- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- USDJPY – Will the BoJ Intervene?

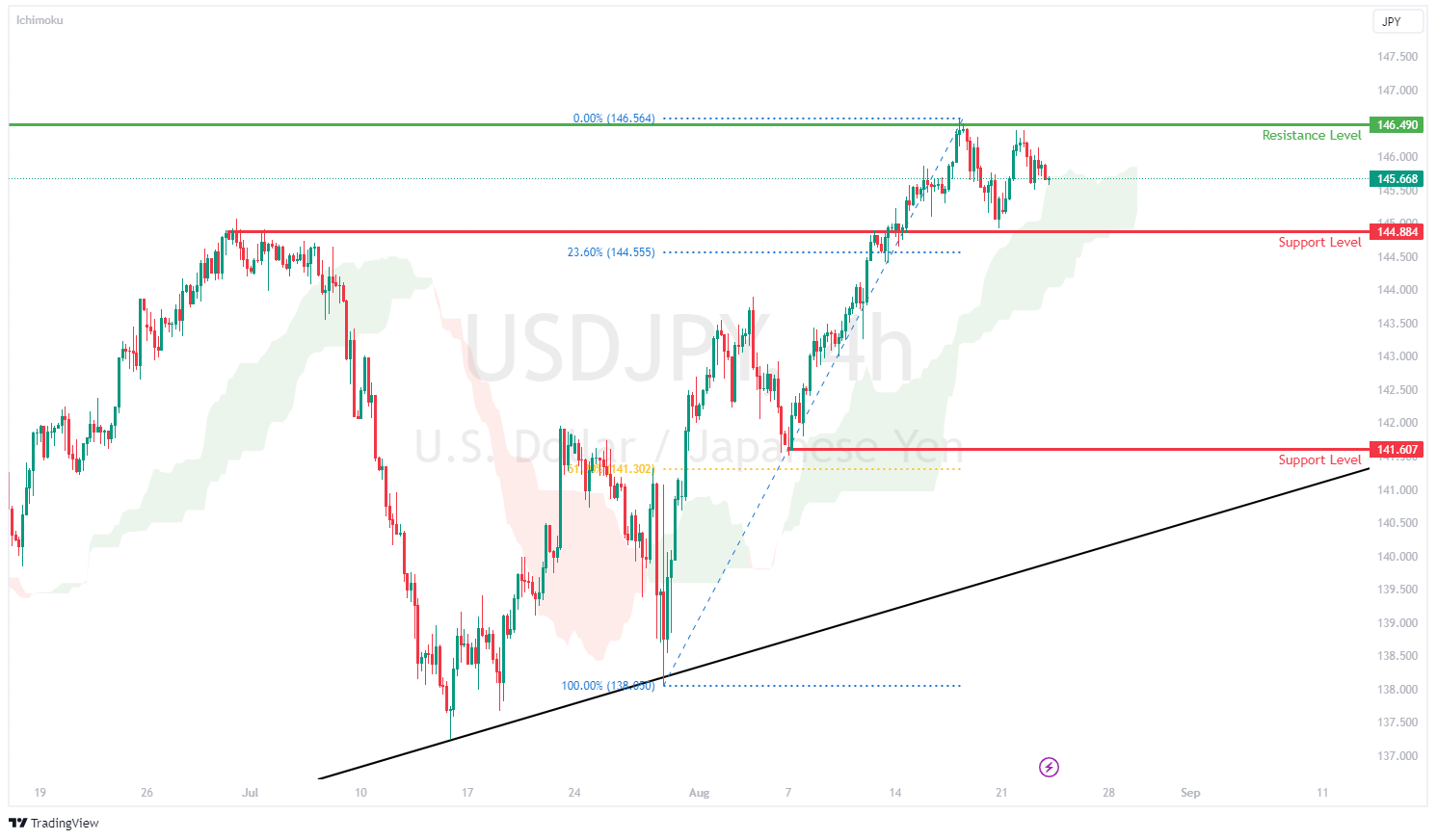

News & AnalysisIn 2022, it was believed that the Bank of Japan (BoJ) intervened three times, in September when the USDJPY was at 145.80, and in October and November when the USDJPY was at the 151.50 and 146.50 price levels respectively. For each of the 3 interventions, the USDJPY reversed strongly by more than 500pips.

With the recent steady climb in the USDJPY in August, rising from 138 to the high of 146.50, there have been increasing comments from members of the BoJ and Japanese government regarding the need for an intervention. The BoJ has avoided interventions, possible for the interim, by announcing increased flexibility on its yield-curve control (YCC). However, the markets viewed the action as insufficient and the stronger DXY continued to take the USDJPY higher.

Continued upside on the USDJPY cannot be ruled out, especially if the DXY continues to strengthen significantly. However, if the USDJPY continues to trade between the 145 and 146.50 price range, the possibility for an intervention from the BoJ increases.

For an impactful intervention, the scale and timing of the decision would not be scheduled. A signal would be based on price volatility, in this case, if the USDJPY breaks through the bullish Ichimoku cloud and down from the 145-round number support level, which aligns with the 23.6% Fibonacci retracement level. A reversal of 500 pips, similar to previous interventions, could see the USDJPY retest the trendline, along the 140 price level, with interim support at the 61.8% Fibonacci retracement and 141.60 price level.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX analysis – USD drops, Gold pops on soft data, falling yields

A raging US equity market fuelled by soft data, a drop in treasury yields and blowout earnings from NVDA (which saw its stock price hit an all-time high) saw risk-on trading through Wednesdays session. USD was choppy on Wednesday with an initial rally in DXY, which saw it briefly pierce the major resistance at 103.60, dramatically reversing cour...

August 24, 2023Read More >Previous Article

EURUSD tests near term support

After reaching the high of 1.1250, last tested in 2022, the EURUSD has been trading steadily lower and currently sits along the 1.0850 support level, ...

August 23, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.