- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- The Week Ahead – XAUUSD, AUDUSD, DXY

News & AnalysisGlobal markets enter the second week of the new year in cooldown mode with risk assets taking a hit after the red-hot finish to 2023. The NASDAQ having its worst start to a year since 1999, dropping almost 4% on the week, risk sensitive currencies AUD and NZD following not far behind.

FX traders have a slew of CPI reports in the coming week to look forward to, with inflation readings out of Switzerland, Australia, China and the US that have the potential to get FX markets moving.

Charts to Watch

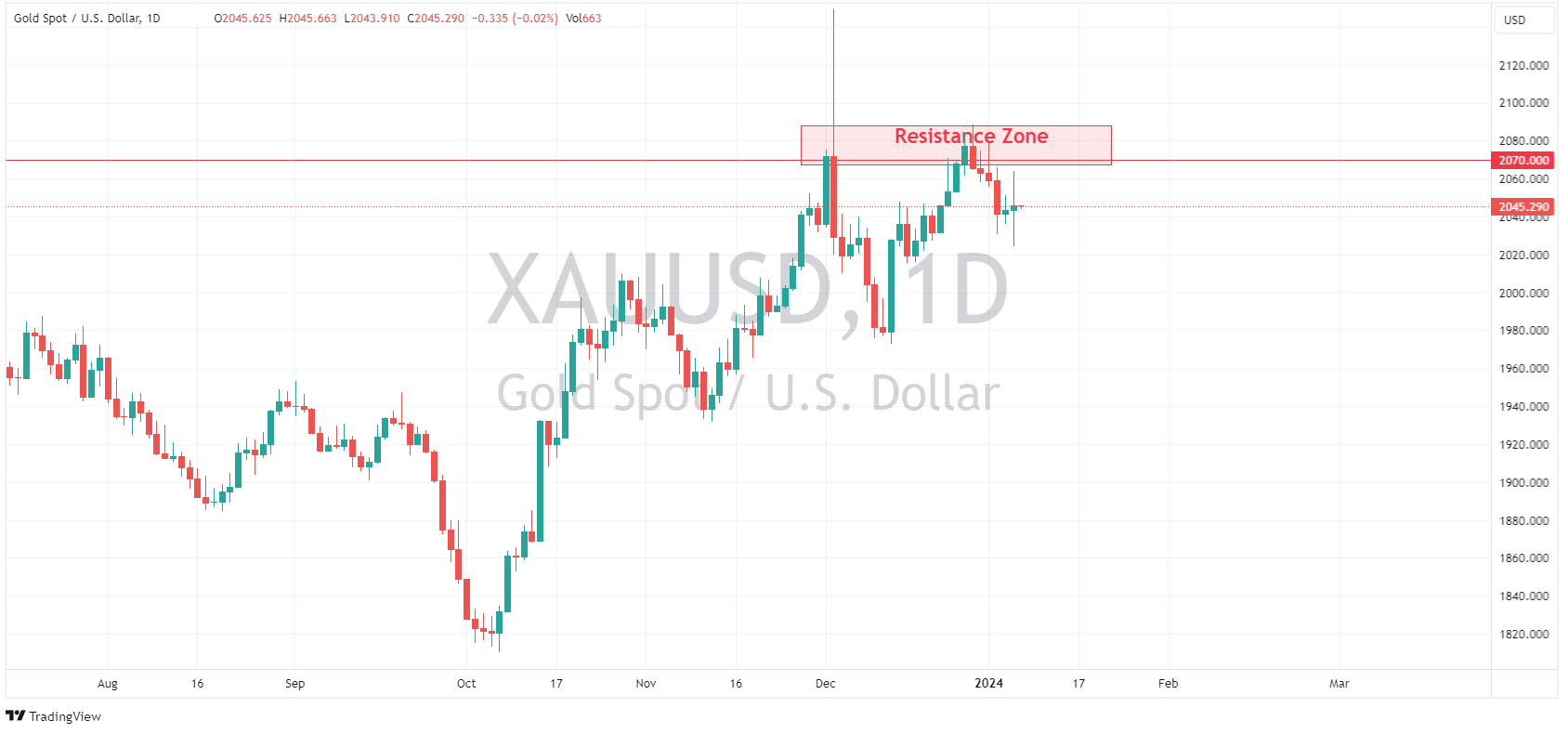

Gold – XAUUSD

Gold faltered last week as higher yields and a US dollar on tear weighed on the precious metal. Attempts by the bulls to push through and hold the key 2070 level were rebuffed and saw XAUUSD drop to a low of 2025 in Fridays NFP inspired volatile session.

