- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- 2020 Kicks off with US-Iran and Climate Change Crisis

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- 2020 Kicks off with US-Iran and Climate Change Crisis

- Iranian-backed militia killed an American Defense Contractor

- The US retaliated with missile strikes

- The American Embassy in Baghdad was attacked

- US airstrikes killed top Iranian military official, General Qassem Soleimani

- Iran responded by launching missile strikes at two bases hosting U.S. forces in Iraq

- Major equity benchmarks traded at a record high

- US stock indices are trading higher by 1% and above

- Most European Bourses are also experiencing similar gains

- Australian benchmark outshines its peers with more than 4% gain

- FTSE100 is lagging slightly behind with 1% gain

- Trade deal; and

- Central Banks.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe start of the year was marred by the escalating tensions between the US and Iran while extreme weather conditions across the global triggered fierce debates about climate change.

What do we know so far about the tensions between Iran and the US?

As the world witnesses the rising tensions between the US and Iran, and a uniting Iran over the assassination of one of the most influential and powerful men, the downing of Ukraine International Airlines flight PS752 has caused international outrage and brought internal division within Iran.

Beyond Economic War

The existential conflict between the US and Iran moved beyond an economic war. In 2019, the US announced further economic sanctions on Iran, which has put Iran into a deeper recession. As a significant buyer of crude from Iran, China sees the situation as an impediment that can hurt its economy. The Iran risks may, therefore, overshadow the trade deal.

Investors have already priced in some extent of the risks associated with Iran since President Trump pulled out of the 2015 nuclear deal and started to impose sanctions. Even though the headlines brought Iran back on the geopolitical risks radar and caused a spike in volatility, we do not see the conflict changing the investment landscape at this stage.

Climate Change

2020 is set to be the confirmation of a new era for climate change. As we entered a new decade, the extreme weather conditions around the world have forced leaders of many countries to reassess their actions over climate change and transform the global energy system.

In Australia, the unprecedented and raging bushfires across the country act as a warning to the world and has even challenged a reluctant Prime Minister to take more action

Energy Sector

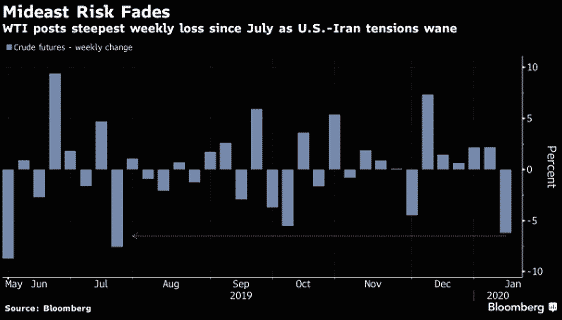

Oil prices experienced their largest weekly drop since July 2019 despite the tensions in the Middle East. Coincidently, markets were hit by two contradictory themes for the oil and gas industry: Iran Risks and Climate Change.

Source: Bloomberg Terminal>It should be highlighted that the energy sector emerged as the worst-performing sector of S&P500 in the last decade. Investors are stepping into 2020 being accustomed to the global oil glut and the gradual shift in the oil and gas industry.

Iran risks fuelled expectations of a reduction in supply while the “green” shift lowers demand expectations.

Eyes are now on the US-China trade deal!

Stock Markets

Despite an erratic few weeks of trading, global stock markets have performed quite well:

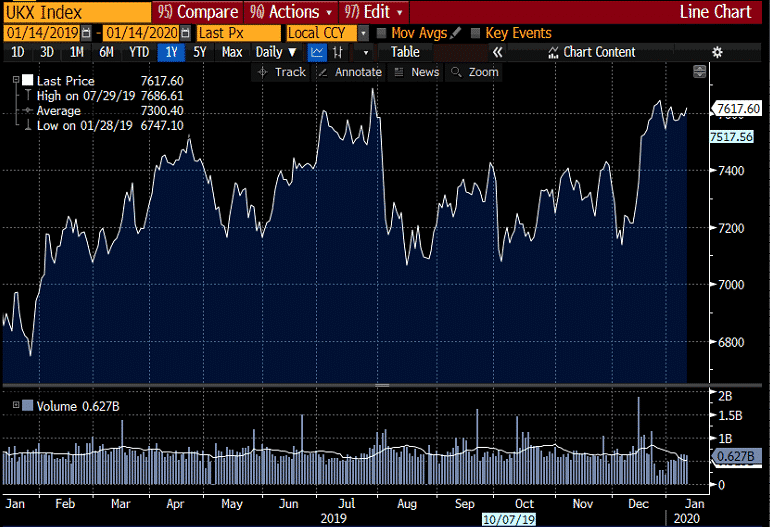

Brexit will remain the dominant factor for the UK markets. Despite the volatile year 2019, the FTSE100 posted two-digit gains. The Tory win had pushed the index above the 7,500 mark. Looking ahead, the Footsie is expected to rebound and investors are eyeing the next target at 8,000 level for 2020.

However, given that a large amount of earnings of the index is derived from overseas, an appreciation of the Sterling may hinder the performance of the FTSE100 to play catch up with its global peers.

Source: BloombergAre Re-Pricing Risks Required?

The killing of a key commander took the markets by surprise. Heightened geopolitical risks have somehow become the new normal and unless there is any serious escalation, medium to long-term effect on the markets would be limited. In a new world of higher tariffs, de-globalisation, and historic low levels of interest rates, the most significant risks for 2020 are:

About GO Markets

GO Markets was established in Australia in 2006 as a provider of online CFD trading services. For over a decade we have positioned ourselves as a firmly trusted and leading global regulated CFD provider. Traders can access hundreds of CFD instruments including Forex, Shares, Indices and Commodities.

Follow us and keep up to date with the latest market news and analysis.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Video: Inner Circle – Interviews with successful traders – Nigel Hawkes

Please find the recording of the Latest Inner Circle session, the first in our NEW interviews with successful traders series. Nigel Hawkes is the epitome of a lifetime trader, now at 71 he trades for a living. Hear his fascinating trading journey, the foundation principle of "Six ways the market moves" and his 3 golden rules he abides by in his ...

January 15, 2020Read More >Previous Article

Accumulating into a Profitable Trading Position: A System Checklist

Position accumulation is to increase exposure to a currency pair, by adding a second (or more) position in the same trading direction. Although on the...

January 15, 2020Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.