- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Netflix Q1 numbers are in

News & AnalysisNetflix reported their Q1 earnings after the closing bell on Tuesday.

The online streaming service reported total revenue of $7.16 billion in Q1 beating analyst forecast of $5.77 billion. Earnings per share were reported at $3.75 vs. $2.98 estimate.

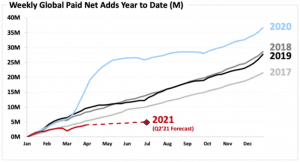

With both revenue and earnings per share higher than analysts’ expectations, the new paid subscriber additions came in way below analysts’ forecast of 6.29 million – at 3.98 million. The latest dip in new additions could be the beginning of a further slowdown in new subscribers as lockdown eases around the world and people return to normality.

”Revenue grew 24% year over year and was in line with our beginning of quarter forecast while operating profit and margin reached all-time highs. We finished Q1’21 with 208m paid memberships, up 14% year over year, but below our guidance forecast of 210m paid memberships. We believe paid membership growth slowed due to the big Covid-19 pull forward in 2020 and a lighter content slate in the first half of this year, due to Covid-19 production delays. We continue to anticipate a strong second half with the return of new seasons of some of our biggest hits and an exciting film lineup. In the short-term, there is some uncertainty from Covid-19; in the long-term, the rise of streaming to replace linear TV around the world is the clear trend in entertainment,” Netflix said in a letter to investors following the announcement.

Shares of Netflix was down by around 9% in post-market on Tuesday following the latest numbers, down at $495 per share after ending the trading day a $549.57 per share.

Netflix

Source: TradingView

You can trade Netflix (NFLX) and many other stocks from the NYSE, NASDAQ and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Intel reports Q1 earnings

Intel, the US technology giant reported its Q1 earnings after the closing bell on Thursday. The company reported revenue of $18.57 billion, above analyst forecast of $17.90 billion. Earnings per share were at $1.39, also beating analyst expectations of $1.15 per share. Intel’s data-centre group revenue fell by over 20% year-over-year to $5....

April 23, 2021Read More >Previous Article

European and US markets hit all time highs, Bitcoin breaks out, the Dollar slides

Equity markets US stocks jumped overnight to reach record levels as stronger than expected print on retail sales and a sharp improvement in the numbe...

April 16, 2021Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.