This weeks US CPI figure will be a big test of the markets pricing of Fed rate cuts, hotter than expected and gold could take another leg down with that 2070 resistance level capping the upside. Cooler than expected could see the bulls make another attempt to breach and hold that level as support.

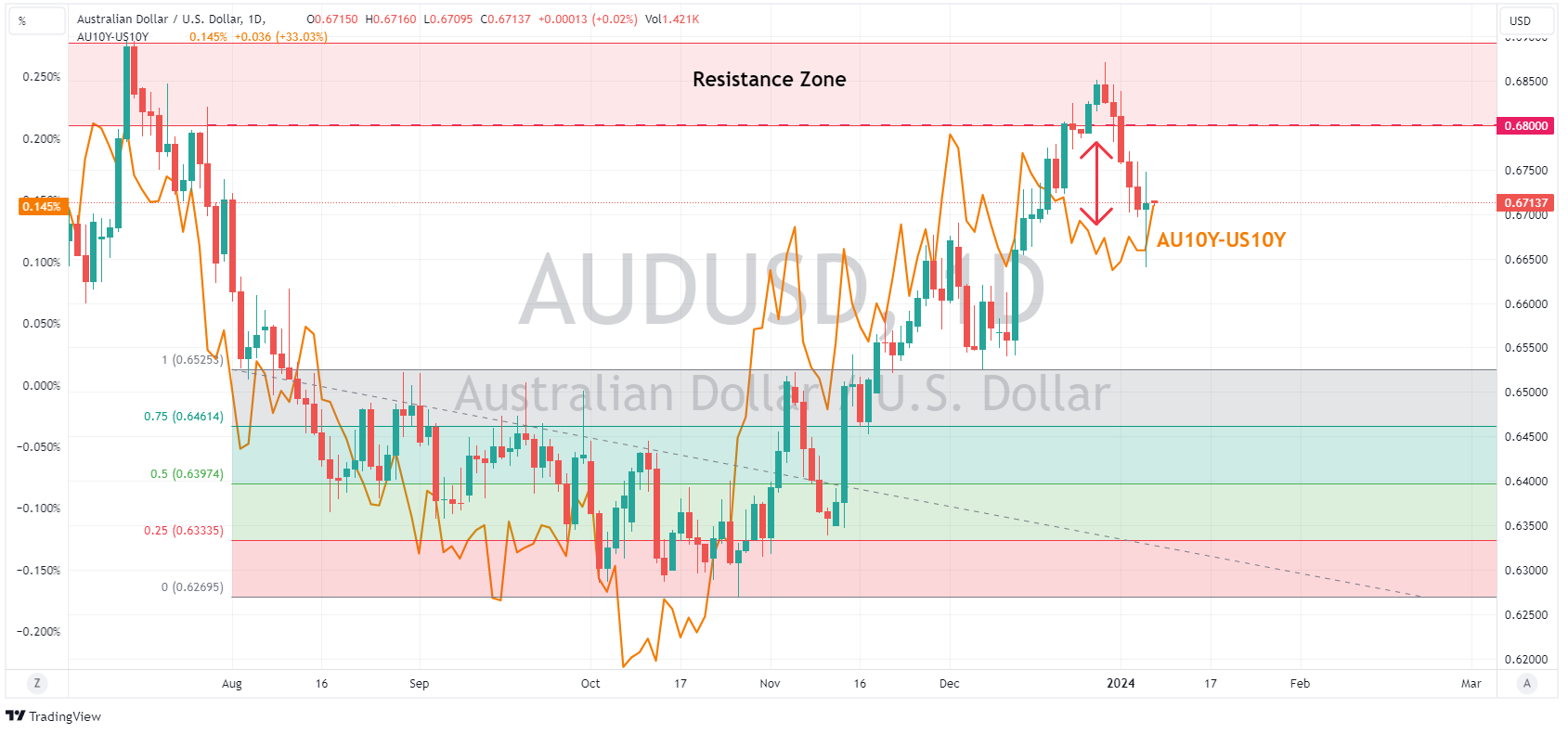

AUDUSD

AUDUSD didn’t have a great week either, having its biggest weekly drop since November. Decembers surge higher in this pair did look like to far too fast when looking at the AU and US rate differential, AUDUSD also hit a zone of resistance between 0.68 – 0.69 where sellers managed to turn the pair around. This week’s Aussie, Chinese and US CPI readings all set to causing some volatility in the pair. Key level to watch to the upside is the resistance starting at 0.6800, to the downside the big figure at 0.6700 has lent some short-term support to this pair.

