- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- ANZ set to acquire Suncorp in mega acquisition

- Home

- News & Analysis

- Shares and Indices

- ANZ set to acquire Suncorp in mega acquisition

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisBig 4 bank ANZ is set to takeover Suncorp in a massive buyout. The agreement stipulates that the buyout is only for the banking side of the business with the insurance arm not being apart of the deal.

Details of the deal

ANZ is set to pay Suncorp 4.9 Billion dollars 1.3 time the current Net Tangible Asset value of Suncorp. The completion and integrating process is likely to take between 5-7 years. ANZ will also pay a 50-million-dollar licensing fee for the use of Suncorp’s branding for up to 5 years. This licence can be extended for another 2 years with an additional fee of 10 Million dollars per year if needed. The deal is expected to bring about a net gain of 4.1 Billion dollars which the company intends to return to its shareholders. To fund the acquisition, ANZ will raise 3.5 Billion dollars via a retail a placement, at a price of $18.90 per share.

Potentially regulatory hurdle

The deal will still have to supervised by the ACCC. The ACCC will have to be satisfied that the deal does not substantially lessen competition. Some legal experts say the deal will likely still be given the ok, the ACCC will do say begrudgingly. However, it is still an important obstacle that needs to be satisfied.

Impact on Suncorp

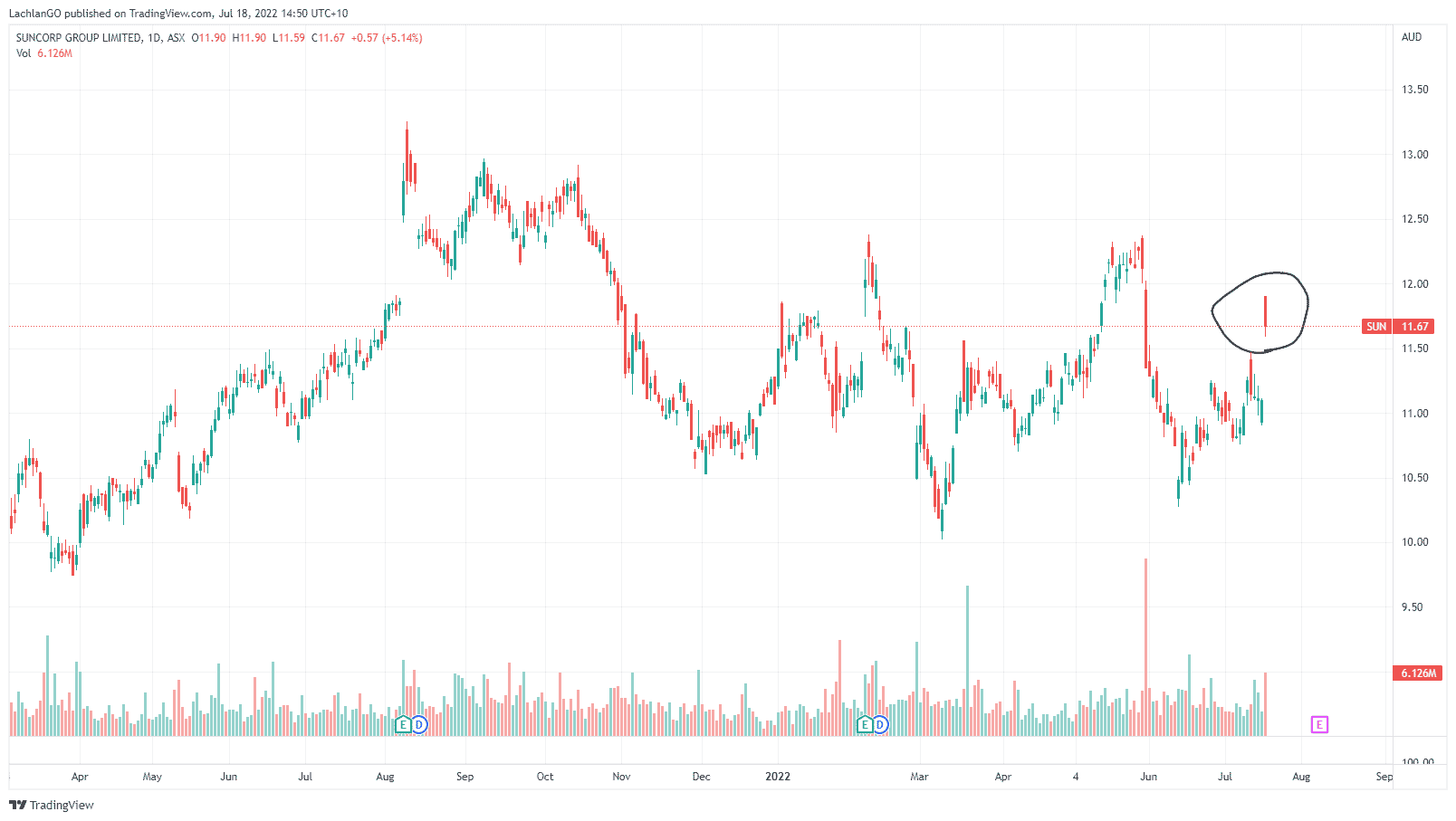

The deal will allow the company to better focus on their insurance business and simplify the organisation. Their insurance arm includes brands such as APIA, Bingle and AAMI. The premium will also allow for the share price of SUN has saw a nice gap up in price on the morning of the announcement with an almost 6% jump.

Impact on ANZ

The merger has the potential to really propel ANZ forward, especially in a tough market for banks with the impending threat of a recession. The acquisition is expected to increase ANZ’s retail and commercial earnings by 10%. ANZ CEO, Shayne Elliott stated that the acquisition “will be a cornerstone investment for ANZ and a vote of confidence… This is a growth Strategy for ANZ, and we will continue to invest in Suncorp Bank.” Finding extra revenue sources especially in such a competitive industry may act as an important point of strength in such a tough current market. The ANZ share price remains in a halt until Thursday 21 July.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Market jumps on the back of weak USD and better then expected earnings

The US stock market saw one of its best days in months, as speculation swirled that the 'bottom' may be in. The indices gained their momentum from better-than-expected earnings and a weakening of the USD, with the USDX dropping to $106.58. With more earnings still to come better than expected results may see the S&P500 and markets break out of ...

July 20, 2022Read More >Previous Article

Oil dips to the bottom of its range as recession fears hit the market.

Oil has seen its first real slip up in price since March. The commodity had been running on the back of high inflation and supply issues stemming from...

July 15, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.