- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Gold pushes through $2000 as demand grows during uncertain times

- Home

- News & Analysis

- Shares and Indices

- Gold pushes through $2000 as demand grows during uncertain times

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisGold has seen a resurgence in the past few weeks on the back of inflationary pressure and geopolitical tensions in Ukraine and Russia. Prior to the conflict, the price of Gold was hovering around $1,800 USD per ounce. After pushing through $2000 USD per ounce the price is now moving closer to its all-time high at $2070.

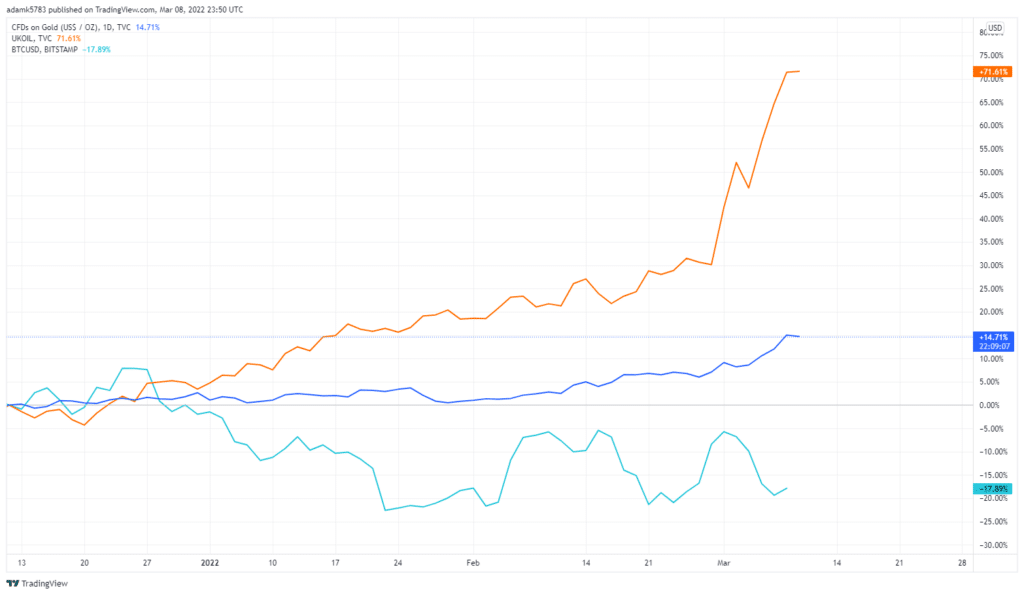

The rise in other commodities such as Oil, Gas, and Coal has also added to the rise in the price of Gold as concerns of inflation are increased, the interest in Gold usually follows. An interesting comparison can be made with regards to the increasing price of Oil. Whilst both commodities can be used as hedges against the market, Gold provides a more stable option whilst Oil is the more volatile option. Both have seen strong rises due to the conflict and whilst Oil’s has been more meteoric, Gold has been steadier, as can be seen in the chart below.

Gold has also performed extremely well against Bitcoin and other cryptocurrencies during the volatility that has been caused by the conflict. There was potential for Bitcoin and Cryptocurrency to provide a hedge against the market, however Bitcoin has been outperformed by Gold at this point.

Gold vs BTC vs Oil

An interesting quandary to the Gold rise is the geopolitical element. For instance, Russia’s central bank purchased more Gold in 2021 than all other central banks, except for those in India and the United Arab Emirates. This means that there may be a shortfall in supply.

