- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Black and Yellow Gold

- Tuesday: API Weekly Crude Oil Stock

- Thursday: EIA Report

- Friday: Baker Hughes US Oil Rig Count

News & AnalysisCommodities markets were on sell-off mode on Friday. The black and yellow gold was sent to the downside dragged by the disappointing Purchasing Managers Index data.

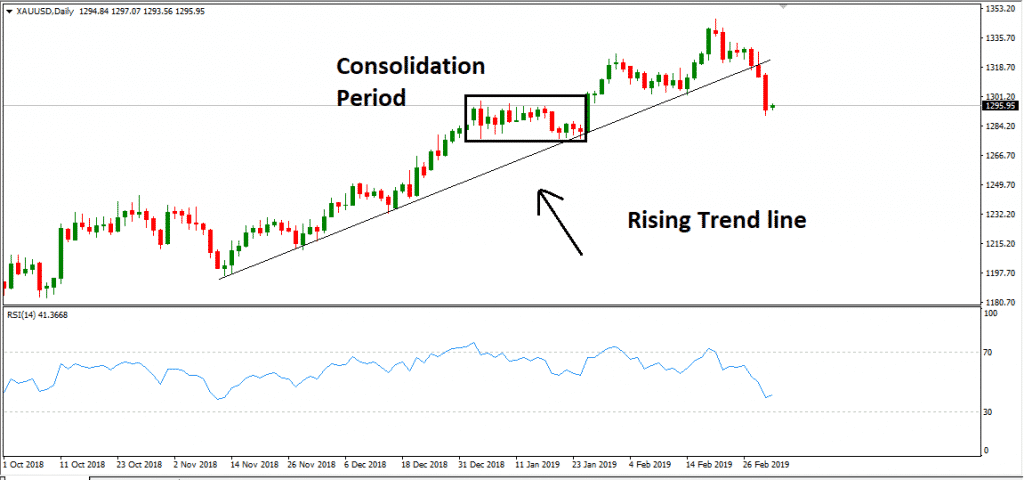

Gold – XAUUSD

The Chart shows that Gold price pulled back as from last Wednesday on a broad-based US dollar strength and retreated from its 2019 highs. The yellow metal struggled to find buyers amid a risk-on mode. Being driven mostly by the greenback, Gold traders will eye the series of US data releases this week for fresh trading impetus. Central banks rate decisions scheduled across the week and trade or Brexit headlines may also bring some volatility.

Technically, XAUUSD is in the RSI oversold conditions and the positive trade headlines emerging this morning might help the yellow metal to bounce back. After being in a consolidation period throughout the month of January, XAUUSD has continued trading to the upside capped by a rising trend line. However, gold prices gave up the bullish momentum and dropped below the line setting a bearish tone for XAUUSD.

XAUUSD (Daily Chart)

Source: GO MT4WTI and Brent Crude

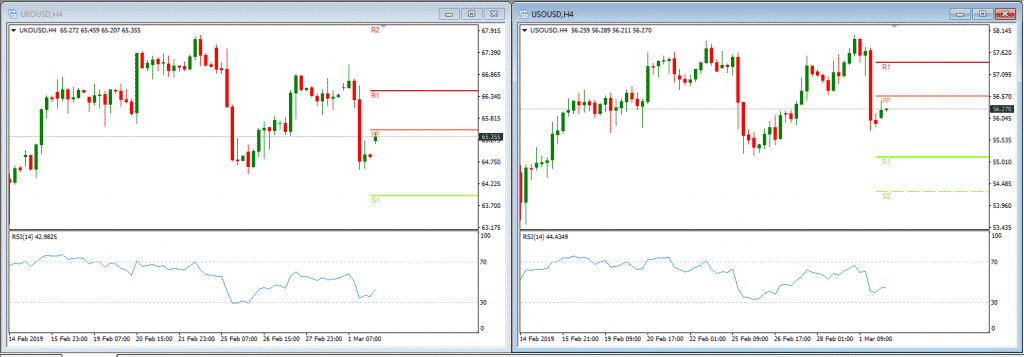

Oil prices were also under pressure on Friday whereby WTI and Brent Crude erased more than 2%. After ending February in positive territory, oil prices started a new month in the red. The tightening of global supplies and the US sanctions have supported the upside price action of oil prices since the beginning of the year and last week sell-off started with President Trump’s comments on high oil prices.

UKOUSD and USOUSD (H4 Chart)

Source: GO MT4We expect the weekly oil reports to provide short-term direction for oil prices:

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk .

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Know the Score: Holding Costs of Daily Fx Positions

Many traders consider trading daily timeframes but when used to trading the shorter timeframes, overnight holding costs of positions may not be something they have come across previously. This brief article has the aim of understanding why these trading costs exist and how they are calculated. But First…An important message about holding costs�...

March 5, 2019Read More >Previous Article

Margin Call Podcast – S1 E7: Sophie Gerber | Founder of Sophie Grace and Co-Founder of TRAction Fintech

Sophie Gerber (Linkedin) is a leader in the space of legal & compliance in the finance industry within Australia, publishing regularly across ...

February 27, 2019Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.