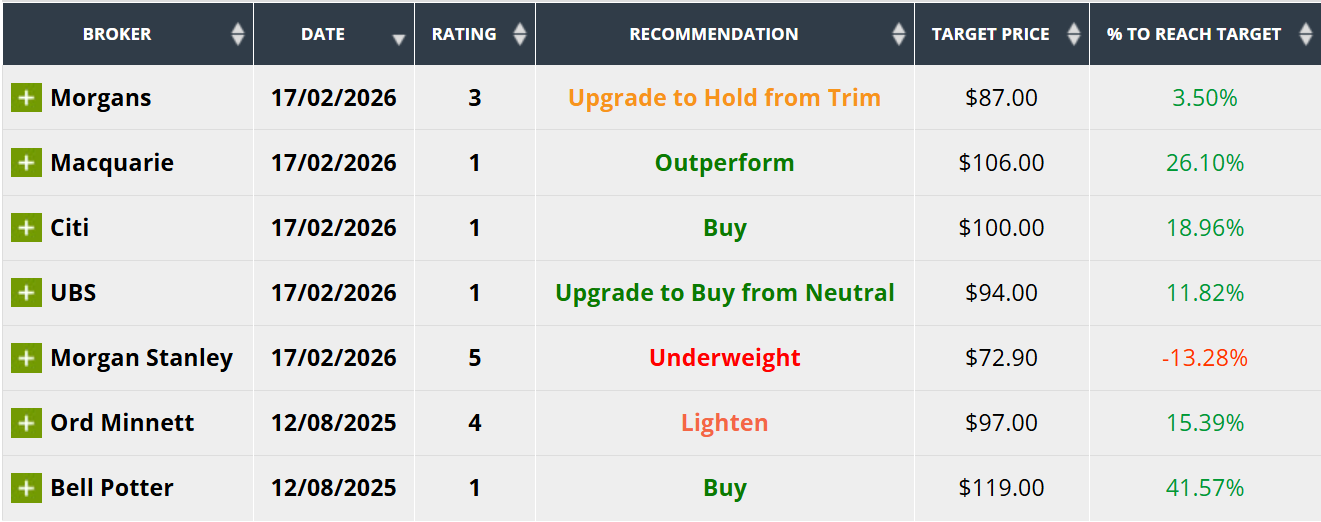

交易者在看什么

昆士兰银行自1月1日以来约为+10.06%,在最新的报告中,交易者正在关注投资收益率趋势、灾难损失头条以及定价周期降温的任何迹象。

- 经纪人处理: 经纪商看涨期权显示乐观:跑赢大盘(麦格理)、买入(花旗、瑞银)、增持(摩根士丹利),以及两次从持仓上调买入(Ord Minnett、Bell Potter)。

- 目标和隐含动作: 该表显示最新价格约为21.89澳元。目标价格从21.80澳元到26.00澳元不等。所示经纪商的平均目标约为24.06澳元(约合+9.9%)。

- 经纪人语气: Ord Minnett的最高目标为26.00澳元(约合18.78%)。贝尔波特也被显示为买入的升级,但目标价略低于隐含最后一点(-0.41%)。

风险: 重大灾难事件,声称通货膨胀和市场定价 “峰值利率” 还为时过早。

5。古德曼集团 (ASX: GMG)

古德曼集团是利率故事与估值故事的交汇点。当收益率上升时,由于贴现率不再是理论上的,长期股票将被重新定价。

GMG仍然可以进行运营,但股票的交易方式通常是就资本成本、上限利率以及市场认为未来越来越便宜还是更昂贵的全民公决。

交易者在看什么

GMG年初至今约为+2.86%,交易员关注10年期国债收益率、市值利率动态、融资状况和数据中心叙事势头。

- 经纪人处理: 经纪商看涨期权显示正向偏差,没有卖出。3次买入(贝尔波特、花旗、瑞银),外加累积(摩根)、跑赢大盘(麦格理)、增持(摩根士丹利)和1次持有(Ord Minnett)。

- 目标和隐含动作: 目标价格从31.25澳元到41.50澳元不等。隐含的最后收盘价约为28.42澳元,表中的简单平均目标价约为36.35澳元(比隐含的最后收盘价高出约27.9%)。

- 经纪人语气: 摩根士丹利最看好目标价为41.50澳元(+46.02%)。花旗也持建设性看法,买入价格为40.00澳元(+40.75%)。Ord Minnett是持仓的谨慎异常值,为31.25澳元(+9.96%)。

风险: 收益率上升时的估值压缩、再融资叙述和上限利率重新定价。

6。JB Hi-Fi (澳大利亚证券交易所股票代码:JBH)

JB Hi-Fi往往会随着家庭预算的情绪而变化。当消费者保持稳定,促销活动保持可控时,故事可能看起来很简单。

当支出紧缩和折扣增加时,市场会迅速转向利润风险和指导风险。

交易者在看什么

自1月1日以来,JB Hi-Fi约为-12.64%,交易者正在密切关注销售势头与消费者信心、促销强度和利润弹性。

- 经纪人处理: 总体而言,这种组合是建设性的,但并不一致。该表显示了2次买入(花旗、贝尔波特)加上1次从中性(瑞银)升级为买入,1次跑赢大盘(麦格理),1次从Trim(摩根士丹利)升级为持有,以及另外两个谨慎的看涨期权,即减持(摩根士丹利)和Lighten(Ord Minnett)。

