- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- The New “Lows”

News & AnalysisBy Deepta Bolaky

Trade and geopolitical risks were at the forefront of the meltdown that rattled the markets on Friday. Turkey’s currency crisis prompted a massive sell-off across the markets hitting the European banking sectors the hardest. Fears began to mount as investors freted its rippling effects on the global markets.

The current risks and a hawkish Fed are giving rise to the “Strong Dollar Story” which are putting pressure on developed and emerging economies. Emerging markets are mostly being hit by rising protectionist measures and US sanctions. There was growing interest in the Earning Markets and the overall outlook was promising until rising protectionist measures started kicking-in.

Contagion Effect

A diplomatic row between the US and Turkey sparked a contagion fear globally, resulting into new “lows” in the Forex markets at a time where major currencies were already facing a strong US dollar.

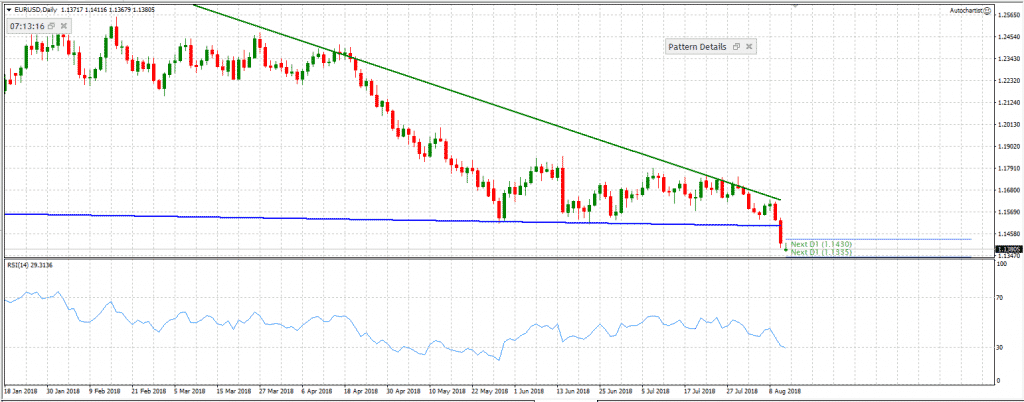

EURUSD – Banking contagion

The Turkish lira lost more than 13% against the dollar on Friday. The weakness in the Lira has elevated Turkey’s debt burden and the ECB expressed its concerns about the exposure of the European banks with Turkey. The shared currency slipped on Friday and EURUSD fell to one- year low. Even though the contagion might have some lingering effects in the eurozone banking sector in the short-term, we note that bank supervisors might be able to pull tools at their disposal to contain the damage in the long-run. The key risk for the Euro might therefore be the policy divergence.

On the technical side, the pair has formed a descending triangle which indicates a bearish formation whereas the RSI value is currently at 28.916 indicating oversold conditions. The overall situation may suggest that EURUSD could bounce off before incurring deeper losses.

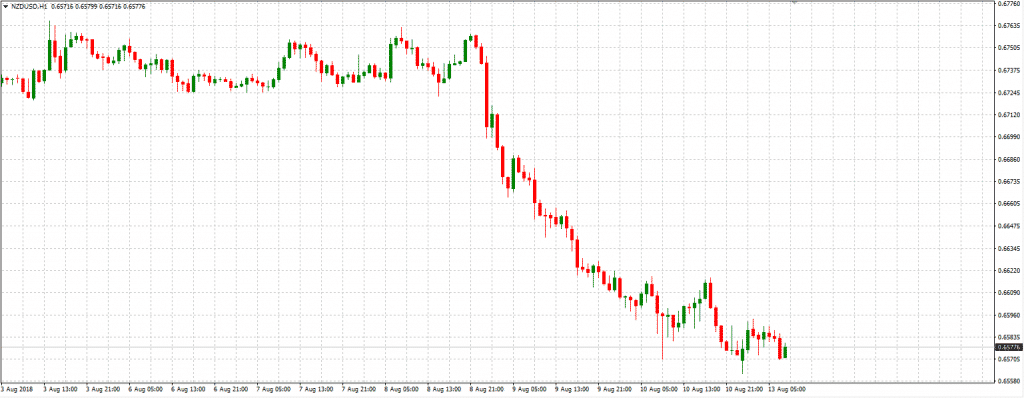

NZDUSD – NZ-US interest rate advantage

The New Zealand dollar was dragged down by subdued fundamentals at a time where the NZ-US interest rate advantage has been eroded. The Kiwi was battered by the dovish statement by the RBNZ and the contagion fears following the currency crisis in Turkey. A sour risk tone in the markets is hauling the NZD pairs from a” negative” to a “bearish” outlook. The NZDUSD pair dropped to two-year low.

The pair has made a minor bounce back. Any move passed last week’s lowest level would most likely indicate the presence of sellers and can potentially drag the pair pass the 0.6400 level. Any sustained move above 0.6570 level will signal presence of buyers. This can also be the profit-taking or counter-trend buying.

