- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Bank of America stock dips as earnings fall short of expectations

- Home

- News & Analysis

- Shares and Indices

- Bank of America stock dips as earnings fall short of expectations

- Founded: 1998 (via the merger of BankAmerica & NationsBank), 1956 (as BankAmerica), 1784 (as its predecessor, the Massachusetts Bank, through the merger with FleetBoston in 1999)

- Headquarters: Charlotte, North Carolina, United States

- Number of employees: 217,000 (2022)

- Industry: Financial services

- Key people: Brian Moynihan (Chairman and CEO), Anne Finucane (Co-Vice chairman), Bruce Thompson (Co-Vice chairman)

- 5 day: -5.68%

- 1 month: -3.35%

- 3 months: +21.36%

- Year-to-date: -3.55%

- 1 year: -7.82%

- Barclays: $43

- Odean Capital Group: $37.94

- Goldman Sachs: $33

- Oppenheimer: $51

- BMO Capital Markets: $40

- Jefferies Financial Group: $28

- Evercore ISI: $33

- Morgan Stanley: $32

- Piper Sandler: $27.50

- Royal Bank of Canada: $35

- HSBC: $35

- Wells Fargo: $40

- Citigroup: $33

- UBS Group: $36

- JP Morgan: $34

- Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours

- Reduce your risk and hedge your existing positions ahead of a new trading day

- Extended trading hours on popular US stocks means extended opportunities

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisBank of America stock dips as earnings fall short of expectations

15 January 2024 By Klavs ValtersBank of America Corp. (NYSE: BAC) announced Q4 2023 financial results before the opening bell in Wall Street on Friday.

The US bank reported revenue that fell short of estimates of $23.5 billion vs. $23.703 billion expected.

Earnings per share was reported well below analyst expectations at $0.35 per share vs. $0.533 per share estimate.

Company overview

CEO commentary

“We reported solid fourth quarter and full-year results as all our businesses achieved strong organic growth, with record client activity and digital engagement. This activity led to good loan demand and growth in deposits in the quarter and full-year net income of $26.5 billion. Our expense discipline allowed us to continue investing in growth initiatives. Strong capital and liquidity levels position us well to continue to deliver responsible growth in 2024,” CEO of Bank of America, Brian Moynihan said in a press release.

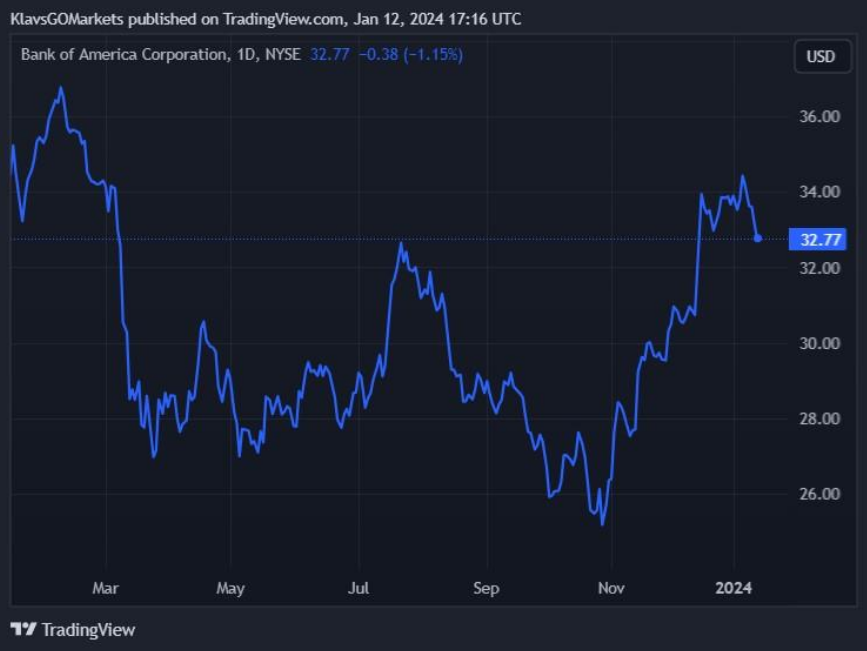

Stock reaction

The stock was down by just over 1% on Friday at $32.77 a share.

Stock performance

Bank of America stock price targets

Bank of America Corp. is the 39th largest company in the world with a market cap of $256.76 billion.

You can trade Bank of America Corp. (NYSE: BAC) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform. To find out more, go to “Trading” then select “Share CFDs”.

GO Markets offers pre-market and after-market trading on popular US Share CFDs.

Trade the pre-market session: 4:00am to 9:30am, normal session, and after-market session: 4:00pm to 8:00pm, Eastern Standard Time. Excludes Fridays. Please see specifications section on platform for further details.

Why trade during extended hours?

Sources: Bank of America Corp., TradingView, MarketWatch, CompaniesMarketCap, MarketBeat

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

UnitedHealth tops estimates but the stock is down

World’s largest healthcare company, UnitedHealth Group Inc. (NYSE: UNH), reported fourth quarter and 2023 full-year financial results on Friday. The company achieved revenue of $94.427 billion for Q4 of 2023 (up by 14% vs. Q4 2022) vs. $92.126 billion expected. Earnings per share (EPS) reported at $6.16 per share vs. estimate of $5.985 per ...

January 15, 2024Read More >Previous Article

JP Morgan Q4 2023 earnings results are here

US financial services giant, JP Morgan Chase & Co. (NYSE: JPM), reported the latest financial results for Q4 2023 before the market open in the US...

January 15, 2024Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.