Technical Analysis

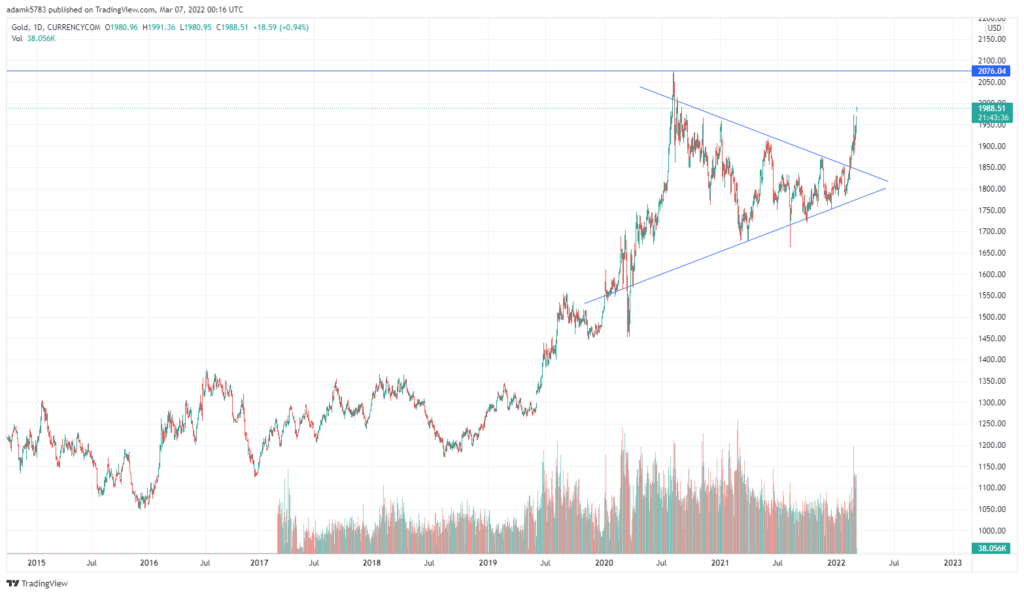

The long-term chart has shown a long period of consolidation ultimately forming a symmetrical triangle pattern from which the price has broken out. It saw a big rise during the beginning of the pandemic and reached a maximum price of $2075 USD per ounce. When the price broke out of the triangle, initially an increase in relative volume occurred. In addition, the retracement of the breakout was short-lived, and buying pushed the price up relatively easily.

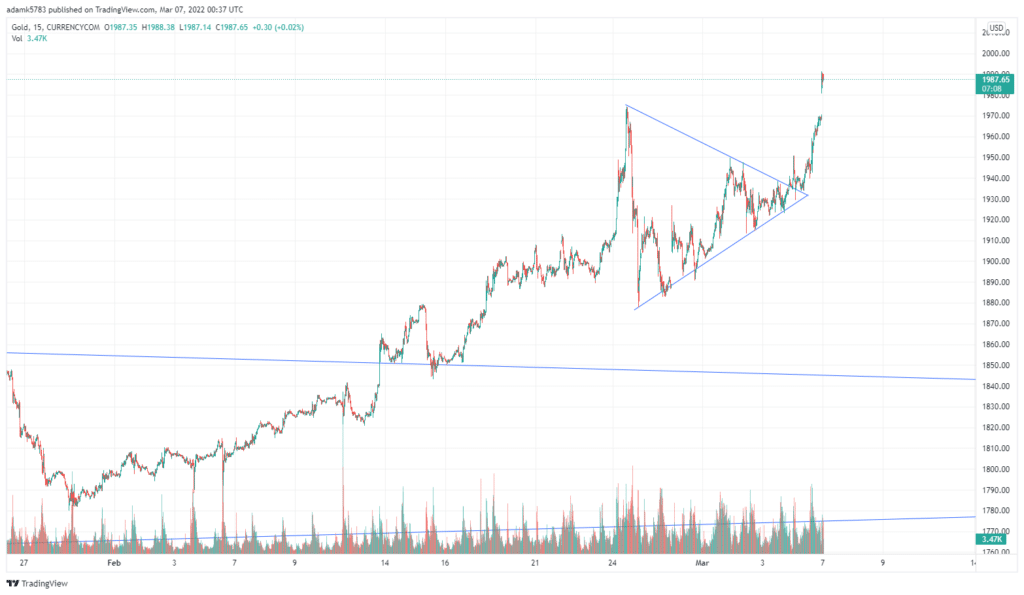

Another symmetrical triangle formed on the four-hour chart on the breakout of the breakout. Once again there was a strong increase in volume for the intimal move before it began the price began to contract again. These continual price contractions and triangles forming may indicate that supply is being soaked up and that buying demand is present.

On the four-hour time frame, it can be observed that the short sharp periods of consolidation have continued to be formed. Importantly, the consolidations have been relatively short, with in a tight range and broken with a high level of volume.

If volatility continues to be prominent and Inflation remains a threat, Gold will likely remain relevant. It will be interesting to see what happens with the price, if it is able to push through the all-time high price of $2075 per ounce.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Potential for Ukraine and Russian Negotiations drives a market rebound

The global markets had a strong night of trading on the back of renewed peace talks between Russia and Ukraine. Equity indices were up, whilst commodities took a breather from their recent highs. Reports coming out of Europe indicated that Ukrainian President Volodymyr Zelensky has cooled off on the prospect of Ukraine joining NATO and is open to d...

March 10, 2022Read More >Previous Article

Commodities’ record high prices wreaking havoc for inflation

A sudden rapid increase in commodity prices, propelled by supply concerns stemming from the Russia and Ukraine conflict, has brought about inflationar...

March 9, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.