- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Gold eases heading into FOMC

News & AnalysisAfter a fortnight of trending north, Gold has fallen over the past 5 days. It is currently trading at around $1960, showing a slight decline of approximately 1.35% from its recent high of $1987.53.

Price is currently trying to break out of the downward channel that it has been in since late last week, so something to keep an eye on going into the key economic data due out this week.

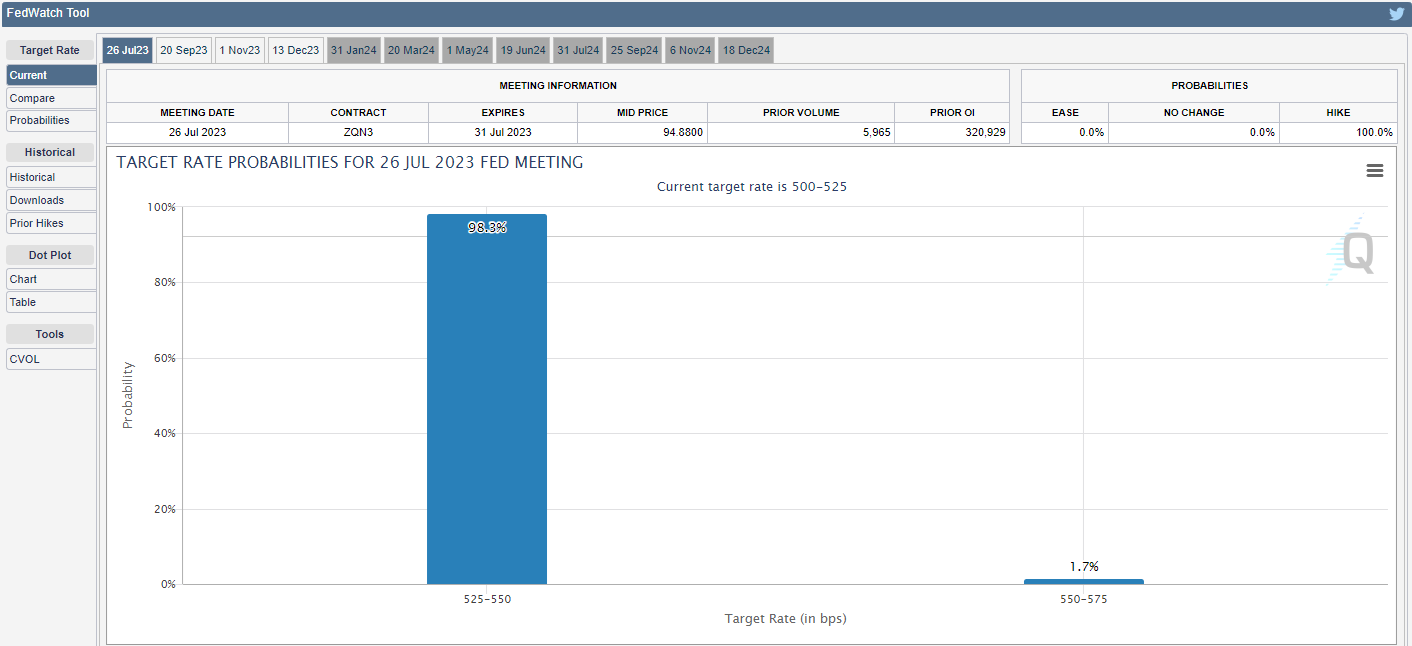

All eyes are now on the upcoming FOMC meeting, where the market is currently pointing towards a high probability (over 98%) of a 25bps rate hike on Wednesday.

Considering the historical inverse relationship between gold and the USD, let’s explore potential reactions by Gold to the FOMC meeting:

Rate Hike Scenario (USD Strengthens): If the FOMC goes ahead with the 25bps rate hike, it could lead to a strengthening of the USD. Higher interest rates tend to attract more investments into the US currency, potentially dampening demand for gold. Consequently, gold prices might face downward pressure in this scenario.

Rate Pause Scenario (USD Weakens): Conversely, if the Fed decides to maintain interest rates at 5.25% or hints at a more dovish approach, the USD could weaken. A weaker USD often prompts investors to seek refuge in gold as a hedge against currency depreciation and inflation. As a result, gold prices could see an uptick due to increased demand.

Source: CME Fedwatch tool

With the markets almost entirely pricing in a 25bps hike, unless we get a surprise in the figure, volatility may stay subdued until Fed Chair Jerome Powell begins his press conference shortly after the announcement. Investors and traders will be eagerly analysing his language to see if there are any hints on future movements by the Fed.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FOMC Preview – One and Done, or More to Come? The Charts to Watch

The long-awaited July FOMC meeting is finally upon us where rates markets are pricing in a sure thing for a 25bp hike (even a small chance of a 50bp), the question that traders will be looking for to be answered is “is this it?”. With a growing number of economists calling this the top in rates, butting up against the FOMC June statement and un...

July 26, 2023Read More >Previous Article

FX Analysis – Treasury Yield surge Pushes USD Higher, AUD Outperforms on Hot Jobs Report

The US Dollar was firmer Thursday, continuing its bounce from extreme oversold levels, the DXY peaking at 100.97, just short of the major resistance a...

July 21, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.