- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Johnson & Johnson Q4 results are in

News & AnalysisJohnson & Johnson (JNJ) reported its Q4 earnings before the opening bell on Wall Street on Tuesday. Let’s take a closer look at how the pharmaceutical giant performed in the previous quarter.

The company reported total revenue of $24.804 billion in Q4 (up by 10.4% from the same period in 2020), below analyst forecast of $25.276 billion.

Earnings per share at $2.13 a share in the previous quarter (up by 14.5%, pretty much in line with analyst forecast of $2.12 a share.

Joaquin Duato, Chief Executive Officer commented on the Q4 and 2021 results: ”Our 2021 performance reflects continued strength across all segments of our business. Guided by Our Credo, I am honoured to assume the role of CEO, leading our global teams in continuing our work to deliver life-changing solutions to consumers, patients, and health care providers.”

”Given our strong results, financial profile, and innovative pipeline we are well positioned for success in 2022 and beyond,” Duato added.

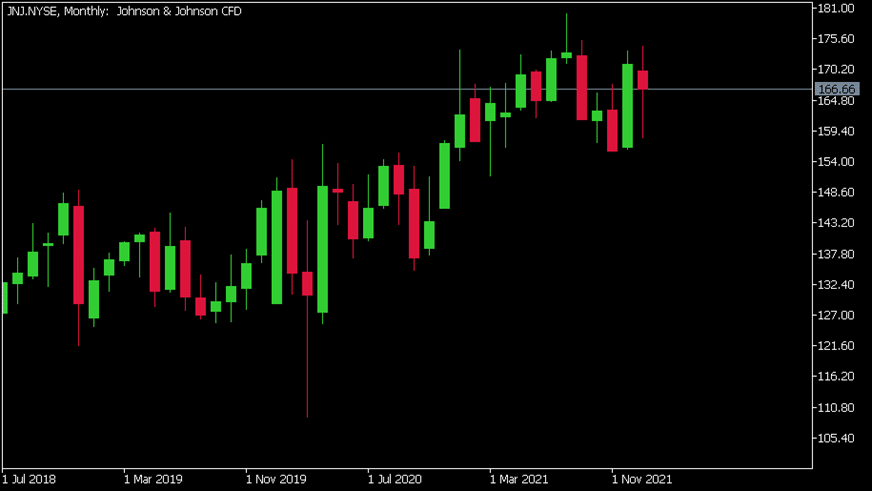

Johnson & Johnson chart (Monthly)

Share price trading higher following the latest results, up by around 2% during the trading day on Tuesday at $166.66 per share.

Johnson & Johnson is the 12th largest company in the world and with a total market cap of $438.19 billion.

You can trade Johnson & Johnson (JNJ) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Johnson & Johnson, TradingView, GO Markets MT5, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The Federal Bank and how it affects us

All major countries’ economies have one thing in common; they are all subject to a central bank. Here in Australia is no different, we have the RBA Reserve Bank of Australia. Their roles are largely the same everywhere: a key role of central banks is to conduct monetary policy to achieve price stability (low and stable inflation) and to he...

January 27, 2022Read More >Previous Article

Verizon tops Wall Street expectations

Verizon Communications Inc. (VZ) released their previous quarter financial results before the market open on Tuesday. The US telecommunication giant t...

January 26, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.