- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Trading Strategies, Psychology

- Trading plan specifics – Articulating your trail stop strategy in your plan

- Home

- News & Analysis

- Trading Strategies, Psychology

- Trading plan specifics – Articulating your trail stop strategy in your plan

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisTrading plan specifics – Articulating your trail stop strategy in your plan

23 December 2019 By Mike SmithWe have discussed many times the importance of unambiguous, and sufficiently specific statements within your trading plan in previous articles and at the weekly “Inner Circle” webinars (for more information see the Inner Circle in the navigation bar).

The benefits of this are twofold:

1. Assist in developing consistency in execution when trading when attempting to follow a trading plan in the “heat of the market” &

2. Facilitate measurement of aspects of your trading plan to review and refine on evidence.

This article aims to give you an example in the context of trailing a stop, one of the key exit strategies employed by traders.

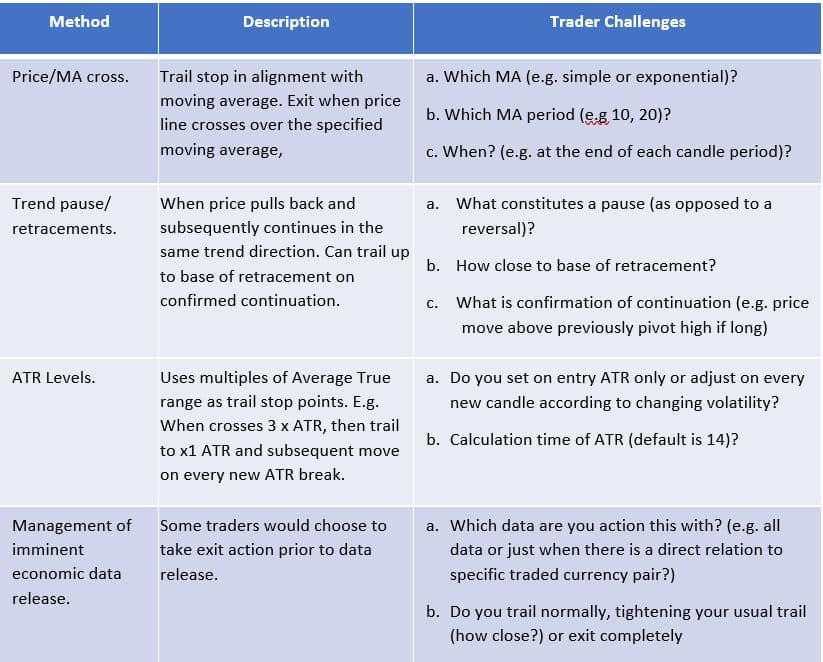

Below are some commonly used trading scenarios for trailing a stop, relevant challenges faced when attempting to be appropriately specific within your plan are below.

So, for example, using the first example, we could articulate the statement as follows:

“I will check the current 15EMA at the end of every chosen candle chart period for any open position, and trail my stop to this level until the price has crossed below (if long), or above (if short), at which point I will exit the trade”.Your challenge is simple. Once you have chosen your trail stop method, review your existing statement and make a judgement and take action if you think you could tighten it up to mean that statement potentially better meets those two aims highlighted at the beginning of this article.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Trend retracement or reversal? – Can volume be a useful “clue”?

Trading Volume: General principles Many experienced traders (even those using a simple system will incorporate volume as part of their entry (common) and/or exit (less common) system. It is essential (as with any indicator) that you understand the role volume can and cannot play with suggestions of what is happening to marke...

December 26, 2019Read More >Previous Article

2019 in a Nutshell and the Transition to a New Decade

If we could describe the year 2019 in one word, we believe uncertainty says it all. The world entered 2019 with a high level of ambiguity and is po...

December 20, 2019Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.