- 目标和隐含动作: 目标价格从72.90澳元到119澳元不等,隐含的最后收盘价约为84.06澳元。表中的简单平均目标约为96.56澳元(比隐含的最后收盘价高出约+14.9%)。

- 经纪人语气: 贝尔波特最看好目标价为119.00澳元(+41.57%)。麦格理对跑赢大盘也持乐观态度,为106.00澳元(+26.10%)。谨慎方面,摩根士丹利减持,为72.90澳元(-13.28%)。表格中的最新变更说明显示,瑞银从中立上调至买入,摩根从Trim升级为持有(均为2026年2月17日)。

风险: 失业意外、折扣造成的利润损失以及围绕消费者数据的快速情绪逆转。

7。柔道资本 (ASX: JDO)

柔道资本是你可以在屏幕上放的 “中小型企业(SME)信贷加资金竞赛” 的最简洁的表达。

它是一家专注的贷款机构,一个浮动利率的贷款账簿,在融资成本和违约决定同时开始对话之前,它的增长看上去很英勇。

在 RBA 敏感的磁带中,柔道可以像论文一样移动,你无法暂停。利差、存款、信贷质量和情绪都是实时重新定价的。

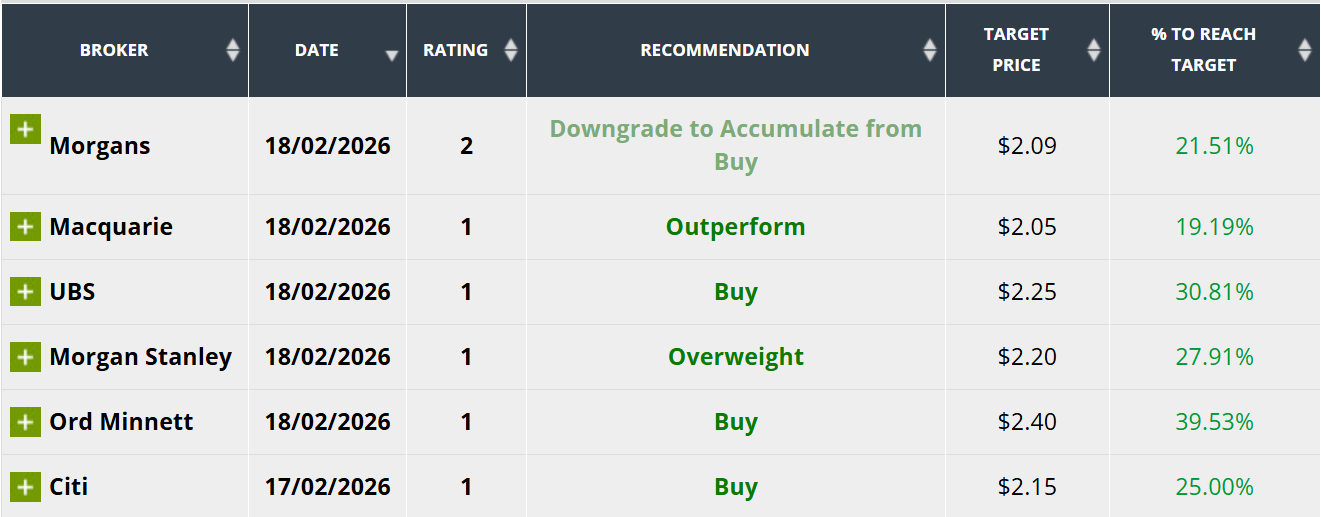

交易者在看什么

自1月1日以来,柔道下跌了约-0.58%,这意味着交易者正在关注净利率(NIM)与存款的竞争、中小企业的欠款和违约信号以及资金压力的任何变化。

- 经纪人处理: 显示的呼叫均为正数。摩根是累积评级(被视为从买入降级)。麦格理跑赢大盘。摩根士丹利增持。瑞银、Ord Minnett和花旗均为买入。

- 目标和隐含动作: 目标价格从2.05澳元到2.40澳元不等,隐含的最后收盘价约为1.72澳元。表中的简单平均目标约为2.19澳元(比隐含的最后收盘价高出约27%)。

- 经纪人语气: Ord Minnett最看好目标价,为2.40澳元(+39.53%)。瑞银以2.25澳元(+30.81%)的价格买入。摩根士丹利增持为2.20澳元(+27.91%)。花旗以2.15澳元(+25.00%)的价格买入。在下调Acculate评级后,摩根股价为2.09澳元(+21.51%)。麦格理跑赢大盘,为2.05澳元(+19.19%)。

