- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Qantas outlook report

News & AnalysisOverview

Qantas is Australia’s national carrier and the largest and oldest airline in the country. With the Qantas group comprising of Jetstar, Qantas, QantasLink, its frequent flyer service and a freight service, the airline is the sector leader domestically and a global competitor in the international aviation industry. It is also the third oldest airline still operating and has seen many evolutions over the years to be the giant that it is today.

With recent threats of inflation, recessions, and the pandemic, the airline has been dealt some challenging blows but has managed to work its way through due to some astute leadership by its Board and its CEO, Allan Joyce.

Recent Events

Short Term Troubles

In the short term the airline has struggled to service its flights and ground crew. With Covid 19 and the flu still rampant the company has had to deal with cancelations and a reduction in its workforce as it has faced difficult logistical challenges. In June 2022, 8.1% of Qantas flights were cancelled according to the Australian, Bureau of Infrastructure and Transport Research Economics. The company also lead the sector for delays in domestic flights. As a premium airline and the national carrier, the effect on the company’s reputation and goodwill, may prove to be costly. Furthermore, building a long-term reputation of being unreliable may lead to a lowering of its market share as customer look to others.

Bid for FIFO competitor hits a roadblock

Qantas has a bid in place to acquire the airline that services much of the FIFO industry. Qantas had proposed a bid of $4.75 per share to buy the remaining 80% of the company of which it already own a 20% stake. If the takeover were able to pass though regulatory approval it would provide the airline with a dominant share of the resources and industry. However, regulators at the ACCC expressed its concerns about the merger with the body outlining that the transaction may substantially weaken competition.

Upcoming annual report

The company is expected to release its annual report that will give further details on the company’s financial performance for the previous financial year. The company is expecting to achieve EBITDA of between $450 million to 550 million dollars for the second half of the financial year. The impact of the oil crisis and the delta variant may heavily on the results. In addition, assuming operations can return to some normality in the next year, it is possible that the company will be able to return to profitability next year.

Strategy

Long term strategy

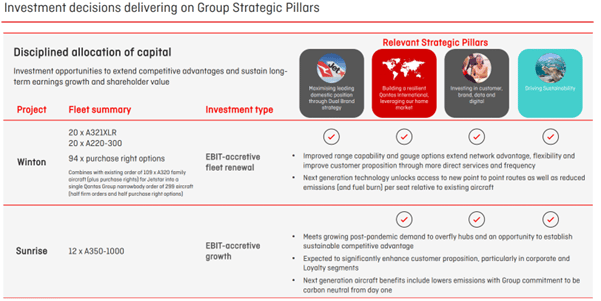

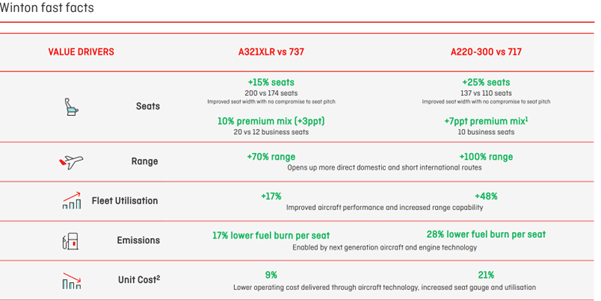

Qantas is transitioning its domestic, freight and international fleet to Airbus aircraft with longer ranges and an increased capacity over the currently used Boeing 737s. The shift towards Airbus’s called ‘Project Winton’ will improve fuel efficiency, range, and flexibility. The change may elevate Qantas’s ability to improve its bottom line as it allows for higher capacity and further range. The flexibility of the aircraft enables Qantas’s fleet to remain more dynamic and for the company to meet the needs of both the international and domestic schedules. Specifically, the project will improve units’ costs vs the current fleet set up.

