- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Moderna Q2 results announced – the stock gets a boost

- Home

- News & Analysis

- Shares and Indices

- Moderna Q2 results announced – the stock gets a boost

- 1 Month +16.71%

- 3 Month +20.11%

- Year-to-date -26.68%

- 1 Year -55.56%

- SVB Leerink $77

- Piper Sandler $214

- Morgan Stanley $199

- Deutsche Bank $155

- UBS $221

- B of A Securities $180

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisModerna Inc. (MRNA) reported its Q2 financial results before the opening bell on Wall Street on Wednesday.

The American biotechnology company posted results that beat expectations, sending the stock higher at the open.

The company reported revenue of $4.749 billion for the quarter vs. $4.097 billion expected.

Earnings per share reported at $5.24 per share vs. $4.58 per share estimate.

“Today’s earnings represent a strong second quarter performance, with $10.8 billion in revenue for the first half of the year. We continue to have advance purchase agreements for expected delivery in 2022 of around $21 billion of sales. Given our strong financial position and commercial momentum, we are announcing today that the Board of Directors has approved a new share repurchase program for $3 billion,” Stéphane Bancel, CEO of the company said in a press release.

“Despite the slowing economy and challenges in the biotech industry, Moderna is in a unique position: a platform to drive scale and speed in research of new medicines, a strong balance sheet with $18 billion of cash and an agile, mission-driven team of over 3,400 people and growing. We will continue to invest and grow as we have never been as optimistic about Moderna’s future. Right now, we have four infectious disease vaccines in Phase 3 trials, and later this year, we expect important data from proof-of-concept studies in rare diseases and immuno-oncology. Our teams are actively working to prepare these new product launches to help patients and drive growth. This is an exciting time for Moderna as we continue to see significant scientific and business momentum,” Bancel concluded.

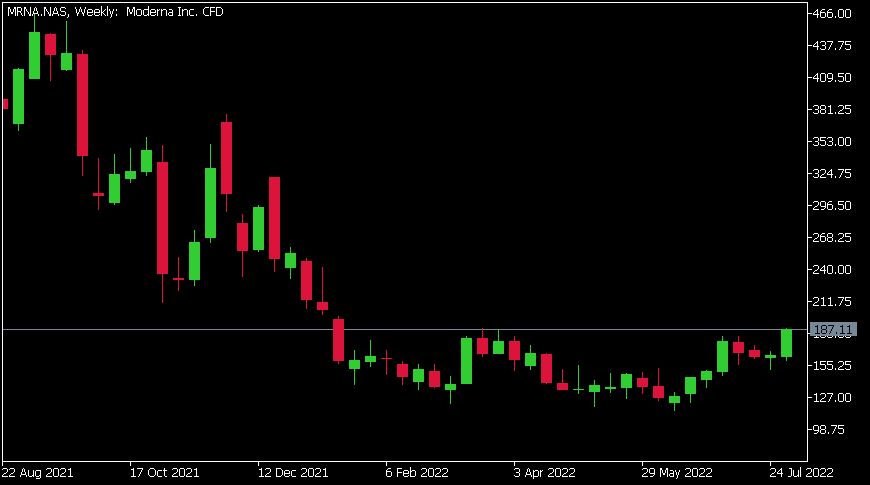

Moderna Inc. (MRNA) chart

The stock was up by around 14% on Wednesday at $187.11 a share.

Here is how the stock has performed in the past year:

Moderna price targets

Moderna is the 180th largest company in the world with a market cap of $74.57 billion.

You can trade Moderna Inc. (MRNA) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Moderna Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

What is going on with Taiwan?

What is going on with Taiwan? Taiwan is back in the news after US speaker of the house Nancy Pelosi visited the country causing a fiery reaction from the mainland of China. Historical background In order to understand the causes of the China/Taiwan tension, some historical perspective is needed. The current te...

August 4, 2022Read More >Previous Article

USDJPY ready to bounce or retrace further.

USDJPY ready to bounce or retrace further. The USDJPY has been recently provided great buying opportunities for traders. However, in rece...

August 3, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.