风险: 中小企业信贷在放缓时转速很快,融资竞争可以比贷款收益率重新定价更快地挤压利差。

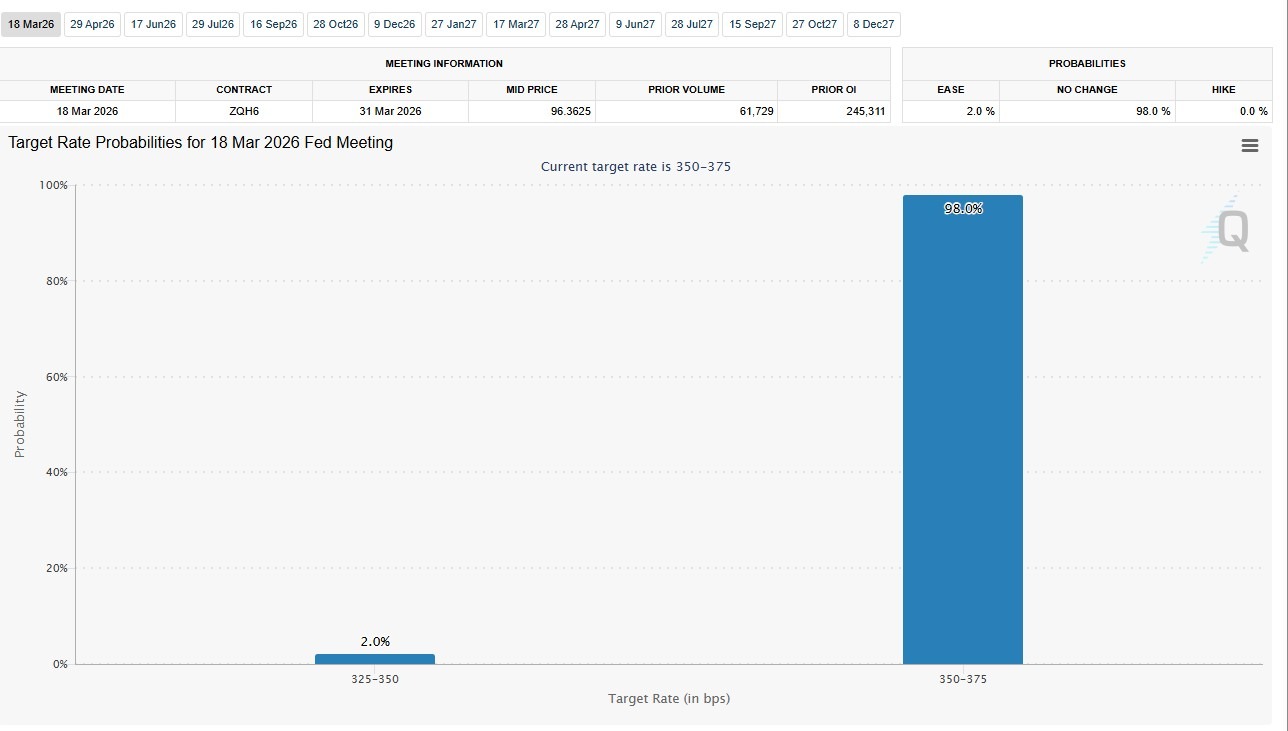

3月份定为美国资产的 “重新定价月”。联邦公开市场委员会会议是中心点,CME FedWatch将暂停作为主要基线。在这种情况下,市场可能会对意外情况变得更加敏感,尤其是那些改变粘性通货膨胀和需求放缓之间感知平衡的印刷品。

