- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Is Trump the Santa Stock Markets Need?

- The Dow Jones Average Industrial surged by 600 points to close at 25,366.43

- S&P500 jumped by 2.3% to finish at 2,743.79

- Nasdaq Composite advanced by 2.95% to end at 7,291.59

- Peaked earnings

- Slow growth in China

- Reduction in global demand

- Brexit jitters

- The rout in oil markets

- Regulatory measures

- Apple shares fell in a bear market territory shaking up the technology sector this month. Being the bellwether of technology stocks, the rout in Apple shares over the decrease in iPhone sales put downward pressure Wall Street. Apple erased $190 billion in five weeks and it lost its $US1 trillion valuation. Trump tariffs threat on iPhones did little to help Apple in staging a recovery.

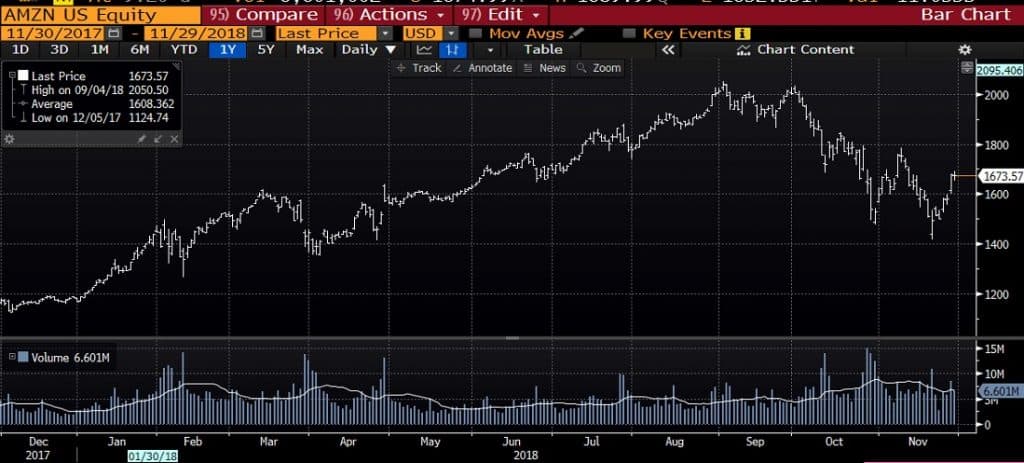

- If it were not for the relief bounce in late November, Amazon was down by 21% since the first of October losing $200 billion market cap at some point. Fundamentals are not flashing red signals that justified such a massive sell-off. The stock’s recent decline may be an overreaction, but it appears that fears were elevated after the disappointing revenue forecasts.

- Other big stocks in the FAANG group are facing regulatory headwinds and concerns over the valuations of such big names.

- Regulation has just started to come down on companies and will likely get tougher.

- These highflying stocks have grown so large that institutional investors are wary to go back to that overweight position. Are investors seeking more large-cap value over large gap growth?

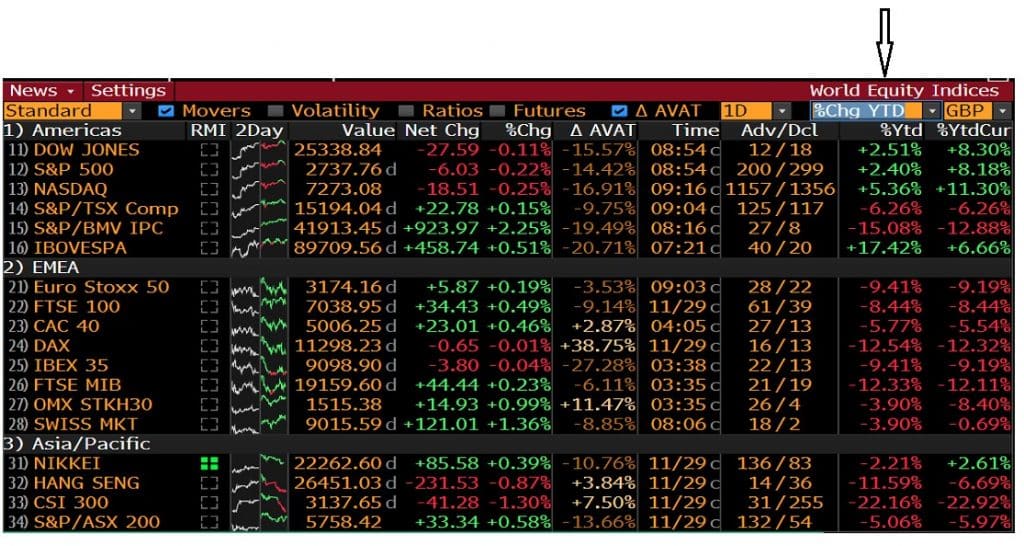

News & AnalysisWithout any doubt it was a difficult year for the stock markets. Recently nearly all equity indices have erased their 2018 gains. October has also lived up to its reputation in being the worst month for equities.

The stock markets bled red, and investors were anxious and cautious. The equity markets have gone through their longest bull run, and markets participants were only expecting a correction of 10% at some point. However, the recent massive sell-off prompted increased fears as the markets were navigating into a sea of headwinds, with growing concerns that it is more than just the markets correcting themselves.

Has Jerome Powell emerged as the saviour?

The policy divergence between the US and the other major central banks was the dominant driver that had altered the spectrum of the buoyancy in the markets at the beginning of the year. A hawkish Fed prevented the equity markets to outperform in 2018.

A sudden dovish shift whereby a few Fed officers appeared to be less hawkish has captured the markets’ attention. Chairman of the he Federal Reserve, Jerome Powell’s comments were the trigger: “interest rates are close to neutral” compared to “interest rates are a long way from neutral” which were embraced by equity traders. Wall Street slowly moved into green again as the possibility of fewer rate hikes boosted equity benchmarks:

Jerome Powell appears to have just put a floor under stocks!

Source: BloombergIs the renewed optimism justified?

It would make sense to say “yes” as the Fed risk has resolved itself and now the markets have “one less” headwind to think about. When the markets dropped as much as 10%, such dovish news is deemed favourable as it plays an essential part to the bottoming process.

However, while the change in language does indicate “dovishness” and be the reason for the market to cheer up, the price action might be exaggerated or could lose steam as trade tariffs with China is far from resolved even though there is more optimism regarding trade negotiations. The stock markets are still fragile and vulnerable to:

We have also seen that technology investors had a rough two months having witnessed the FAANG group wiping off $1 trillion in market value. Fundamental and external risks have forced investors to stop and think.

Source: Bloomberg

Source: BloombergOverall, the equity markets were mostly hit by two major headwinds: Higher rates and Trade tariffs. Now that Powell cleared investor’s doubts regarding interest rate. The attention now moves to the G20 summit. Traders are contemplating different scenarios on how the summit will unfold. The most likely situation given the conflicting news from the White House will be that:

Both parties will announce some kind of negotiation to somewhat calm the markets, but the US will most probably increase tariffs as expected.

Whether the Stock Market will end in the green or still be flashing red, it may very well depend on President Trump.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Canada – Taking A Look At The Loonie Economy

Canada News Flying Under The Radar Canada has been a predominant feature in financial news in the recent few months, with many discussions centered around the NAFTA and ‘new NAFTA’ agreement, the USMCA trade deal. But despite being such a significant story, it has arguably been overshadowed by the big moves in equity markets, Brexit negotiatio...

December 2, 2018Read More >Previous Article

ECB Speeches

The week kicked off with a series of ECB speeches, and markets participants were gearing up to have more updates on the Eurozone economy, intere...

November 27, 2018Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.