- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Trading Strategies, Psychology

- How to trade the Volatility Contraction Pattern

- Home

- News & Analysis

- Trading Strategies, Psychology

- How to trade the Volatility Contraction Pattern

News & AnalysisNews & Analysis

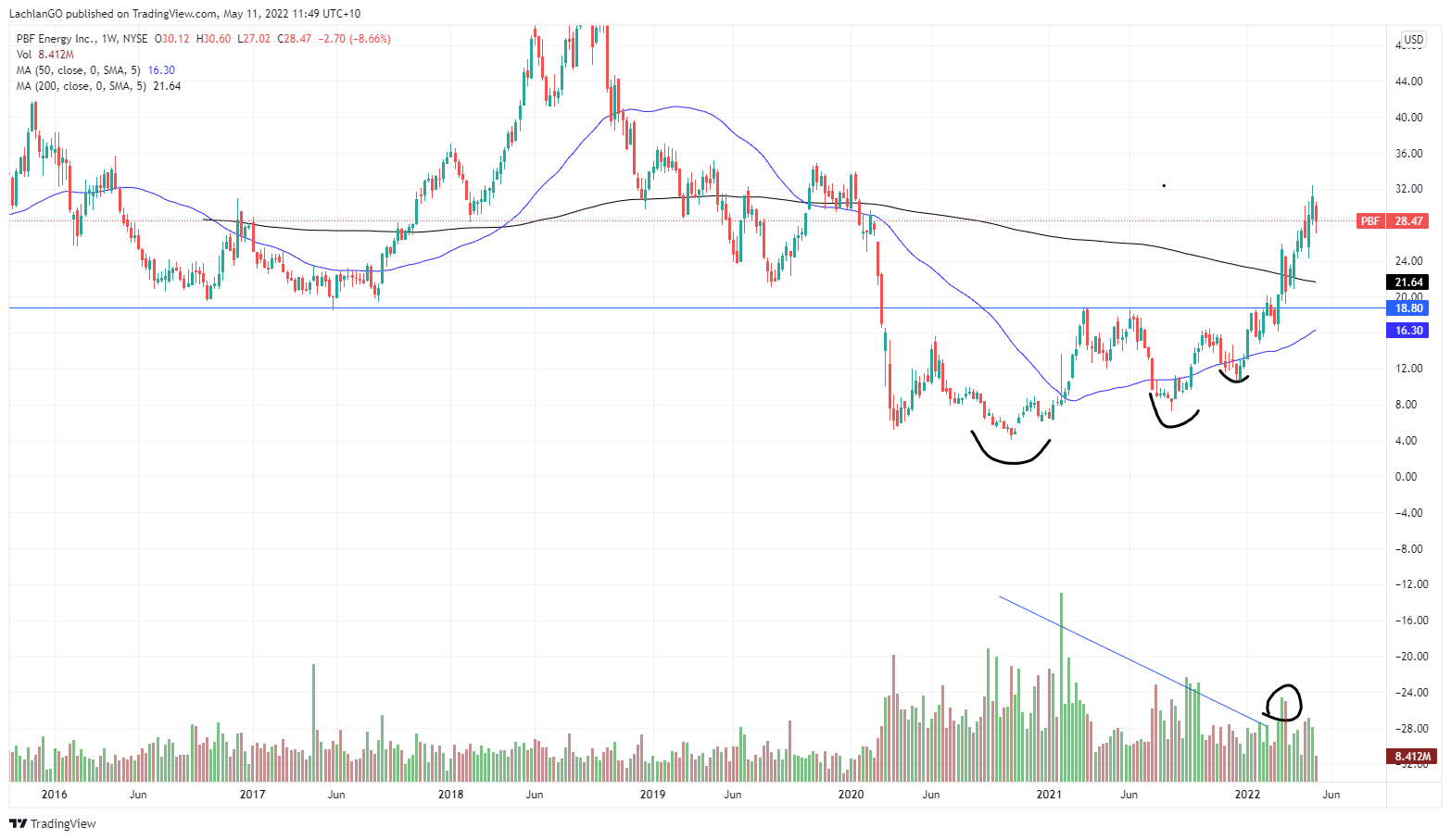

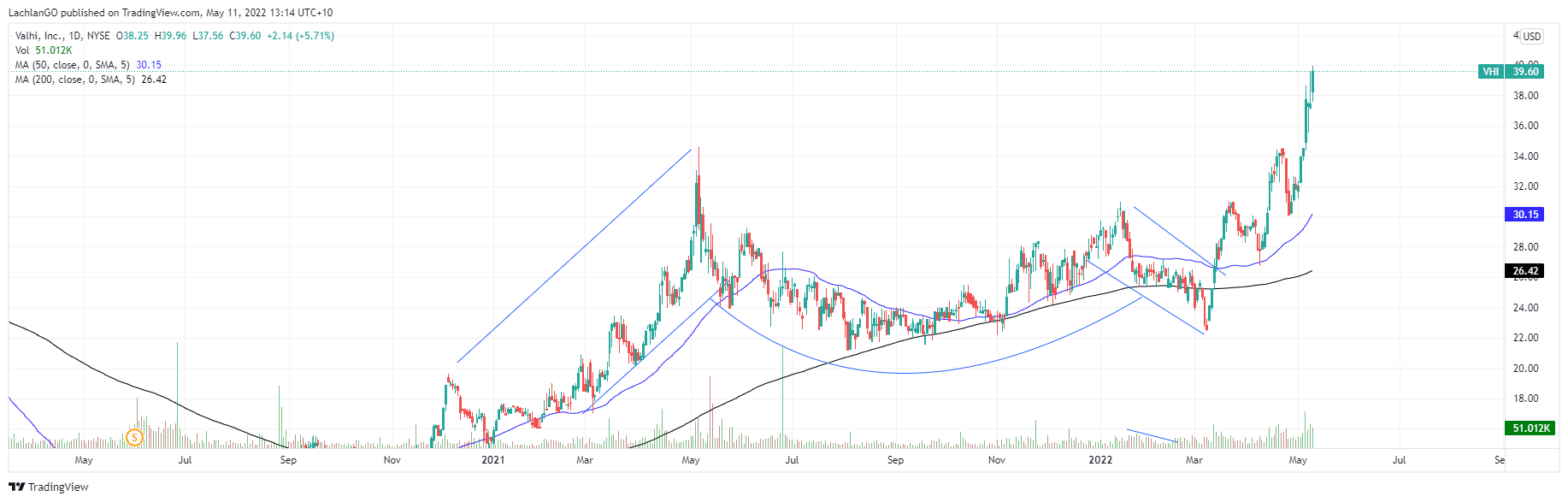

News & AnalysisNews & AnalysisThe Volatility Contraction Pattern, (VCP) is a famous trading pattern identified and dissected by Market Wizard, Mark Minervini. The premise of the pattern is that stocks in long term up trends will pause and consolidate as some holders exit their positions and the stock is accumulated again by buyers in the market. The chart pattern can provide opportunities for powerful break outs and can be used across any time frame. This allows traders to jump in on potential moves before they explode.

Mechanics of the pattern

The background of the pattern is relatively simple. The stock has been previously rising in an uptrend and has found some resistance. It then moves into a period of consolidation categorised by 2-6 retracements with each one being smaller than the previous one. The volume should usually be decreasing as the chart moves to the right. The pattern culminates in a powerful break out that can often be long lasting.

The key for this pattern is that there needs to be a contraction of volatility as the chart moves from the left to the right. This highlights that the volume available is decreasing and becoming scarce. In addition, the more dramatic in volume, the more likely that the move will be explosive. Below the breakout is accompanied by an increase in the relative volume.