费率和政策

关键日期

- 联邦公开市场委员会会议(为期两天): 3月18日至19日(澳大利亚东部夏令时间)。

- 美联储决定(联邦公开市场委员会声明): 3月19日凌晨5点(澳大利亚东部夏令时间)。

- 美联储新闻发布会: 3月19日上午5点30分(澳大利亚东部夏令时间)。

市场在寻找什么

即使利率保持不变,该决定仍然可以通过更新的预测、政策声明和主席的指导来推动市场。

由于暂停的代价在很大程度上,注意力从 “变动与不动” 转向美联储的消息是否证实了当前的利率路径,还是将预期推向了更长期的更高立场或更早的宽松政策。

风险平衡的任何变化(通货膨胀与增长/财务状况)都可能推动前端利率、美元和股票倍数的重新定价。

通货膨胀与联邦观察定价的联系

关键日期

- 消费者价格指数(CPI): 3月11日晚上 11:30(澳大利亚东部夏令时间)。

- 个人收入和支出/个人消费支出(一月份个人消费支出): 3月13日晚上 11:30(澳大利亚东部夏令时间)。

市场在寻找什么

当市场停滞不前时,通货膨胀可能成为预期政策路径的关键波动因素。

稳健的通货膨胀状况可以推动隐含利率走高并收紧财务状况,而较软的通货膨胀状况可以强化暂停的说法,拉动下调预期。

在政策决定之前得出的通货膨胀数据往往对即时重新定价产生更大的影响,而后来的通货膨胀/消费脉冲可能会影响月末的定位和市场对反通货膨胀趋势的信心。

就业数据:下一次对利率预期的考验

关键日期

- ISM 制造业 PMI:3月3日凌晨2点(澳大利亚东部夏令时间)。

- ISM 服务采购经理人指数:3月5日凌晨2点(澳大利亚东部夏令时间)。

市场在寻找什么

在主要的通货膨胀和政策催化剂出现之前,就业人数、失业率和工资信号可以重置收益率、美元和股票的基调。

实际上,意外往往首先出现在前端利率和利率波动中,然后渗透到更广泛的风险情绪和股票定价中,尤其是在数据质疑需求降温和工资压力的假设时。

股票、关税和地缘政治

市场在寻找什么

美国指数对利率叙述仍然高度敏感。最近几周,标准普尔500指数(SPX)和纳斯达克100指数(NDX)的交易价格相对较高,VIX提供了隐含波动率状况的解读。

除了数据日历之外,财报季的尾声仍可能产生特定股票的波动。关税和贸易政策也仍然是实时的宏观风险,对进口商的官方指导能够影响成本、利润率和行业情绪。

美国最高法院还裁定,IEEPA没有授权根据该法规征收关税。这可能会增加特朗普关税法律基础的不确定性。

在地缘政治方面,中东再次出现紧张局势,恰逢原油价格走强,这可能会影响CPI和美联储周前后的通胀预期和风险偏好(以及其他驱动因素)。

3月份的外汇(FX)市场可能会受到集中在本月上半月左右发布的几份具有高影响力的报告的影响。随着本月的推移,中国采购经理人指数、澳大利亚国内生产总值、日本国内生产总值和美联储3月份的会议都可能影响外汇情绪。

事实速览

- 美国的利率预期保持稳定,CME FedWatch暗示3月联邦公开市场委员会会议上不变利率的可能性超过85%。

- 中国采购经理人指数、CPI/PPI和贸易数据将有助于塑造月初的区域风险基调。

- 澳大利亚的国内生产总值、澳大利亚央行的决定、劳动力数据和消费者价格指数为澳元创造了一个集中的国内事件窗口。

- 日本国内生产总值和日本银行(BoJ)政策会议可能会影响国内收益率的重新定价和日元的波动。

- 欧元区消费者价格指数、工业生产和欧洲央行货币政策决定仍然是欧元稳定的关键。

美元 (USD)

关键事件

- 非农就业人数: 3 月 7 日上午 12:30(澳大利亚东部夏令时间)

- 消费者价格指数(CPI): 3 月 11 日晚上 11:30(澳大利亚东部夏令时间)

- 零售销售: 3 月 17 日晚上 11:30(澳大利亚东部夏令时间)

- 美联储的政策决定: 3 月 19 日凌晨 5:00(澳大利亚东部夏令时间)

- 美联储新闻发布会: 3 月 19 日上午 5:30(澳大利亚东部夏令时间)

要看什么

美元仍然主要受通货膨胀和劳动力数据及其对美联储定价的影响所驱动。

芝加哥商品交易所FedWatch的定价表明,在3月的联邦公开市场委员会会议上,市场认为不变利率的可能性超过85%。这表明目前的定位是以暂停为基础的,这增加了对任何可能改变预期的通胀意外情况的敏感度。

由于暂停在很大程度上,美元的走势可能更多地取决于通货膨胀轨迹和长期政策预期,而不是决定本身。更坚挺的消费者价格指数或弹性的劳动力数据可能会强化收益率支持。

关键图表:美元指数(DXY)周线图

欧元(欧元)

关键事件

- 欧元区消费者价格指数(初步估计): 3 月 3 日晚上 10 点(澳大利亚东部夏令时间)

- 欧元区工业生产: 3 月 13 日晚上 9:00(澳大利亚东部夏令时间)

- 欧洲央行货币政策决定: 3 月 20 日上午 12:15(澳大利亚东部夏令时间)

- 欧洲央行新闻发布会: 3 月 20 日上午 12:45(澳大利亚东部夏令时间)

- 欧元区采购经理人指数初值: 3月24日晚上 8:00(澳大利亚东部夏令时间)

要看什么

欧元的走势仍然与通货膨胀的持续性以及增长数据是否稳定了对欧洲央行政策的预期有关。

持续的通货膨胀或活动数据的改善可能会限制宽松预期并支撑欧元。通货膨胀疲软和生产数据疲软可能会增加下行压力,尤其是在美国数据保持坚挺的情况下。

欧元/美元的每日结构在今年早些时候上行延期后出现盘整。短期势头有所减缓,价格保持在长期支撑位上方。

关键图表:欧元/美元日线图

日元 (JPY)

关键事件

- 日本国内生产总值(2025年第四季度,第二次估计): 3月10日上午10点50分(澳大利亚东部夏令时间)

- 日本央行政策会议: 3 月 18 日至 19 日(澳大利亚东部夏令时间)

- 日本央行关于货币政策的声明: 3 月 19 日(澳大利亚东部夏令时间)

要看什么

日元对国内增长数据和日本央行的政策决策仍然敏感。收益率预期和政策正常化信号继续影响美元/日元和跨日元的波动。

日本央行政策会议和随后的沟通可能会影响短期波动和长期利率预期,进而影响日元的情绪。

更强劲的GDP或强化正常化的政策信号可以通过国内收益率调整来支撑日元。更谨慎的消息可能会维持收益率差异,有利于美元和澳元。

关键图表:澳元/日元周线图

澳元 (AUD)

