- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- The Week Ahead – BoJ, ECB, BoC meetings headline – the charts to watch.

- Home

- News & Analysis

- Forex

- The Week Ahead – BoJ, ECB, BoC meetings headline – the charts to watch.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Week Ahead – BoJ, ECB, BoC meetings headline – the charts to watch.

22 January 2024 By Lachlan MeakinMarkets enter the new week with risk-on firmly the narrative with all three major US indexes hitting all-time highs last week. In FX markets, the positive market sentiment has seen the march higher in the US Dollar hit resistance and cyclical currencies AUD, NZD and GBP bounce.

Ahead this week, traders have a slew of risk events to navigate with Central Bank meetings in Canada, Japan and Europe set to headline, also some big US data in Q4 GDP and the PCE inflation reading set to move FX markets.

Charts to Watch

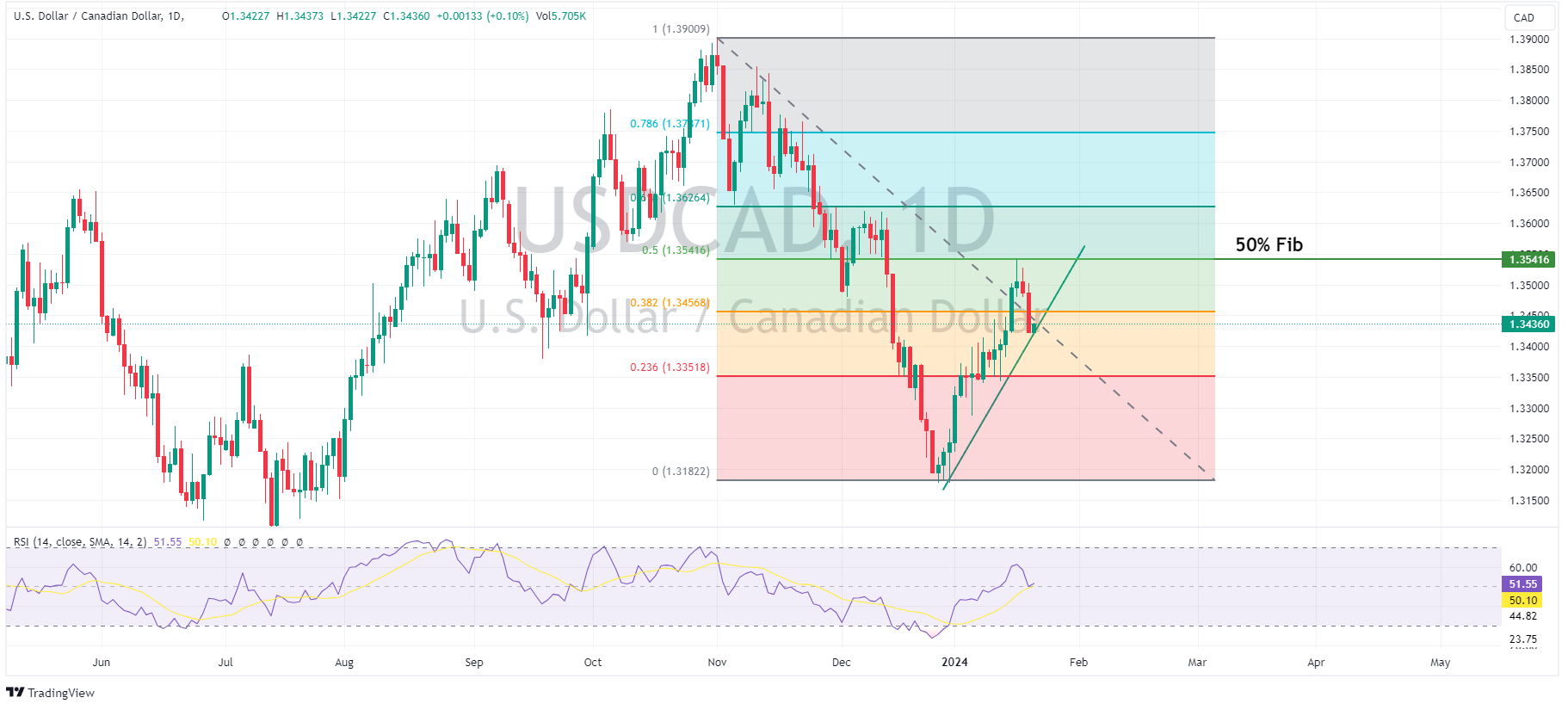

USDCAD – Bank of Canada set to hold after hot CPI

A hotter than expected December inflation reading out of Canada presumably will make any meaningful dovish shift from the BoC very unlikely in this week’s policy meeting with markets fully pricing in a hold from the central bank.

