- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Dynamic margin

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Signal Centre

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Dynamic margin

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Signal Centre

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Trading Strategies, Psychology

- Why you need to understand this market concept to improve your trading: Market Correlation

- Home

- News & Analysis

- Trading Strategies, Psychology

- Why you need to understand this market concept to improve your trading: Market Correlation

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisWhy you need to understand this market concept to improve your trading: Market Correlation

21 December 2022 By GO MarketsWhy you need to understand this market concept to improve your trading: Market Correlation

For new traders and experienced traders, it can be daunting trying to find the best assets to trade. Whether it be equities, foreign exchange or indices, traders should be trying to have as many factors pointing in their favour as possible when entering a trade. These factors can include, the general trend of the individual asset, the price action at the time of entering the trade, candlestick patterns, use of technical indicators, among many others. However, one thing that all traders should know about and understand is correlation.

What is Correlation?

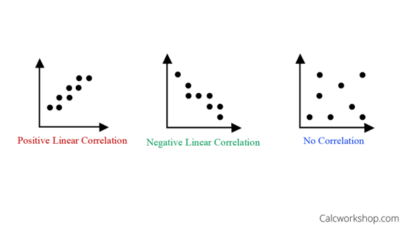

Correlation is the pattern or relationship of how one asset performs relative to another asset. In statistics, there are mathematical measures of correlation including covariance, correlation coefficients and other terms to describe the relationship of one asset to another. These methods can also be used to quantify asset correlations. A correlation between assets can be positive negative or uncorrelated. Understanding which relationship between different assets can help provide some indication of the way in which an assets price will go. Below is a diagram that shows how the return of assets can be plotted against each other and the potential relationship.

For example, imagine that there are two gold companies

Gold company A

Gold company B

Assume that the price of their shares is perfectly, positively, correlated. This means that when gold company A’s share price rises by 1% company B’s share price will also rise by 1%. This same price action will occur in reverse if the price of company A falls by 1%.

Now in practice no two assets are perfectly correlated. However, two or more assets may be very strongly correlated. Therefore, identifying how correlated certain assets are and how the price of one impact on the other can be a powerful tool.

What creates correlation?

Strong correlation between assets usually occurs because the price of the different assets is material impacted by very similar factors. For instance, two companies in Australia may be more correlated than one company in Australia and one company in the USA. This is because geographically the Australian companies will be affected the local economic conditions. This may include things such as inflation, taxation policies and other geographical specific conditions. Other factors that can influence the correlation include similarity of the assets or a company’s business operations, being in the same sector or a range of other factors.

For example, see the correlation between the ‘Big 4’ banks in Australia below. It can be seen due to how similar the businesses are and the conditions of which they operate in the pattern on returns are almost identical.

Index correlation

An important phenomenon to understand is the law of averages and big numbers. Essentially, if large companies are grouped together then they act as a good proxy for the overall market or a specific sector. This essentially is what an ETF or and Index is. Therefore, as it represents how most individual companies are performing, most companies will be to a degree correlated to the overall market index or relevant sector index or ETF.