关键事件

- 澳大利亚国内生产总值: 3月4日上午11点30分(澳大利亚东部夏令时间)

- 澳洲联储货币政策决定: 3 月 17 日下午 2:30(澳大利亚东部夏令时间)

- 劳动力调查: 3 月 19 日上午 11:30(澳大利亚东部夏令时间)

- 消费者价格指数(CPI): 3月25日上午11点30分(澳大利亚东部夏令时间)

要看什么

澳元面临的国内日历以3月16日至17日的澳洲联储会议为中心。增长、劳动力和通货膨胀数据集中在三周的时间内,这增加了波动的可能性。

更强劲的GDP或持续的通货膨胀可能会增强政策谨慎性并支撑澳元。疲软的劳动力或消费者价格指数结果可能会打压利率预期并给澳元带来压力,尤其是兑美元和日元。

本月初的中国数据也可能影响地区情绪和澳元等与大宗商品挂钩的货币。

3月份以月初的中国经济活动和通货膨胀数据开幕,随后是来自日本的大量市场相关数据报告,而澳大利亚储备银行(RBA)则在月中开会,市场目前定价将暂停政策利率

中国

中国3月份的前景充满了活动、通货膨胀和贸易数据,这些数据可以迅速设定该地区的风险基调。市场反应可能取决于政策解释和流动性状况,也可能取决于任何数据意外本身。

关键日期

- 中国制造业和非制造业采购经理人指数: 3 月 2 日下午 12:30(澳大利亚东部夏令时间)

- 中国财新采购经理人指数: 3 月 5 日(澳大利亚东部夏令时间)

- 中国消费者价格指数: 3 月 9 日下午 12:30(澳大利亚东部夏令时间)

- 中国生产者价格指数: 3 月 9 日下午 12:30(澳大利亚东部夏令时间)

- 中国贸易差额: 3 月 10 日(澳大利亚东部夏令时间)

市场相关性

中国3月份的概况是前期数据驱动的,前10天可能是更广泛的地区情绪的焦点。

采购经理人指数数据可以为工业和服务业的势头提供早期信号,而消费者价格指数可以预测国内需求和定价压力。

由于上证综合指数的交易价格仍接近2010年代中期的水平,市场反应可能既取决于总体意外情况,也可能取决于政策解释和流动性状况。

日本

日本本月的重点是确认增长,随后是可能重新调整日元势头的政策信号。

关键日期

- 日本采购经理人指数: 3月2日上午11点30分(澳大利亚东部夏令时间)

- 日本第四季度国内生产总值初值: 3月10日上午10点50分(澳大利亚东部夏令时间)

- 日本央行的政策决定: 3 月 19 日(澳大利亚东部夏令时间)

市场相关性

日经225指数目前接近历史新高,这可能会增加对政策基调的敏感度。

国内生产总值可能有助于验证增长可持续性和国内需求趋势,而日本央行的指导可以塑造收益率曲线和利率预期。

澳大利亚

澳大利亚3月的日历以增长、政策和通货膨胀信号为中心,这些信号可能会影响对国内前景和澳元的预期。如果政策保持稳定,焦点可能会转移到增长的持久性以及通货膨胀的粘性上。

关键日期

- 澳大利亚国内生产总值(国民账户): 3月4日上午11点30分(澳大利亚东部夏令时间)

- 澳洲联储的货币政策决定: 3 月 17 日下午 2:30(澳大利亚东部夏令时间)

- 澳大利亚劳动力: 3 月 19 日上午 11:30(澳大利亚东部夏令时间)

- 澳大利亚居民消费价格指数: 3月25日上午11点30分(澳大利亚东部夏令时间)

市场相关性

尽管澳洲联储的决定决定了利率路径预期和前瞻性指导,但工党数据为工资和消费前景提供了依据,而消费者价格指数证实或挑战了通货膨胀轨迹。

澳大利亚证券交易所200指数的交易价格接近历史新高,澳元兑几个主要交叉盘表现出多年的相对强势。如果澳洲联储暂停,焦点可能会从利率方向转移到增长耐久性和通胀持续性上。

全球 首次公开募股(IPO) 市场在 2025 年复苏。1,293家上市公司的收益增长了39%,达到1718亿美元,这是自疫情后繁荣以来最大的年度反弹。

这种势头现已延续到2026年,一些金融分析师推测这可能是历史上最大的首次公开募股年份。

包括SpaceX、OpenAI和Anthropic在内的少数大型私营公司正在探索今年上市,其总估值可能超过3万亿美元。

2025 年 IPO 市场数据

2026 年最佳首次公开募股候选人

1。SpaceX——估值1.5万亿美元

据报道,SpaceX的收入在2025年达到150亿美元,分析师预计到2026年将增加到220-240亿美元。该公司多年来一直保持正现金流,这主要是由其Starlink卫星宽带网络推动的。