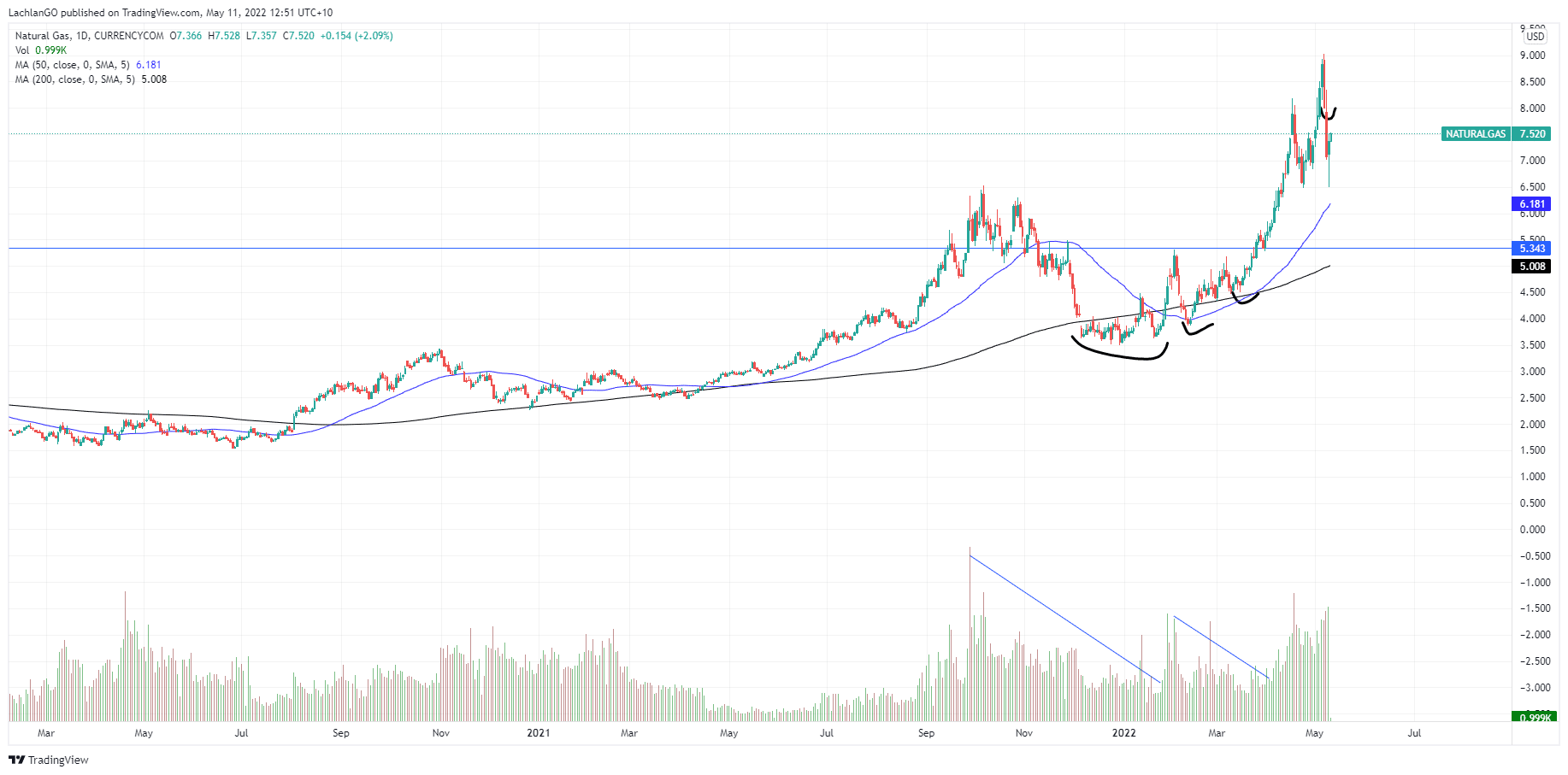

In the chart below for Natural Gas, the decrease in volume can be associated with the contracting candlestick pattern. This occurs prior to the break of the long-term resistance. The breakthrough was also associated with a large amount of buying volume.

The VCP can manifest itself in other patterns such as a cup and handle patterns. The key is that the candlesticks must be decreasing volatility.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

AGL and The Mike Cannon-Brookes Take Over. Part 2.

Continuing from my previous article on Mike Cannon-Brookes and the take over of AGL, there has been some very important breaking news from the Australian giant and the country’s biggest polluter, AGL Energy. To give you some background information; Mike Cannon-Brookes (MCB) had launched a takeover of the company as he felt he could change the...

May 31, 2022Read More >Previous Article

Market set for another volatile week

The market looks for another volatile week as geopolitical concerns and high commodity prices look likely to remain a key factor in the last week of M...

March 28, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.