- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Trading The HK50 Index

News & AnalysisYou might have heard about Hong Kong in the news, recently they celebrated twenty years of “return to the motherland”. Before we discuss the HK50 index, it’s let’s briefly review the historical and political situation. You might be asking yourself, is Hong Kong a separate country or part of China?

Source: https://www.hsi.com.hk/HSI-Net/static/revamp/contents/en/dl_centre/factsheets/FS_HSIe.pdf

In the strictest sense, Hong Kong is part of China, her official name being Hong Kong Special Administrative Region of the People’s Republic of China. Confusingly, Hong Kong has her own immigration policy, money, stock exchange, postage stamps, flag, etc. This peculiar arrangement is due to the fact that Hong Kong was a British colony from 1841 to 1997. The treaty on “return” stipulated that Hong Kong would continue to operate in a different fashion than most of China, known as “One country, two systems”.

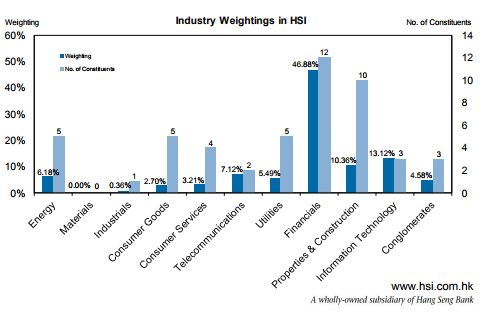

The Hang Seng 50 (HK50 on the GoTrader MT4) has a market capitalization-weighted index of 50 of the largest companies that trade on the Hong Kong Exchange. These companies cover approximately 65% of its total market capitalization. Finance represents almost half of the index. An additional quarter is weighted in information technology, properties, and telecommunications.

As you can see in the weekly view below, HK50 recently broke the 25,000 point mark for the first time in nearly two years. From an all-time high in April 2015, it was last over 25,000 in July 2015. Continuing a rally from January 2016 which saw the index drop to a five year low.

Source: Go Trader MT4 HK50

Despite the fact that the index’s constituent companies are listed in Hong Kong, 55% of the companies are based in China. A meteoric rise from 5% in 1997, 25% in 2003 and an all-time high of 59% in 2009. HK50 is tied at the hip to the Chinese economy.

How tied is HK50 to mainland Chinese companies you ask?

On Tuesday July 4th shares suffered their worst day in 2017, falling 1.5%, representing the biggest one-day percentage fall since December 15th. Tencent, one of the ten most valuable companies in the world, headquartered in nearby Shenzhen and making up nearly 11% of the composite. Tumbled 4% relating to recent negative comments around its popular one-line game products, we should continue to see growth as China’s first-quarter GDP growth hit 6.9%, the highest level since the fall.By: Samuel Hertz

GO MarketsReady to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The Bank of England Rate Decision

The Bank of England on the 3rd August, will announce whether they will increase, decrease or maintain the key interest for the United Kingdom. In this article we will look ahead with some industry experts and see how the UK economy performed last quarter. Who decides the rates? Interest rates are set by the Bank of England’s Monetary Policy Comm...

July 28, 2017Read More >Previous Article

Qatar Turmoil Continues

On 23rd June 2017, Saudi Arabia and its allies issued a list of demands giving Qatar 10 days to respond to their ultimatum. It has now been just over ...

July 10, 2017Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.