- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Salesforce record fourth quarter and Slack expectations

- Home

- News & Analysis

- Shares and Indices

- Salesforce record fourth quarter and Slack expectations

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

Salesforce the worlds #1 customer relationship management (CRM) platform has just announced record fourth quarter and full fiscal 2022 results exceeding expectations. The pandemic-led shift to hybrid work has kept up a strong demand for its cloud-based software.

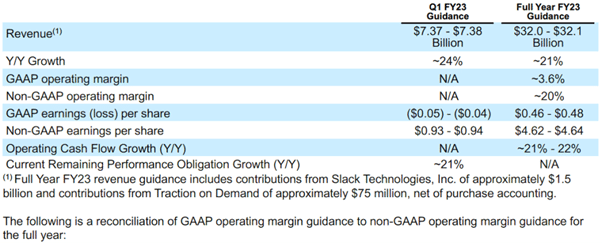

Total fourth quarter revenue was $7.33 billion, an increase of 26% year over year, and 27% in constant currency. Salesforce’s subscription and support revenue for the fourth quarter also rose 24.7% to $6.83 Billion.

“We had another phenomenal quarter and full-year of financial results,” said Marc Benioff, Chair and Co-CEO of Salesforce.

With our customers’ success driving our financial success, we’re generating disciplined, profitable growth at scale quarter after quarter,” said Bret Taylor, Co-CEO of Salesforce. “Our Customer 360 platform has never been more strategic or relevant in driving the growth and resilience of our customers around the world.”

Salesforce has also been working to integrate Slack after its $27.7 billion purchase of the instant messaging platform, as well as adding products in a bid to sell more tools to existing customers. Analysts see a lot of room to increase sales of the company’s flagship software that lets businesses manage and interact with customers. Salesforce believes the software market can grow double digits over the next several years, as companies across the globe continue to have conversations about facilitating hybrid and remote work models.

Salesforce has not slowed down Slack’s roadmap, with the platform launching Slack Huddles and Clips in the second half of 2021.

Salesforce said it expects $1.5 billion in sales form Slack in its fiscal year 2023.

Salesforce’s stock price has been on a downhill ride in the past several months, falling more than 30% from it’s November record high of over $310. Shares have recently increased over 4% and are currently trading at $209.65.

Salesforce (CRM)

Salesforce.com Inc. is the 51st largest company in the world with total market cap of $205.75 billion

Gavin Patterson the Chief Revenue Office said the global sanctions against Russia arising out of the war with Ukraine will have “minimal impact” on Salesforce’s business and haven’t forced the company to take any actions.

You can trade Salesforce.com Inc. (CRM) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Reuters, Yahoo Finance, itnews

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Advantages and disadvantages of using an Expert Advisor (EAs)

What is an Expert Advisor (EA)? Expert Advisors (EAs) are trading software that automatically run and trade based on their preprogrammed rules for initiating, managing, and exiting trades in the market. These automated trading systems are very popular among traders and are widely used on the Metatrader 4 and 5 platforms. For most traders, EA...

March 3, 2022Read More >Previous Article

Dicker Data’s year of acquisitions

Dicker Data is an Australian-owned and operated, ASX-listed technology hardware, software and cloud distributor. They were founded in 1978. As a d...

March 2, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.