- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Russia and Ukraine’s Crisis: Brent and Crude Oil Price action

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Russia and Ukraine’s Crisis: Brent and Crude Oil Price action

- Global benchmark April Brent crude climbed $3.06, or 3.1%, to end at $100.99 a barrel. The contract, which expired at the end of the session, settled at its highest since September 2014, posting a gain of 10.7% for the month.

- West Texas Intermediate crude for April delivery on the New York Mercantile Exchange rose $4.13, or 4.5%, to settle at $95.72 a barrel. The front-month contract finished at the highest since August 2014, up 8.6% for the month, according to Dow Jones Market Data.

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

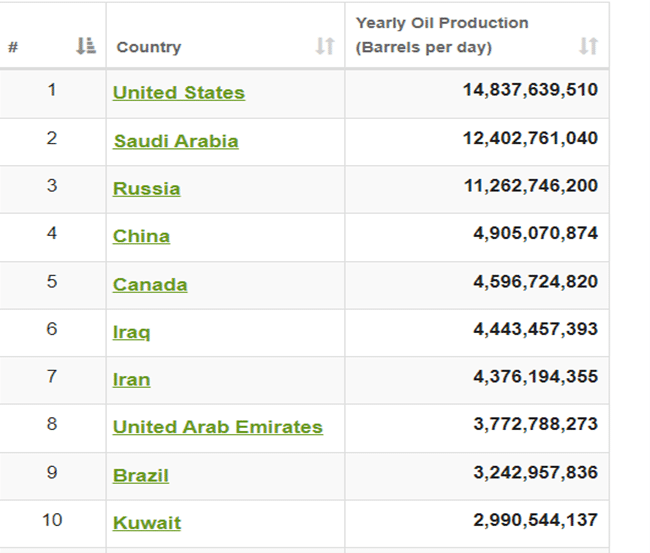

In the midst of the Russian, Ukraine crisis, there are huge ramifications that affect us all in the global market. Energy is a critically important export. Russian oil and gas exports make up a fifth of Russia’s economy and half of its earnings from exports. The country is the European Union’s biggest oil trading partner, according to the latest data from Eurostat. Russia also ranks 5th in the world for oil consumption, accounting for about 3.7% of the world’s total consumption of 97,103,871 barrels per day. They are also ranked 3rd in oil production, which is the most important factor when it comes to costs, sitting close to the oil powerhouses of United States and Saudi Arabia. They are also some way ahead of China, who sits in 4th lagging behind Russia by a wide margin of 6 million barrels per day (Fig.1).

As you can imagine any disruption to any country in this list on a normal day, would trigger a price movement. So a war and subsequent sanctions on a country who controls so much consumption and production of the precious liquid would make more than a ripple.

Latest Price Action

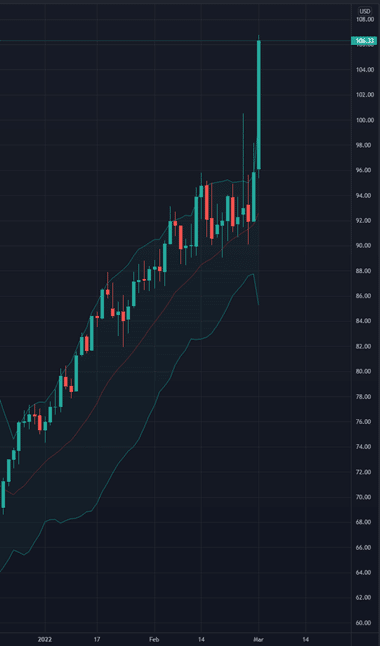

Over the last few days, we have seen Oil prices finished higher each closing day, a sharp increase over night of 9.72% to start today’s session at $106.33 (Fig.2).

Fig. 2

WTI Oil followed suit and had a jump of 11.5%, a sharp increase over night to start today’s session at $106.75 (Fig.3).

Fig. 3

The Wall Street Journal reported that the U.S. and other major oil-consuming countries were weighing the release of 70 million barrels of oil from emergency stockpiles in response to surging crude prices. This is to try to stabilize the oil prices and make up the supply that Russia would normally deliver pre sanctions.

It’s important to tread carefully when trading assets such as these commodities, which are driven by Geopolitics, unforeseen supply and demand levels and corporate institutions around the world who have their own agendas in mind when thinking of their bottom line. Profits.

Sources: QUARTZ, worldometers.info, The Wall Street Journal, Tradingview.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Surging commodities and high volatility the theme as the Ukraine conflict continues

US and European equity markets remained volatile as fighting between Russian and Ukraine forces continued and negotiation talks failed to result in any progress. Both parties however have committed to another round of discussions. The VIX, Wall Street’s volatility measure surged 12% to 30 indicating the increased fear investors are feeling fro...

March 2, 2022Read More >Previous Article

Zoom exceeds Wall Street expectations for Q4

Zoom Video Communications Inc. (ZM) reported its fourth-quarter 2021 financial results after the closing bell over in the US on Monday. The US base...

March 1, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.