The 2024 rally in USDCAD hit resistance at the 50% fib level last week and pulled back sharply to test the lower trend line support late in the week. Key levels to watch will be the 50% fib level to the upside (1.3541) if the Bank does confound analysts and take a dovish turn. If the bank strikes a hawkish tone then the trendline support followed by the big figure at 1.34 to the downside.

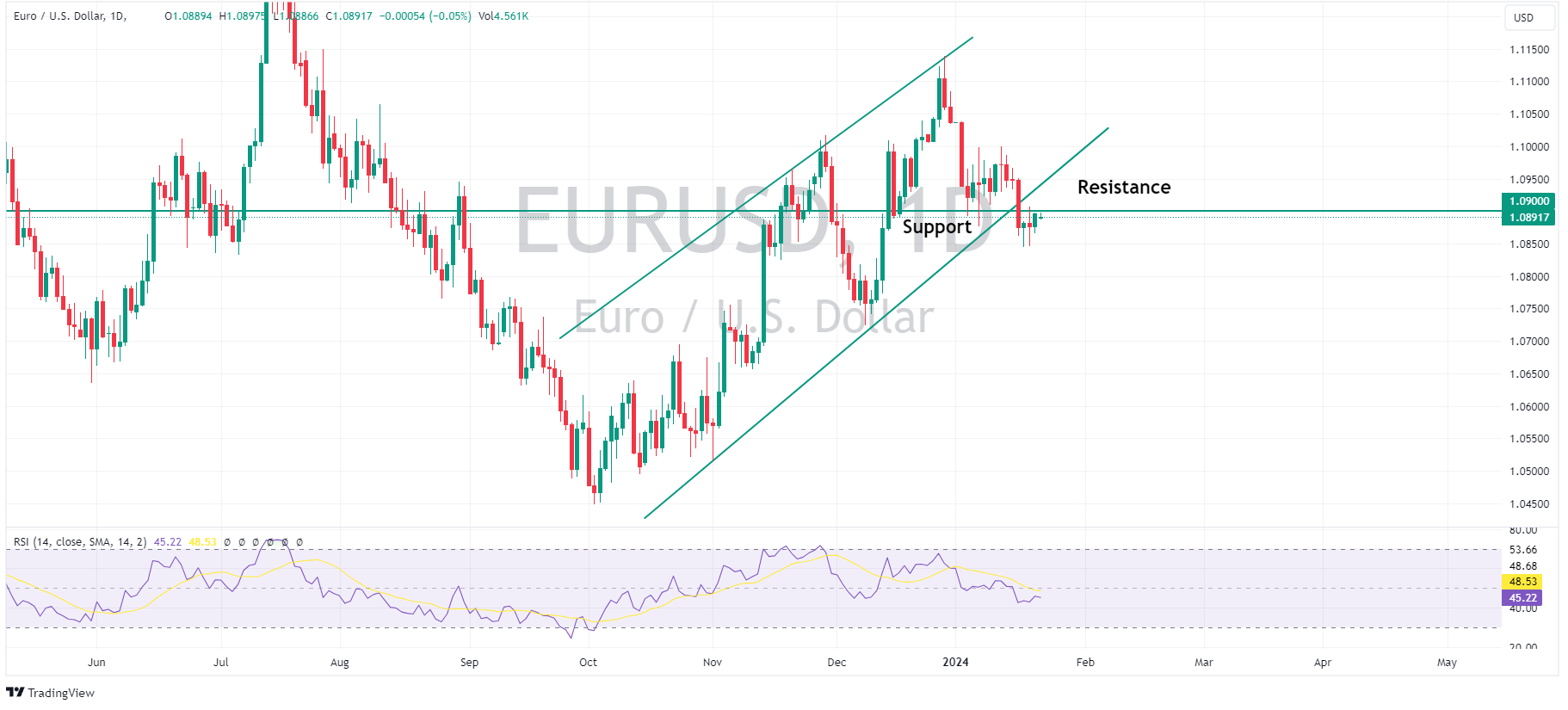

EURUSD – to pushback or not pushback

In December’s policy meeting the ECB basically announced the end of the current rate hiking cycle. Since then markets have priced in an aggressive trajectory of ECB rate cuts this year against the backdrop of a slowing EZ economy. Are the markets being too dovish in their predictions? This weeks ECB meeting may settle it if we see a hawkish pushback, or no pushback at all.

EURUSD set new 2024 lows last week, breaking the key 1.09 support level, which has now turned into resistance. This will be a key level to watch this week to see if it can re-establish itself as support, or continue as a cap to the upside.