Project Sunrise

Qantas aims to be the first airline to connect the East Coast of Australia to key cities in Europe and the USA with direct flights. Specifically, Sydney and Melbourne will be able to reach London, Paris, NYC, and Chicago with just one flight. Beginning in 2025 the program will utilise modified Airbus A350’s to make the journey. This strategy may provide the airline with an important point of difference as the first airline to partake in this route strategy. The ‘project’ has two potential major advantages. Firstly, it allows for a reduction in costs. By removing layovers, the airline can save on costs associated to the airport and refueling and staff constraints. Secondly, it allows Qantas to develop more route paths into Europe without the need to rely on code sharing agreements.

Forecasting future cash flows and revenues

The company is expected to return to profitability next year as it comes out the other side of the pandemic. The model used has predicted a revenue growth rate inline with the previous years of profitability. Furthermore, considering the project sunrise the projecting is that the company can return to the revenue levels of 2017 – 2019 by the year 2024/2025. Whilst a conservative approach has been used, it is not unreasonable to have revenue get to this level earlier. The forecast revenues below are for the next 5/6 years.

In addition, it is assumed that during the year 2025 the company may see increased costs as it looks to establish its Project Sunrise and it goes through retraining of staff, crew, and maintenance staff. It is possible that in those initial years, Net profit may decrease due to this implementation.

Forecast Revenue, in Million $

2021 2022 2023 2024 2025 2026 2027 5,930 8,685 11,000 14,000 17,000 17,792 18,621 Last financial year, the airline was able to improve its Net Profit margin by from 5% to 14% by heavily reducing its capital expenditure. The pandemic caused the company to reduce its maintenance and purchasing costs. As of the last annual report Qantas was in a strong short- term position with a current ratio of 1.5. with the new report imminent, the ability meets its short-term liabilities, specifically relating to the price of fuel will be an important metric to analyse.

With a Debt/Asset ratio of 0.33 the company has a solid balance sheet and is not at an overleveraged position.

After assessing all the opportunities and risks and understanding a price target of $5.50 in the next 12 months is not an unreasonable target, with a return to profitability and the airline hopefully seeing the end of Covid 19 restrictions.

Threats

Inflation

With record high levels of inflation, the cost of inputs across the supply chain for Qantas. With the increases in costs of most inputs the airline will have to be careful in its pricing to ensure it can survive the increase in costs. With the increase in fuel being an obvious problem, other input costs will also negatively affect the airline. In Australia, inflation is currently hovering around 6%. However, with the airline being multinational, and operating globally it is exposed to the inflation risk of the country it operates in.

Recession

With much of the work expecting a recession, the pressure on the travel industry may increase again. Whilst it may be a soft landing for Australia’s economy, exposure to the world markets places Qantas at a level of risk. Demand for travel may be reduced. Coming out of the pandemic, this is something that Qantas may find tough to deal with. With the company already implementing various strategies to reduce costs, the question remains, how can costs be cut further.

Oil Prices

As inflation reared its ugly head across the much of the developed world, Qantas has suffered at the hands of peaking oil prices. With the price of Crude oil peaking at over $130 US a barrel during the height of the Ukraine and Russian war the cost was passed on to the airline industry. In response to the increases in prices the company had to increase the price of air fares proportionally to offset the price. In addition, 90% of the fuel costs for Qantas were hedged through till June meaning they were likely spared the worst of the spike in fuel price. The figures from the annual report will provide some guidance to how well the company was able to manage the supply shock.

Pandemic

The pandemic has seen lots of blood appear, especially in the travel industry. Whilst the worst of the pandemic seems to be over, the potential for a resurgence or another major outbreak of a virus is still very much real, and the travel industry has not forgotten.

Ultimately, the Airline remains in a strong financial position. However, it has shown that it is prone to unsystematic risks that have the potential to throw the company into chaos.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Deere & Co. results announced

Deere & Co. (DE) reported its financial results on Friday for the third quarter ended July 31, 2022. The American manufacturer of farm machinery and industrial equipment reported revenue of $13 billion for the quarter, slightly above analyst estimate of $12.927 billion. Earnings per share fell short of estimates at $6.16 per share vs. $6....

August 22, 2022Read More >Previous Article

AUD drops on Employment Figures

The Aussie Dollar has seen a drop in its price due to wage and unemployment data released over the past day and a half. The economic data shows that u...

August 18, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.