继2026年2月全股收购埃隆·马斯克的人工智能公司xAi之后,合并后的实体还包括Grok AI和社交媒体平台X(Twitter)。

领先的金融分析师报告称,SpaceX的目标是2026年中期上市。据估计,其下一轮融资将筹集约500亿美元,使其初始市值达到1.5万亿美元,这将使其成为有史以来第二高的IPO估值。

这一估值意味着SpaceX的交易价格将是2026年预计销售额的62-68倍。高昂的溢价需要围绕Starlink和长期的天基人工智能雄心壮志进行大规模的增长假设。

2。OpenAI-估值8500亿美元

ChatGPT背后的公司OpenAI现在报告其开创性的人工智能产品的每周活跃用户超过8亿。

它最初是一个非营利性研究实验室,现已重组为营利性实体,为消费者、企业和开发人员应用程序开发大型语言模型。

据报道,OpenAI的目标是2026年第四季度首次公开募股,完成超过1,000亿美元的融资(有史以来最大的一轮融资),其估值将达到8,500亿美元。

但是,OpenAI仍需要克服一些短期障碍,以实现与如此高的估值相关的潜力。

它预计2026年将出现140亿美元的亏损,预计在2029年之前不会盈利。它正面临来自谷歌双子座和其他削减其市场份额的人工智能初创公司的激烈竞争,埃隆·马斯克已对该公司提起诉讼,要求赔偿高达1340亿美元。

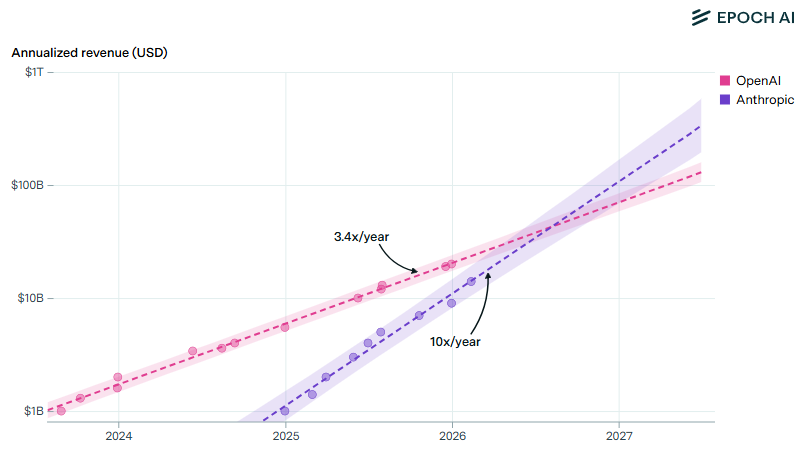

3.Anthropic——估值3500亿美元

尽管OpenAI倾向于消费品,但Anthropic的业务是围绕企业采用而建立的。其收入中约有80%来自企业客户,《财富》10强中有8家现在是Claude的用户。

Anthropic于2026年2月完成了300亿美元的融资,估值为3500亿美元,是其五个月前1830亿美元估值的两倍多。

自2024年以来,Anthropic的年化收入一直以每年10倍的速度增长,远远超过了OpenAI每年3.4倍的增长。如果这种趋势继续下去,到2026年中期,Anthropic的收入可能会超过OpenAI。但是,自2025年7月以来,Anthropic的增长率已放缓至每年7倍。

Anthropic已聘请威尔逊·桑西尼律师事务所开始为首次公开募股做准备,而微软前首席财务官克里斯·利德尔最近被任命为董事会成员,这表明在2026年底可能的上市之前,治理将得到推动。

该公司尚未盈利,但其以企业为主的收入结构和快速的增长轨迹使其成为今年最受关注的首次公开募股候选人之一。

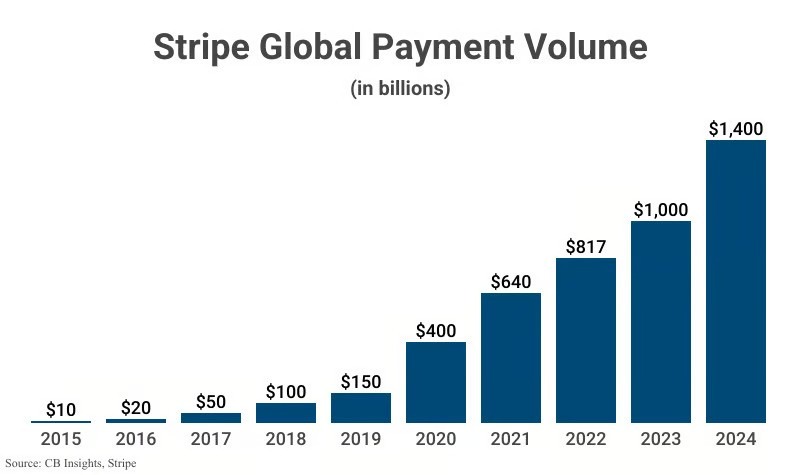

4。Stripe——估值为140亿美元

Stripe 在 2024 年处理的总支付额为 1.4 万亿美元,约占全球国内生产总值的 1.3%。财富100强中有一半的人现在使用Stripe,而最近进入稳定币和人工智能到人工智能的 “代理商务” 支付领域正在扩大其潜在市场。

