- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Geopolitical Events

- US trading thematics Part 3: More than the Trump trade

- Home

- News & Analysis

- Articles

- Geopolitical Events

- US trading thematics Part 3: More than the Trump trade

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisWe’ve held off making comments about the events of what happened last weekend. Everyone has seen it, everyone knows the horrible scenario that it was but it is probably also meant that we have missed really key economic and fundamental trading reasons U.S. markets are now in a very broad bull market scenario.

Inflation

It was only 10 weeks ago an unexpected surge in inflation meant the dominant question in markets was if the Fed would cut rates this year at all. Some five weeks later it increased to one rate but is a distant memory of the three forecasted in January this year.

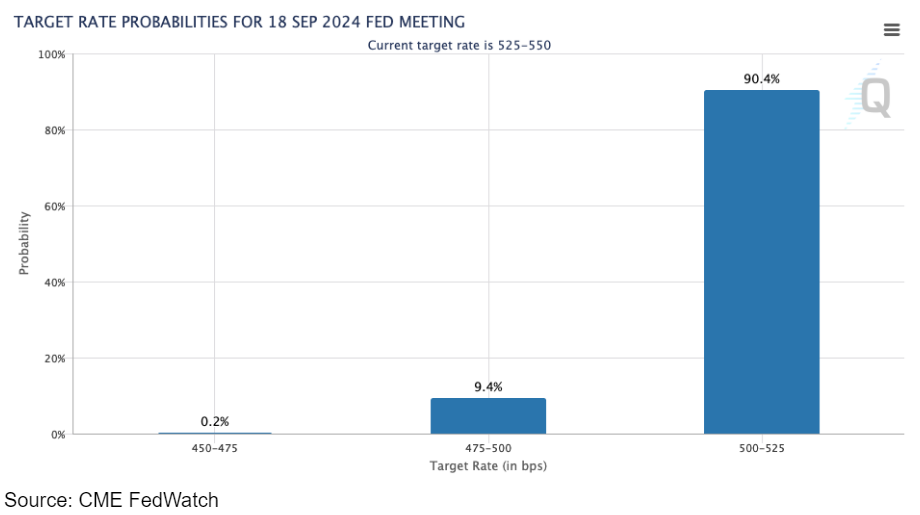

That is now all changed downside surprises to the second quarter inflation and the continued rise in the unemployment rate have not only met cuts are likely but for the first time in 10 weeks the market is now forecasting 100% likelihood of a September rate cut.

Seen here:

Source: CME FedWatch

In fact, as this chart shows there’s even expectations that it may not just be a 25 basis point cut it could possibly be more. Remember the current federal funds rate is 525 to 550 basis points.

As we’ve said before in this trading US series, once the US Federal Reserve starts its right cutting cycle, it is unlikely to stop until it reaches the neutral rate. Expectations are building from investment houses that there could be a possible rate cut in 2024 that being September and December. This is at least the consensus some are even suggesting that November could be included as well seeing the January forecast coming to fruition.

Will understand this more tonight when governor Waller presents and adds a function but it’s likely that he will back chair Powell’s comments on Monday that ‘rights will need to be lower by the year end’.