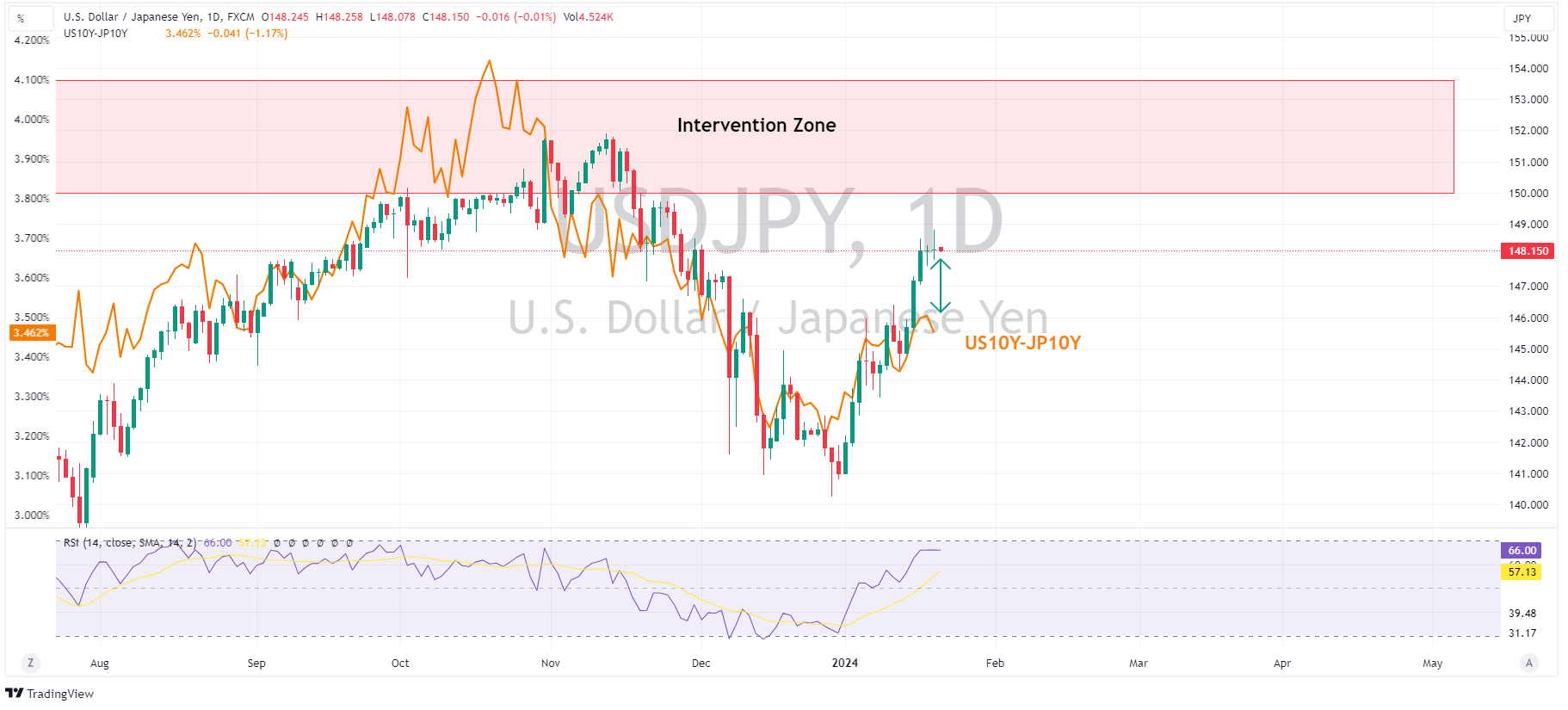

USDJPY – BoJ to maintain YCC

No surprises are expected from the BoJ on Thursday, with the bank look set to maintain its YCC policy and negative short-term rate policy. It’s more likely any policy shift will come after the March annual wage negotiations, though the BoJ have been known to surprise before.

USDJPY has risen sharply in 2024, at these levels it does look a little overbought as it has streaked ahead of the US10Y-JP10Y yield differential which has been the main driver of this pair in recent past. We are also approaching the 150 level, where chatter of intervention may start up.

The weeks full calendar at the link below:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Tesla Q4 Earnings Preview – Can a strong report turn the stock around?

TSLA comes into Wednesdays Q4 earnings report having taken a beating so far is 2024, with the stock price down almost 16% in the first 4 weeks of the new year. Q4 was a quarter that saw the company’s deliveries trend higher, driven by stronger sales of its entry-level vehicles following price cuts, an upside surprise may be on the cards lending r...

January 23, 2024Read More >Previous Article

TSMC posts better-than-expected results – the stock rises

World’s second largest semiconductor company, Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE: TSM), reported the latest results for Q4 of 2023 be...

January 19, 2024Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.