- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Oil – Can Basic Economics Be Responsible For An 11% Decline?

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Oil – Can Basic Economics Be Responsible For An 11% Decline?

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

On the back of what has been a pretty punishing month for Oil, now trading below $70 a barrel for WTI crude, we’re going to take a look at Oil, the fundamental drivers behind the price swings and what the future could hold for the Oil markets. For the sake of clarity, this article will be looking exclusively at WTI Crude.

So what drove the close to 11% decline in Oil? What has stalled fund managers and market voices calling for oil to revisit $100 a barrel? Well, mostly it is a confluence of reasons, some rooted in basic economics and one fear-based reaction on the back of the “stock market rout” as it has been dubbed. Now although we are going to be focusing on some of the reasons for this decline, these are not specific to this sell-off alone, these are fundamental drivers in the price of Oil markets.

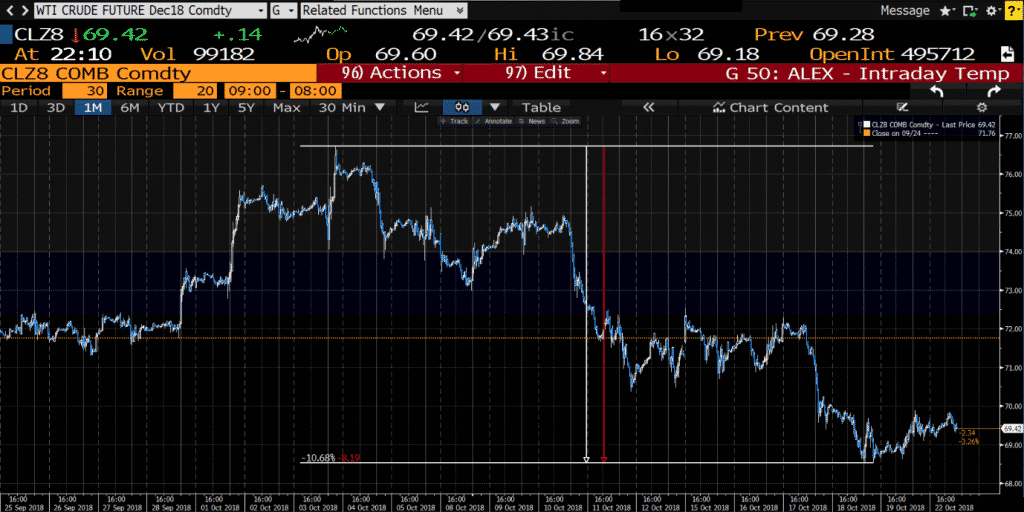

WTI Crude December Contract – October sell of from $76.72 to low of $68.53

One of the reasons for the sell-off is that of a supply jump. U.S. crude stockpiles rose by 22.3 million barrels, which is the most substantial increase since 2015. This factor comes down to basic economics. With a boost in supply and the more something is readily available; naturally, the associated value will be lower, and this is what is weighing here.

However, the story doesn’t end there. It can also provide an insight into how the general populous is leaning as an increase in stockpiles means that the current supply level is too much for current demand. For example, it could potentially be an indicator in sentiment, companies shifting to renewables, and more and more people moving to electric vehicles, etc. All of these factors would impact the appetite for oil which then leads to an oversupply, subsequently causing a tumble in price as we’ve seen of late.

One of the other factors for Crude also stems from this balancing act of supply and demand. With Crude spiking to highs not long seen, it sparked some fear that the high prices would weigh on demand for the asset, causing investors to be more cautious and to close out long positions. Since then both OPEC and the International Energy Agency have both revised down the oil growth forecasts.

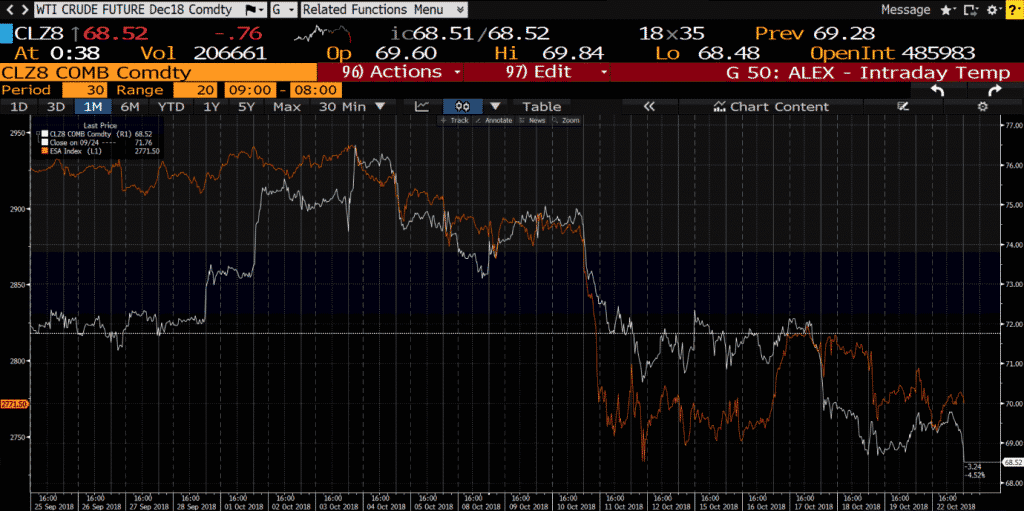

WTI December Contract and S&P Overlay – During the “stock rout”

The so-called “stock market rout” also took its toll on the Oil price, with investors dumping risk assets and moving into safe-haven assets, i.e., bonds, gold, etc. this helped to perpetuate Crude’s slide and saw it shed a further 5% of its value.

So, with WTI Crude oil currently, at the time or writing sitting at lows of $66.70 a barrel, what lies ahead for Oil? With continued sell-offs seen in equities markets and steadily more risk-off sentiment throughout the market, we could continue to see Oil slide. However, as markets tend to jump between risk-on & risk-off on a daily, sometimes more frequent basis, we can expect to see plenty of activity in the Oil market, and this will undoubtedly be one of our watchlist staples.

For more information or any questions feel free to reach out to me on twitter

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives, including Oil Commodity trading, carries a high level of risk.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Preview: Bank of England Rate Decision

On Monday, UK Chancellor Phillip Hammond announced its latest budget, which did not have a massive impact on Pound Sterling. Now that is out of the way; it’s time to focus on another critical economic event – the Bank of England rate decision. The decision is set to be announced at 12:00 PM London time on Thursday. About Interest Rates Inter...

October 31, 2018Read More >Previous Article

Gold Making Waves – Where Will Price Settle?

Creating New Monthly Highs Yesterday gold reached a three-month high of $1,239.68 which, as we head into the final quarter of 2018, is once again sti...

October 24, 2018Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.