- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Target stock rallies as earnings exceed expectations

- Home

- News & Analysis

- Shares and Indices

- Target stock rallies as earnings exceed expectations

- Founded: June 24, 1902

- Headquarters: Target Plaza Minneapolis, Minnesota, United States

- Number of employees: 440,000 (2023)

- Industry: Retail

- Key people: Brian Cornell (Chairman & CEO)

- 5 day: +10.37%

- 1 month: +16.15%

- 3 months: +26.24%

- Year-to-date: +17.79%

- 1 year: +3.03%

- JP Morgan Chase & Co.: $157

- Telsey Advisory Group: $160

- Oppenheimer: $170

- Wells Fargo & Company: $165

- Stifel Nicolaus: $153

- Gordan Haskett: $170

- Morgan Stanley: $165

- TD Cowen: $148

- BMO Capital Markets: $130

- Royal Bank of Canada: $157

- Citigroup: $142

- Jefferies Financial Group: $135

- Tigress Financial: $180

- Evercore ISI: $130

- Bank of America: $135

- Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours

- Reduce your risk and hedge your existing positions ahead of a new trading day

- Extended trading hours on popular US stocks means extended opportunities

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAmerican supermarket chain Target Corporation (NYSE: TGT) announced the latest earnings results before the opening bell on Wall Street on Tuesday.

Target reported revenue of $31.919 billion for the previous quarter vs. $31.827 billion expected.

Earnings per share (EPS) also topped estimates at $2.98 vs. $2.416 per share expected.

Revenue and EPS increased by 1.6% and 57.67% year-over-year respectively.

The company achieved full-year revenue of $105.803 billion in 2023, down from $107.588 billion in 2022.

Company overview

CEO commentary

Target CEO, Brian Cornell had this to say to investors: “Our team’s efforts changed the momentum of our business, further improving our sales and traffic trends in the fourth quarter while driving profitability well ahead of expectations.”

“Throughout the season, guests responded to newness, value, and the inspiration and ease of our in-store and digital shopping experience. Looking ahead, we’ll continue to invest in the strengths and differentiators that have delivered strong financial performance over time. We’ll also roll out fresh innovations, including our new Target Circle membership program, as part of our roadmap for growth aimed at meeting consumers where they are, reigniting sales, traffic and market share gains, and positioning Target for profitable growth in 2024 and beyond,” Cornell added.

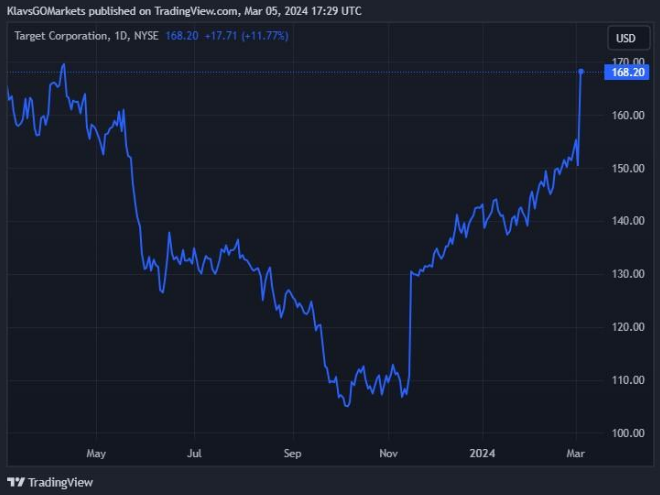

Stock reaction

The stock rallied by over 11% after the latest financial results were announced, trading at $168.20 a share – the highest level since April 2023.

Stock performance

Target stock price targets

Target Corporation is the 215th largest company in the world with a market cap of $77.39 billion, according to CompaniesMarketCap.

You can trade Target Corporation (NYSE: TGT) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform. To find out more, go to “Trading” then select “Share CFDs”.

GO Markets offers pre-market and after-market trading on popular US Share CFDs.

Why trade during extended hours?

Sources: Target Corporation, TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

NIO Q4 2023 and full-year results are here

Last week, Chinese electric vehicle manufacturer NIO Inc. (NYSE: NIO) released its latest delivery numbers for February. On Tuesday, it was time for the company to announce Q4 2023 and full-year financial results. Let’s take a closer look at how the company performed. NIO achieved revenue of $2.409 billion for the last three months of 2023, wh...

March 6, 2024Read More >Previous Article

FX analysis – Gold hits new closing high, USDJPY holds above 150, DXY flat despite rising yields

Gold surged again in Monday’s session despite a rise in US Treasury yields and setting a new closing high. There was little fundamental news to driv...

March 5, 2024Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.