- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- October Stock Market Volatility – The Myth

- The return from summer vacations

- The federal government’s fiscal year which begins on the first of October

- The third-quarter corporate earnings.

News & Analysis

The Psychological effect behind the Stock Markets’ Most Volatile Month.

Generally, the volatility in October has been well-above average, and this does have a psychological effect on investors’ minds. The biggest market crashes – Black Monday/Tuesday and other turmoil had occurred in October making it the “Jinx Month”.

The sharp and sudden drop that occurred last week shows that October is living up to its reputation of being the Stock Market Most Volatile Month. It could be investors being superstitious, but so far, there are not known drivers only some theories which include:

On average, more daily moves above 1% are recorded in October. The S&P500 recorded three more than 1% daily moves already which kind of justified the belief.

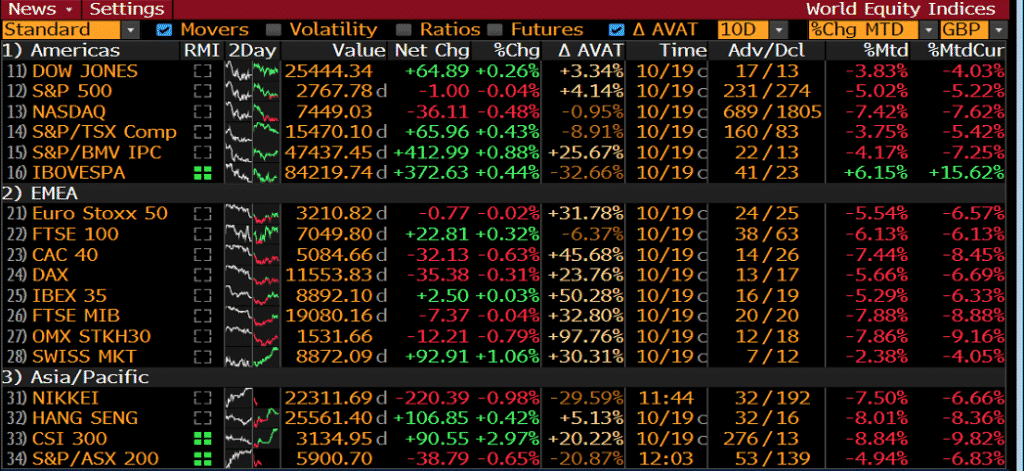

World Equity Indices (% Change) – Month-to-date

Source: Bloomberg Terminal

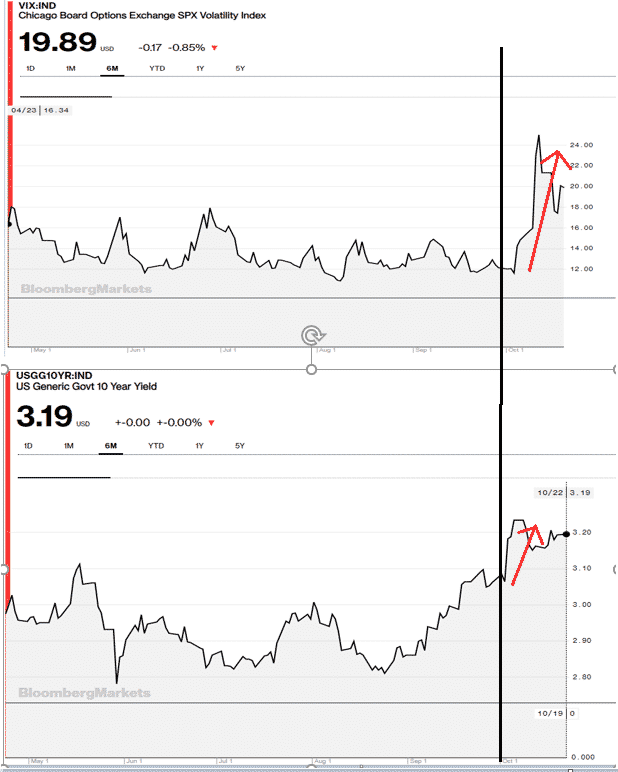

Besides the myth, rising yields are set to be the challenge for this quarter and appear to be the primary driver behind the recent surge in volatility. The prospect of more instability is high and quite alarming given that the US stock markets are already inflated. The actions by the Fed have also put the stock markets in a dangerous bubble.

Are the markets prone to more volatility? Alternatively, does the recent fluctuations signal a bear market? The recent weeks of volatility are evidence that trading equity will likely remain choppy in the short-term. At this stage, it is difficult to recognise whether the bull market has reached the top and investors need to get out before the bear market or whether investors should stay away from the “buy the dip” strategy in the emerging and Asian equity markets.

All in all, short-term investors might find it hard to catch the rhythm of the stock markets, but if investors were to maintain a long-term view, it might be worth listening to Warren Buffet advice:

“Buy, Hold and Don’t watch too closely when the market sells off.”

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

What to expect from the European Central Bank this Thursday?

The European Central Bank (ECB) is set to announce its interest rate policy this Thursday. Market participants are widely expecting the rate to remain on hold, but most importantly, the “language” and the “tone” of the statement will be closely watched. It is unlikely that there will be any surprises from the ECB policy meeting and th...

October 24, 2018Read More >Previous Article

Up Next: The Bank of Canada Rate Decision

One of the must-watch economic events this week will be the Bank of Canada interest rate decision. The decision is scheduled to be announced on Wednes...

October 22, 2018Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.