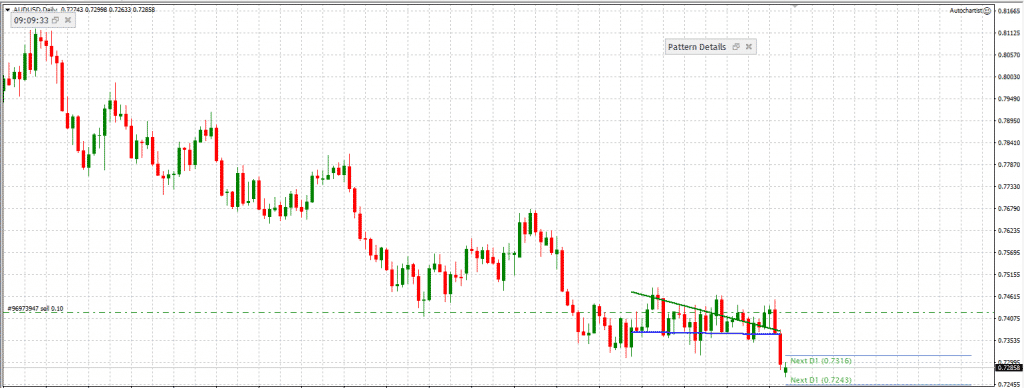

AUDUSD

The Australian Dollar is also feeling the heat of the geopolitical risks and a dovish RBA. The week kicked off on a sour note and AUDUSD fell below an important trendline at 0.7350. The slide can continue if the contagion fears escalate in the Eurozone and risk aversion persists.

AUDUSD bounced back after gapping lower on Monday. It is currently trading in the one-year low range. Technically, the pair is also in a descending triangle suggesting a bearish trend but traders should keep an eye on the RSI which is moving towards the oversold conditions. This situation can also be driven by some short-covering rallies.

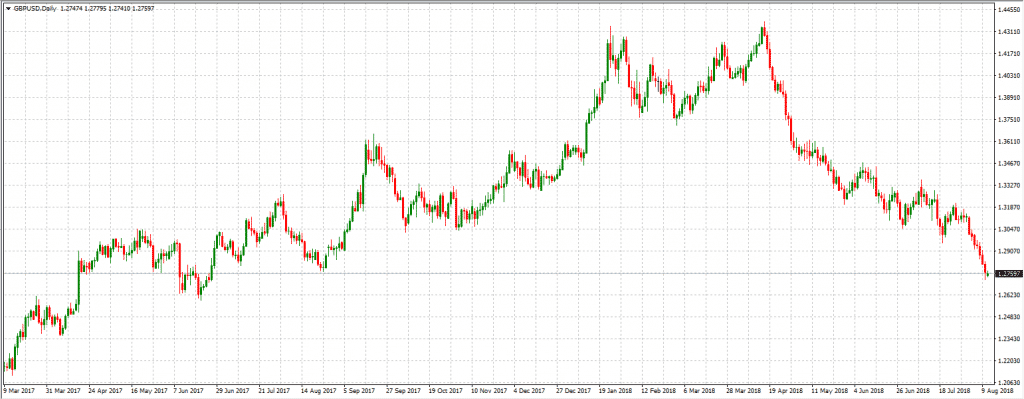

GBPUSD- Brexit saga

The pair is trapped at the 12-month lows as the volatility of a “no-deal” Brexit has increased. The Sterling was already on the backfoot with the Brexit tensions and a full-blown return of risk aversion could open up further downside opportunities for the Cable. GBP bulls will have to rely on a series of data scheduled over the week for fresh impetus.

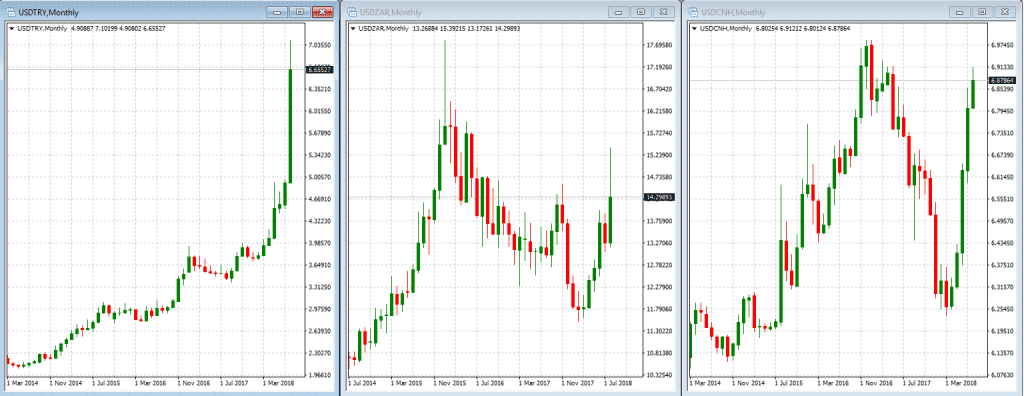

Moving on to the emerging markets, contagion is the “buzzword of the week” and appears to be flowing through the emerging markets. Emerging currencies are sliding under the influence of a stronger US dollar and currency crisis in Turkey. The rising contagion fears has even caused a flash crash in the South African Rand.

As of this writing, Turkey’s central bank has announced intervention measures which is bringing some relief and toning down the bearish outlook in the Forex and equity markets.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

No Turkish Delight – Is A Currency Devaluation Of 40% Justified?

Most political scientists believe that all problems in the world are related to politics, and most economists believe that all problems are rooted in economics. However, what’s happening in Turkey now seems to be a combination of both as I'll explain. Firstly, investors have always regarded Turkey as one of the Emerging Markets with good economi...

August 14, 2018Read More >Previous Article

GBPAUD – Brexit ‘No Deal’ To Spark A 1000 Pip Move?

Since September last year, the British Pound has enjoyed a relatively easy time against the Australian Dollar, often described as a solid bull run. Ho...

August 13, 2018Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.