Stripe仍然是全球最受期待的金融科技IPO之一,但该公司过去表现出上市的紧迫性。联合创始人约翰·科里森于2026年1月在达沃斯表示,Stripe “仍然不着急”。

Stripe没有进行首次公开募股,而是每六个月进行一次招标,估值不断上升,在不放弃控制权的情况下为员工提供流动性。

这些频繁的招标实际上是公开市场之外的私人市场替代方案。但是,传统的首次公开募股仍在进行中,该公司2月份的要约估值为1400亿美元或以上,自2024年以来的盈利能力消除了上市的主要障碍之一。

5。Databricks——估值1340亿美元

Databricks 于 2026 年 2 月完成了 50 亿美元的融资,估值为 1340 亿美元。

2026年1月,该公司的年化收入超过54亿美元,同比增长65%,其中人工智能产品创造了14亿美元。

首席执行官阿里·戈德西曾表示,该公司准备 “在时机成熟时” 上市,大多数分析师预计将在2026年下半年上市。Databricks的估值为1340亿美元,是上市竞争对手Snowflake的两倍多(约合580亿美元)。

底线

按估值计算,2026年有可能成为历史上最大的首次公开募股年份。SpaceX和Databricks是最有可能的候选人,其本身与2025年所有首次公开募股的总估值相当。

如果像OpenAI和Anthropic这样的主要人工智能参与者以及世界领先的支付金融科技公司Stripe也在年底之前上市,那么仅通过首次公开募股,2026年全球市场的总增加值就可能超过3万亿美元。