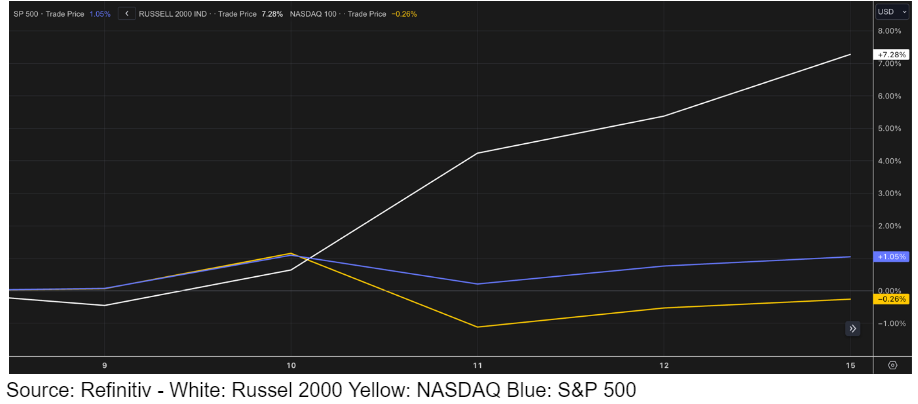

We think this is what is being missed over this week in relation to the bull market in equities and the change in FX and bond markets. You only have to look at the Russell 2000 to understand this change. The industry is now up over 12.5 per cent in the last month alone and 7.5 percent of that has come in the last seven days. Compare that to the NASDAQ for example which actually sat still over the same period. This is due to the rotation trade based on right cut expectations not the Trump trade.

Remember small cap firms are much more reliant on capital borrowings and thus much more susceptible to interest rate movements. The index has been much unloved over the last trading period as small caps have been left in the dust due to their risk and exposure to rate.

But with the prospect of right cuts plural, the attraction to risk the attraction to rotate out of fully valued trades makes sense.

Here is the performance of the Russell 2000 S&P 500 and the NASDAQ over the past seven days

Source: Refinitiv – White: Russel 2000 Yellow: NASDAQ Blue: S&P 500

What will be very interesting to see is something like NVIDIA becoming a funding source as it is begun to show evidence of being. We see in NVIDIA, Meta and Microsoft falling into this funding category over the coming weeks, as traders move into higher risk. What we think might catch them out is earnings.

Earnings

This brings us to the second part of what is driving U.S. markets. Earning season so far and yes, it’s a small sample size, has been astounding. All have been at the upper end or above the Street View. You only have to look at JP Morgan, Morgan Stanley and most of the other major banks to see this. The bellwether Caterpillar, a forgotten darling, showed just how well it is doing in this ‘soft landing’ economy and surged over 5 percent on its results. Again explains the rotation out of the magnificent 7 and into other sectors something we foreshadowed in part one.

How it is also a warning sign, the probability that NVIDIA and the others beat expectations is high. The question we need to ask is will it be high enough? As if the markets rotating out now could it become reporting day traders have to catch up to better than expected numbers and miss out on a possible next leg? It is something to ponder yourselves as you look to position for what is clearly going to be a strong US earning season.

This brings us to Apple.

News this week that it achieved $8 billion in sales in India is something that can’t be ignored. India is a market that Apple has severely underperformed in over the last several decades as its main competitor in Samsung took hold with cheaper more compelling phones.

However, all that has changed since COVID, the interruptions it experienced taking supply chains out of China have seen it diversify into the world’s second largest populous country. There is only upside for Apple in this space. Secondly data this week showed how well it is now integrating AI into the Apple ecosystems. The links between its watch, phone, eyewear, laptop and iOS systems are strengthening by the day. It is clear that over the next five years AI will make the ecosystem more intuitive and more attuned to everyday use. Thus making apple products that much more attractive and that much more needed by its mature and evolving marketplaces.

This explains why Morgan Stanley this week suggested that in the coming two years Apple could become a $5 trillion company. Apple is up over 20 per cent in the last month, and it could be the one that confirms the bull market in the US he’s going to be sustained.

These two points alone explain why the Trump trade is not the trade driving markets. Yes there is an influence and yes it is something we will talk about over the coming months leading into the US presidential election. But we want to be clear that what really is happening with the Trump trade is behavioural bias and it is blocking out the clear rational evidence that is driving things and thus don’t be distracted by what you see. Concentrate on the concrete evidence that’s in front of us.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Do you catch a falling knife?

We all know the market term ‘don't catch a falling knife’. And in the current market conditions why would you? But with indices, the likes of the magnificent 7, industrials and banks doing so well in 2024 people are asking where's the value? And that is why people chase falling knives, because they perceive this value. They perceive that if ...

July 23, 2024Read More >Previous Article

US trading thematics Part 2: Data Confirming

Will June be the turning point? The market thinks it is – and its reaction to the CPI data not only signalled how it will trade in the coming months...

July 12, 2024Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.