- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- How do dividend adjustments work on my Index CFD position?

- Home

- News & Analysis

- Shares and Indices

- How do dividend adjustments work on my Index CFD position?

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisCash stock indices such as the Dow 30, FTSE 100 and ASX 200 are made up of constituent stocks which is where their price is derived from.

These constituent stocks of an index will periodically pay dividends to shareholders, causing a drop in that stocks price and impacting the overall value of the index.

With GO Markets this index adjustment will be made at the open of the index on the ex-dividend date of the underlying stock(s). This price drop in the index will affect the PnL on an open index CFD trade, to compensate this, there will be credit or debit that will be included in the swap that is made around 00:00 server time.If you have a long index position you PnL will be negatively affected so you will receive a credit in the same amount as the dividend adjustment.

If you have a short index position you PnL will be positively affected so you will receive a debit in the same amount as the dividend adjustment.

It’s an important point to remember that index traders do not profit or loss from these adjustments. It is a zero sum situation where any PnL change has a corresponding debit or credit to compensate.

Example 1:

You have a buy position on the ASX200 contract of 10 lots at 00:00 server time. The next trading day multiple companies go ex-dividend resulting in a 20 point drop in the ASX200 at the open. The swap on this position will be credited $200 AUD (20 points * $10 per point exposure).

The ASX200 will open 20 points lower than it would have without the adjustment. As a result, the PnL on the buy position is $200 worse off, which was compensated for by the swap credit you received.Example 2:

You have a sell position on the FTSE100 contract of 10 lots at 00:00 server time. The next trading day multiple companies go ex-dividend resulting in a 15 point drop in the FTSE100 at the next open. The swap on this position will be debited £150 GBP (15 points * £10 per point exposure).The FTSE100 will open 15 points lower than it would have without the adjustment. As a result, the PnL on the sell position is £150 better off, which was compensated for by the swap debit you received.

(Please note, as dividends are combined with normal financing adjustments, the swap will not be exactly the same as the dividend only)

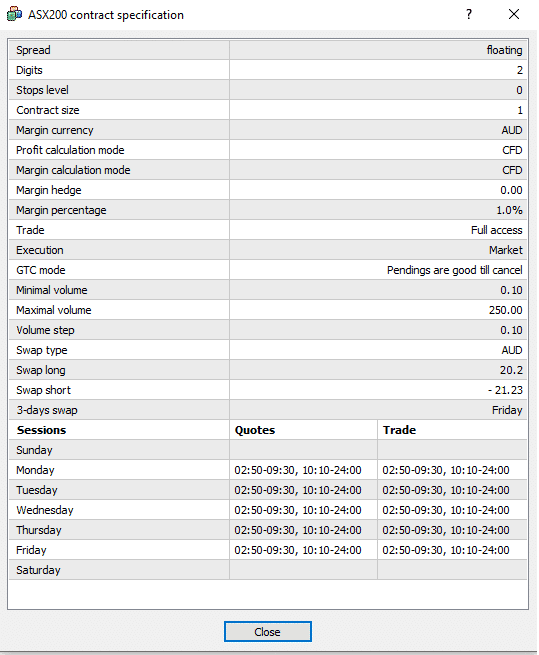

You can view the trading hours and upcoming swap/dividend adjustments in the specifications of an instrument. Example of ASX200 before a 20 point adjustment below:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The VIX Explained: What Every Trader Needs to Know

Introduction The VIX Index, or Volatility Index, often referred to as the "fear gauge," measures expected future volatility in the U.S. stock market. Although it's worth noting that there are VIX variations for gold, oil, and global indices, when people discuss the VIX, they usually refer to the instrument based on the implied (forward looking ...

October 2, 2021Read More >Previous Article

OCO or stop-limit order

One Cancels the Other (OCO) is a trading strategy commonly used in financial markets, including options trading. It is a conditional order that allows...

August 18, 2021Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.