- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – JPY Bid on Ueda Comments, GBP Reclaims Key Level Ahead of Jobs Figures, AUD breaks range.

- Home

- News & Analysis

- Forex

- FX Analysis – JPY Bid on Ueda Comments, GBP Reclaims Key Level Ahead of Jobs Figures, AUD breaks range.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – JPY Bid on Ueda Comments, GBP Reclaims Key Level Ahead of Jobs Figures, AUD breaks range.

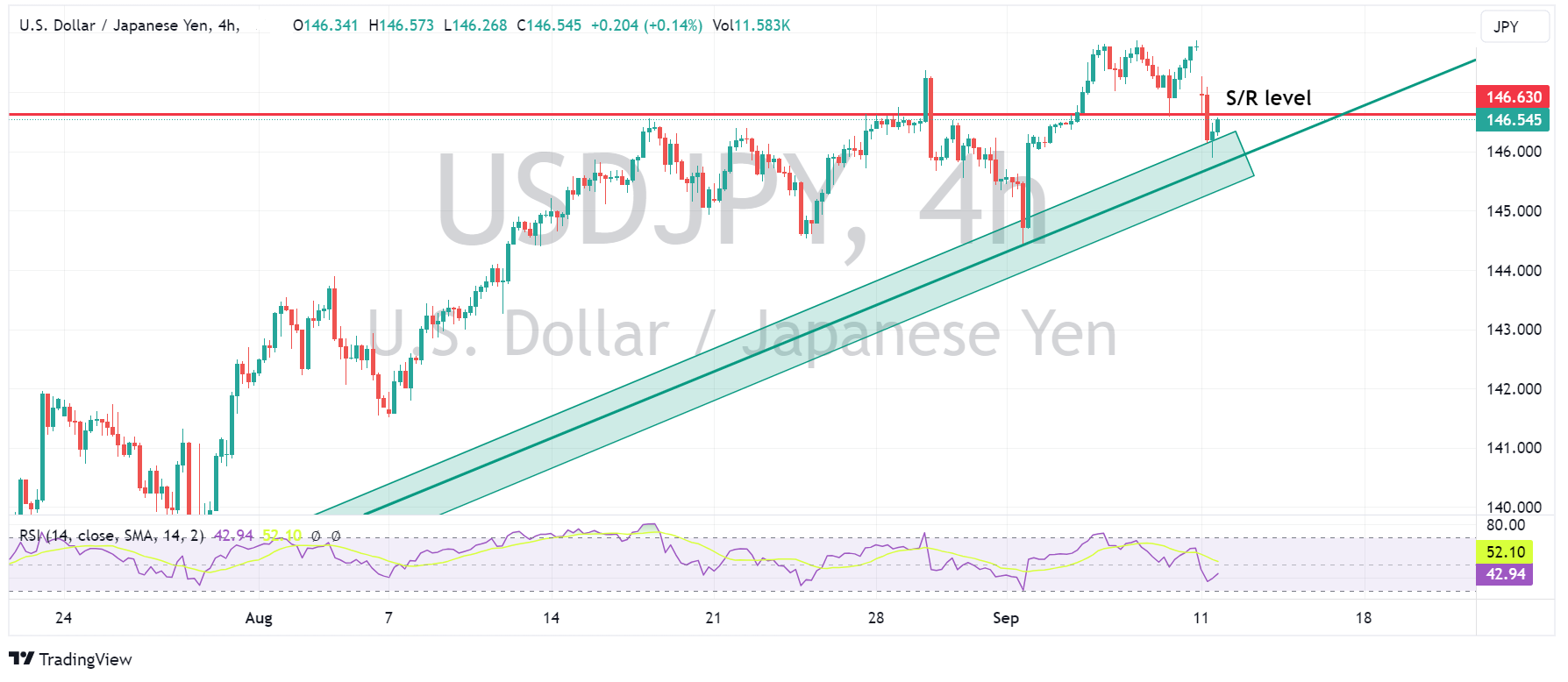

11 September 2023 By Lachlan MeakinComments from Bank of Japan governor Ueda over the week saw USDJPY gap significantly lower at the Asian session open. The pair now trading well under 147 from eight-month highs at Fridays close.

Ueda commented that the BoJ cannot rule out that they might have sufficient data by year-end to determine whether they can end negative rates, this brings the timeline forward of Japanese normalization, previously not signaled to begin until 2024. US-JPY rate differentials compressed on the news, with the predictable move in USDJPY to the downside.

USDJPY found some support at the 4H trendline and has retraced some of its losses in the EU session, hovering just below the key resistance level of 146.63, a resistance level that capped gains in the pair during August.

Key UK wage and jobs data released on Tuesday, is looking to show some cooling in the UK jobs market but probably not enough to avoid a September BoE rate hike. GBPUSD holding the major support at 1.2450 and continuing to rise, reclaiming the psychological 1.2500 level , and piercing trendline resistance to the upside. Tomorrows figure, if a big miss or big beat , should see some action in GBP as rate hike/hold odds adjust.

The Aussie dollar has surged today, AUDUSD breaking out of its tight September range and reclaiming the major S/R level at 0.6400. AUD gaining alongside the CNH after the PBoC set the strongest fix signal on record. Chinese data released over the weekend also showing the worlds second largest economy bouncing back from deflation.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX analysis – USD bounces back, JPY, GBP and AUD all under pressure as risk sentiment sours.

Tuesdays FX session is turning out to be a mirror image on Monday’s session Where the USD was battered against its major peers. Today, seeing almost a full retrace of those moves as USD is once again king. The Dollar Index (DXY) respected the upward trendline support that has led DXY higher since July (with the exception of a brief break in ea...

September 12, 2023Read More >Previous Article

EURUSD Faces Key Support Ahead of US CPI Data Release

The EURUSD pair has been navigating challenging waters in recent weeks, experiencing a decline of more than 5% since mid-July. This decline has primar...

September 11, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.