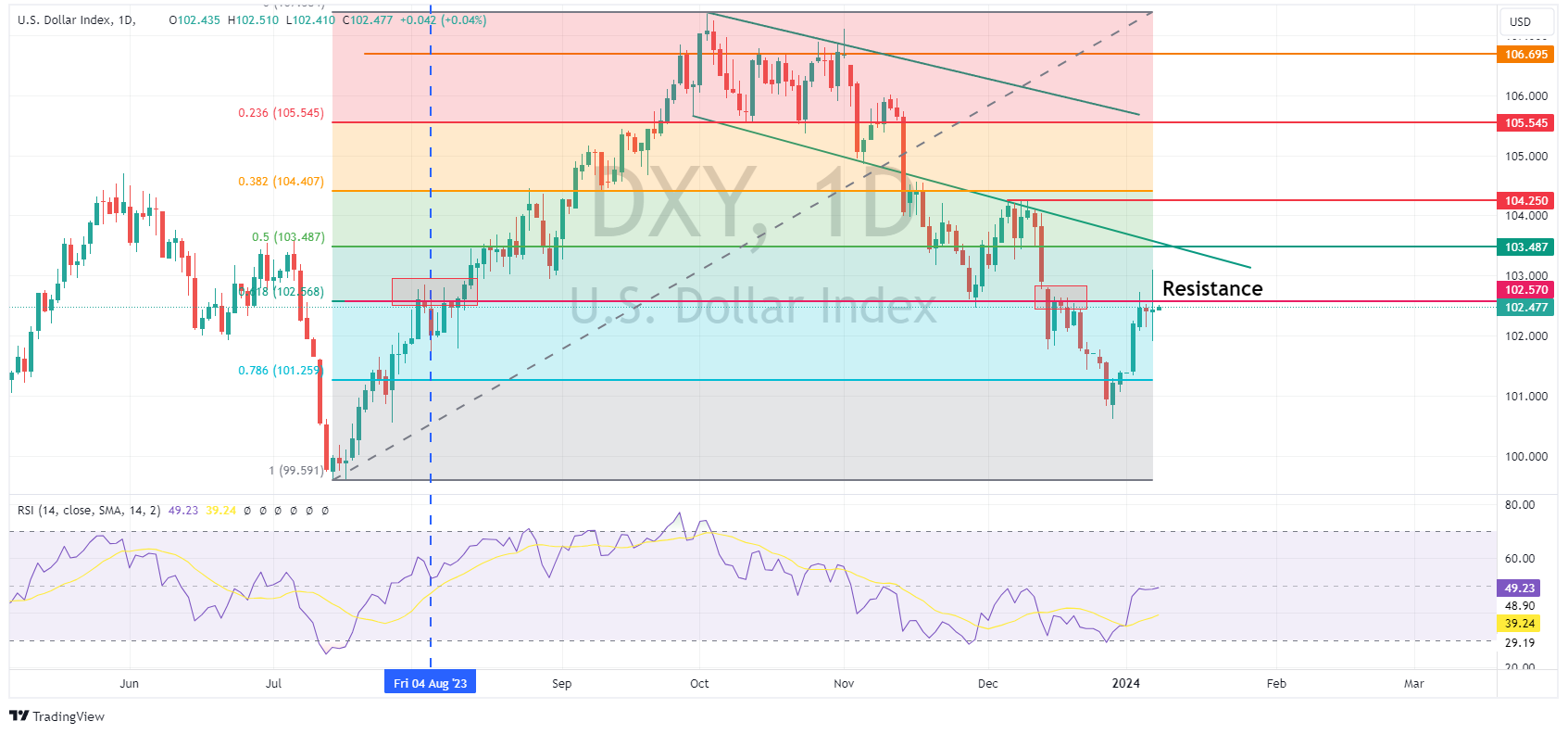

US Dollar Index – DXY

The US dollar has had a resurgence to start 2024 with DXY pushing through key levels 101 and 102 with ease. Resistance at 102.57, where upside faltered in December and August ’23, has come into play and a couple of attempts to breach were rejected last week. This level also lines up with the 61.8% Fib level measured from the July lows to October highs and will be the key level to watch coming into the US CPI reading.

Full calendar of the week’s economic announcements at the link below:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Market Analysis – Oil tumbles on Saudi price cut – USD, JPY, CHF

USD ultimately ended lower on Monday with the US Dollar Index (DXY) first testing the resistance at 102.57 to the upside before reversing course to test the support at 102 to the downside. A risk on equity markets and some dovish developments. Data saw the NY Fed Survey show lower than expected inflation expectations. There was also a dovish call f...

January 9, 2024Read More >Previous Article

Constellation Brands posts mixed results

US producer and marketer of beer, wine and spirits, Constellation Brands Inc. (NYSE: STZ), announced Q3 fiscal 2024 financial results before the marke...

January 8, 2024Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.