市场将进入未来一周,澳大利亚和日本的通货膨胀数据,以及地缘政治紧张局势的加剧,继续影响能源价格和更广泛的风险情绪。

- 澳大利亚居民消费价格指数(CPI): 通货膨胀数据可能会影响 澳大利亚储备银行(RBA))政策路径,澳元(AUD)和当地收益率对任何意外都很敏感。

- 日本数据集群: 东京消费者价格指数(初值)加上工业生产和零售销售提供了通货膨胀和活动脉冲,可能会影响日本银行(BoJ)的正常化预期。

- 欧元区和德国居民消费价格指数: 通胀速率数据将考验反通货膨胀的说法,并影响欧洲央行的降息时机预期。

- 石油和地缘政治: 由于中东紧张局势再起,布伦特原油创下2025年8月8日以来的最高收盘价,这加剧了能源驱动的通胀风险。

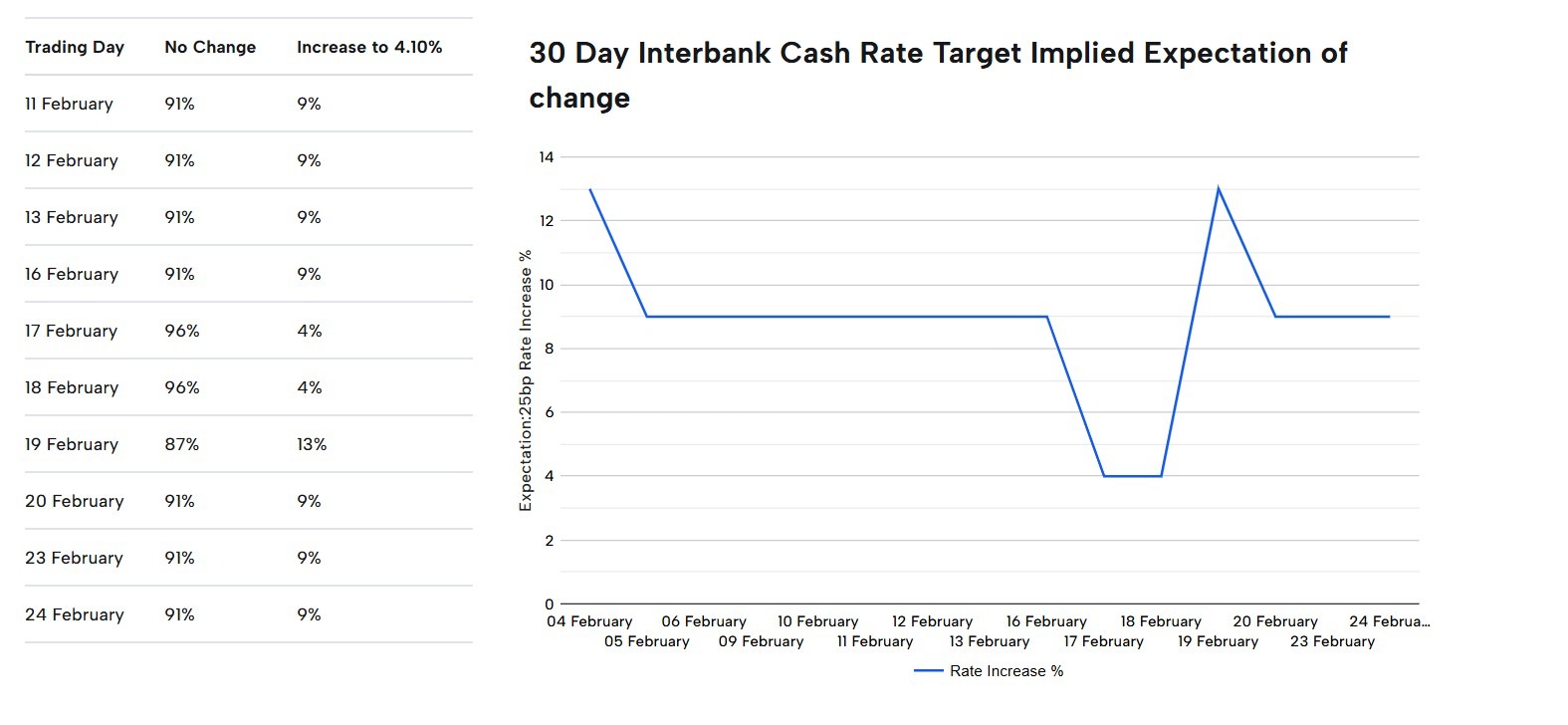

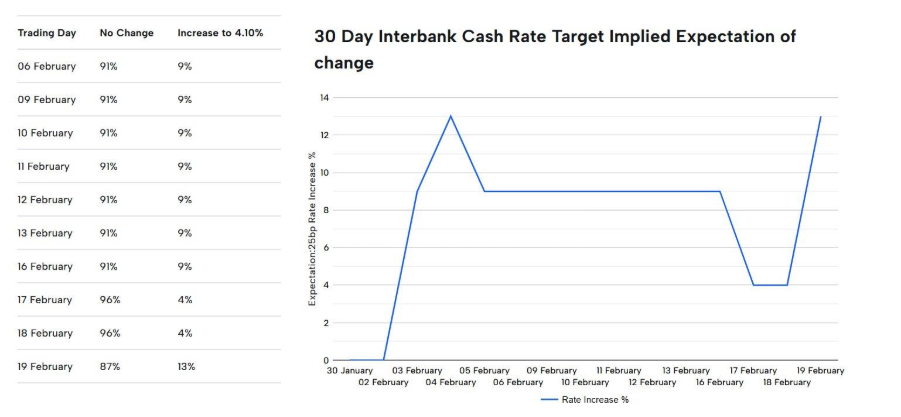

澳大利亚消费者价格指数:澳大利亚央行的预期会发生变化吗?

澳大利亚即将发布的消费者价格指数将受到密切关注,以了解通货膨胀是否稳定或超过预期的持续性。

随着利率预期的调整,强于预期的印刷量可能与更高的收益率和更高的澳元走强有关。较软的结果可能会支持人们对更稳定的政策立场的预期。

关键日期

- 通货膨胀率(MoM): 2月25日星期三上午 11:30(澳大利亚东部夏令时间)

- CPI: 2月25日星期三上午 11:30(澳大利亚东部夏令时间)

监视器

- 澳元在发布前后波动。

- 地方债券收益率反应。

- 利率定价变化。

日本通货膨胀和增长数据

日本周末发布的公告将东京消费者价格指数(初值)与工业生产和零售销售相结合,为价格压力和国内需求提供了更广泛的解读。

东京消费者价格指数通常被视为全国通胀动态和日本央行辩论的及时信号。工业产出和零售支出增加了活动的背景。

整个集群的意外情况可能会推动日元的急剧波动,特别是如果结果改变了人们对日本央行正常化步伐和持续性的看法。

关键日期

- 东京居民消费价格指数: 2月27日星期五上午 10:30(澳大利亚东部夏令时间)

- 工业生产: 2月27日星期五上午 10:50(澳大利亚东部夏令时间)

- 零售销售: 2月27日星期五上午 10:50(澳大利亚东部夏令时间)

监视器

- 日元对通胀意外敏感度

- 债券收益率因活动数据而变动

- 如果增长势头预期发生变化,股市的反应

能源和避险流动

在中东紧张局势再次爆发的情况下,油价已攀升至2025年8月8日以来的最高收盘价。

最近关于霍尔木兹海峡附近地区军事活动加剧和航运风险头条的报道加强了能源安全作为市场关注的焦点。霍尔木兹海峡仍然是全球能源流动受到广泛关注的阻塞点。

油价上涨会刺激通胀预期并影响债券收益率。同时,地缘政治的不确定性可以通过避险需求和相对利率定位来支撑美元。

监视器

- 布伦特原油价格水平

- 美元兑主要货币走强

- 随着通货膨胀风险溢价的调整,收益率变动

欧元区和德国的通货膨胀

德国和整个欧元区(HICP)的快速通胀数据将测试该地区的反通货膨胀趋势是否保持不变。

德国的发布可能会影响欧元区总体数据之前的预期。如果核心通胀被证明是棘手的,那么对欧洲央行可能放松政策的时机和步伐的预期可能会发生变化。

关键日期

- 德国通货膨胀率: 2月28日星期六上午12点(澳大利亚东部夏令时间)

监视器

- 欧元围绕通胀数据波动

- 欧洲主权债券收益率

- 降息概率调整

关键经济事件