- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Australian Earnings Results – ASX200 Hits Record High

- Home

- News & Analysis

- Shares and Indices

- Australian Earnings Results – ASX200 Hits Record High

- Underlying NPAT (pre AASB161) at $76.2m was up 13.7%

- Underlying EBIT (pre AASB161) at $125.2m up 6.8% and margin expansion by 70bps to 11.7%

- Underlying EBITDA (pre AASB161) at $234.6m up 2.5% and margin expansion by 40bps to 21.9%

- Net revenue up 0.5% with organic growth offsetting the impact of lower commodities revenue and the introduction of Queensland landfill levies

- Footprint 2025 Progress: Integration of Toxfree on track; completed SKM acquisition and integration commenced; Plastic Pelletizing MOU confirmed; announced EfW project in Sydney

- FY20 underlying EBITDA guidance post AASB16 of ~$515m to $525m

- Total 1H20 revenue of $205.9m, up 31%

- NPATA1 of $33.5m, up 22%

- Net profit attributable to equity holders of $59.9m, up 160%

- EBITDA $62.5m, up 29%

- A fully franked interim dividend of 1.70 cents per share

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisIt was another busy day for the Australian share market with a series of corporate results; namely for Asaleo Care, Crown, Cleanaway, Domino’s Pizza, Fletcher Building, Fortescue Metals, Lovisa, McPherson’s, Mount Gibson, McMillan Shakespeare, Nearmap, Seven Group, Sonic Healthcare, St Barbara, Stockland, Vicinity Centres, Wesfarmers, and WiseTech Global.

We have seen big moves in the markets after the earnings reports on Wednesday, which drove the Australian equity benchmark to record highs.

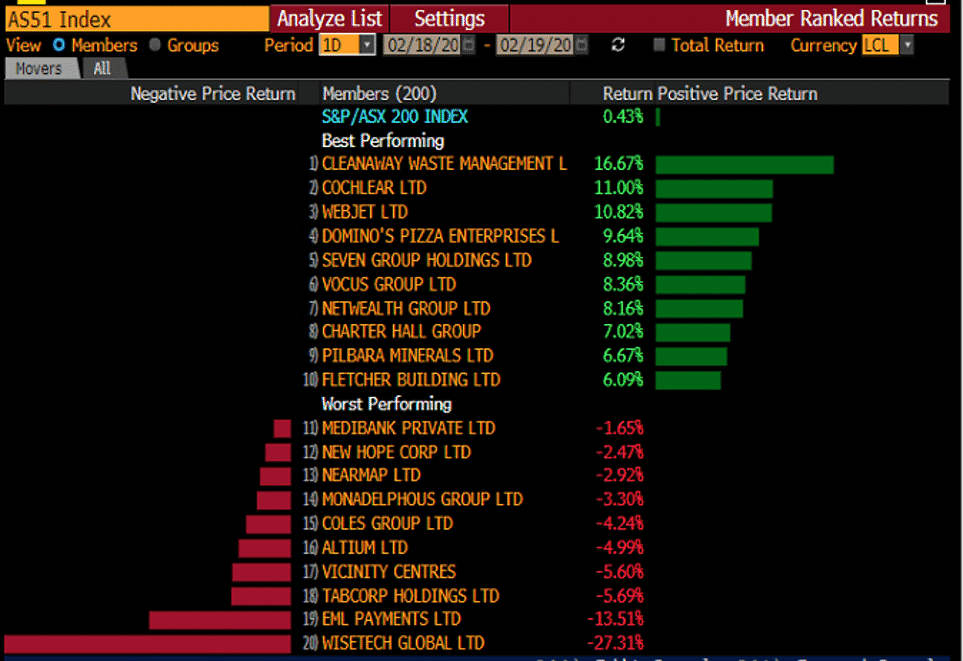

The Index added 31 points or 0.43% to 7,145 points. Cleanaway Waste Management, Domino’s Pizza, Netwealth Group, Webjet and Cochlear led gains and offset the huge losses that were seen in technology stocks like EML Payments and Wisetech Global.

Source: Bloomberg Terminal

Cleanaway Waste Management (CWY), a leader in sustainable total waste management solutions in Australia rose by more than 15% on upbeat results and emerged as the best performer of the ASX200:

Wisetech Global (WTC) share price plummeted by more than 25% despite strong growth, as the company warns of the effect of the COVID19 on the logistic activities.

After last year’s reports alleging that the company was manipulating its accounts, the downgrade of its forecast for the full year from a range of between $440 million and $460 million to between $420 million and $450 million has spooked investors.

About GO Markets

GO Markets was established in Australia in 2006 as a provider of online CFD trading services. For over a decade, we have positioned ourselves as a firmly trusted and leading global regulated CFD provider. Traders can access hundreds of CFD instruments including Forex, Shares, Indices and Commodities.

Follow us and keep up to date with the latest market news and analysis.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Inner Circle Video: “Why is my trading system not working?”

Please find below the recording of the video from this weeks exciting Inner Circle session “Why is my trading system not working?": Five key areas to explore NOW. Please note the disclaimer at the start of the video. https://vimeo.com/392460601 Any questions about the content covered then please feel free to drop an email to mi...

February 20, 2020Read More >Previous Article

Australian Earnings Results: Altium Kept the ASX200 in the Red

In the Australian share market, the focus remains on the earnings report. Most sectors were trading in negative territory with significant losses i...

February 18, 2020Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.