Size matters

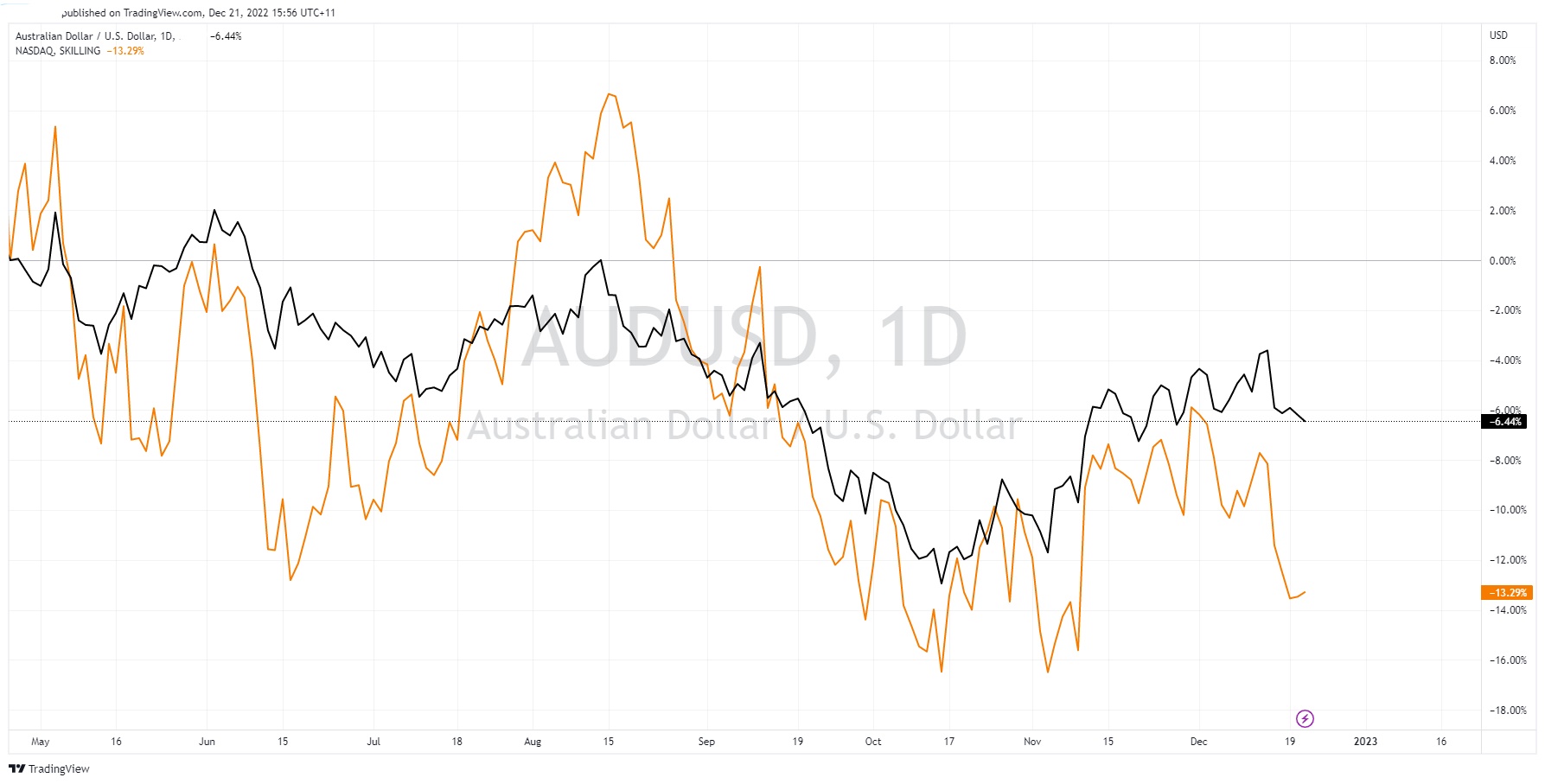

Another important thing to understand about how correlation works is that smaller assets or companies will tend to correlate towards the performance of the major players within the sector. For instance, in the technology sector, smaller technology company’s such as zoom will likely be correlated to larger companies such as Apple and Microsoft by virtue of being in the same sector. Correlations do not just occur in equities and are prevalent in FOREX and commodities. Correlation can be found between growth assets such as the Nasdaq Index which is a technology heavy Index and growth currencies such as the AUD or NZD. Similarly, more stable assets such as the Dow Jones will likely be more correlated to commodities such as oil, they represent more stable industry and manufacturing sectors.

How does it improve your trading?

By simply being aware of the direction of the correlated assets, a trader is better able to trade with underlying trend and momentum. This is vital when trying to optimise edge and improve trading accuracy. It can also equally show when a stock is underperforming or overperforming. For instance, if the general trend of a sector leader is trading 5% higher over a certain period, and a smaller company in the sector is trading at 10% higher it is outperforming the ‘sector’ and understanding why this occurs is an important step into deciphering what is driving price action.

Having a good understanding of how assets correlate can also help find potential trading opportunities earlier than others. This is because by following a sector it becomes easier to see which assets still may have room to shift their price. Ultimately, if a trader can develop their identification of patterns of correlation and the reasons for the relationships between different assets it can provide a trader with a much stronger and accurate edge.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

CHFJPY sees potential bottom and short-term reversal

The JPY had seen some renewed strength after the Bank of Japan finally intervened late in 2022 to widen its target band on its 10-year band to -0.5-0.5% from -0.25-0.25%. This was seen as an overall positive catalyst for the currency and a sign that the Bank may be ready to increase rates. The question that remains is will th...

January 9, 2023Read More >Previous Article

USDJPY tanks as Bank of Japan adjusts its threshold for intervention

The USDJPY has dropped more than 400 pips in just a few minutes after the Bank of Japan brought adjusted its intervention criteria. The bank did not c...

December 20, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.