- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- KFC operator share price shoots up after a strong year

- Home

- News & Analysis

- Shares and Indices

- KFC operator share price shoots up after a strong year

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe operator of KFC and Taco Bell restaurants across Australia, Europe and South East Asia Collins Foods Limited, (CKF) saw its share price shoot up by above 11% on Tuesday after releasing its annual report.

The company saw its revenue increase to 1,184,521,000 and increased its profit by an impressive 47%. The company also saw a decrease in its net debt and net leverage ratio, as improved cashflow saw the business become more solvent. CKF saw particularly good growth in its European sector where it saw revenue increase from $134.9 million to $190.4 million year on year.

With inflation being a key concern for most businesses in the short/medium term future, CKF outlined how it will deal with rising costs. The company will focus on providing better value than competitors. It has also already locked in prices for chickens until the end of 2022 and 95% of its inputs are sourced locally, minimising supply chain pressures and costs.

CKF managing Director, Drew O’Malley stated that, “KFC Australia managed to deliver positive same store sales growth for the full year, despite cycling unprecedented growth in the prior year. The KFC brand has never been stronger in Australia, and metrics around quality, value and purchase intent are at record level, particularly important in times like these.

Looking forward the company has already seen positive results since the report was finalised. O’Malley outlined that the proven track record of the brands and their customer appeal ensures that CKF is well positioned to manage the challenging economic conditions.

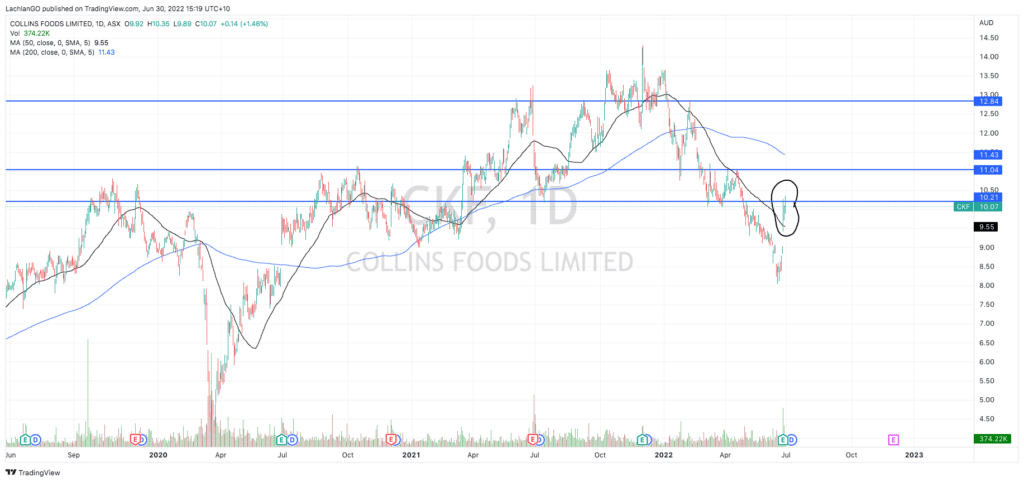

From a technical perspective on the day the annual report came out, the share price gapped up above the 50 day moving average on a high level of volume. The price has so far been unable to make a large move higher as it consolidates through a relatively strong resistance zone. If the price can break out of the resistance zone a target or $11.04 or a secondary target of $12.84 may be practical targets to aim for.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

OPEC announces increase in oil production

The OPEC group has announced plans to increase production of Crude oil to reduce the panic and ease the supply crunch. However, some analysts believe that the amount will be insufficient reduce the price. The organisation agreed to increase production to 648,000 barrels from 400,000 per day beginning in August. Brent crude and WTI dropped in price ...

July 1, 2022Read More >Previous Article

Liontown Resources, (LTR) secures offtake agreement with Ford

Australian lithium company, Liontown Resources, has secured another offtake agreement for its Kathleen Lithium project. The agreement with global car ...

June 29, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.