- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Pound gearing up for a reversal?

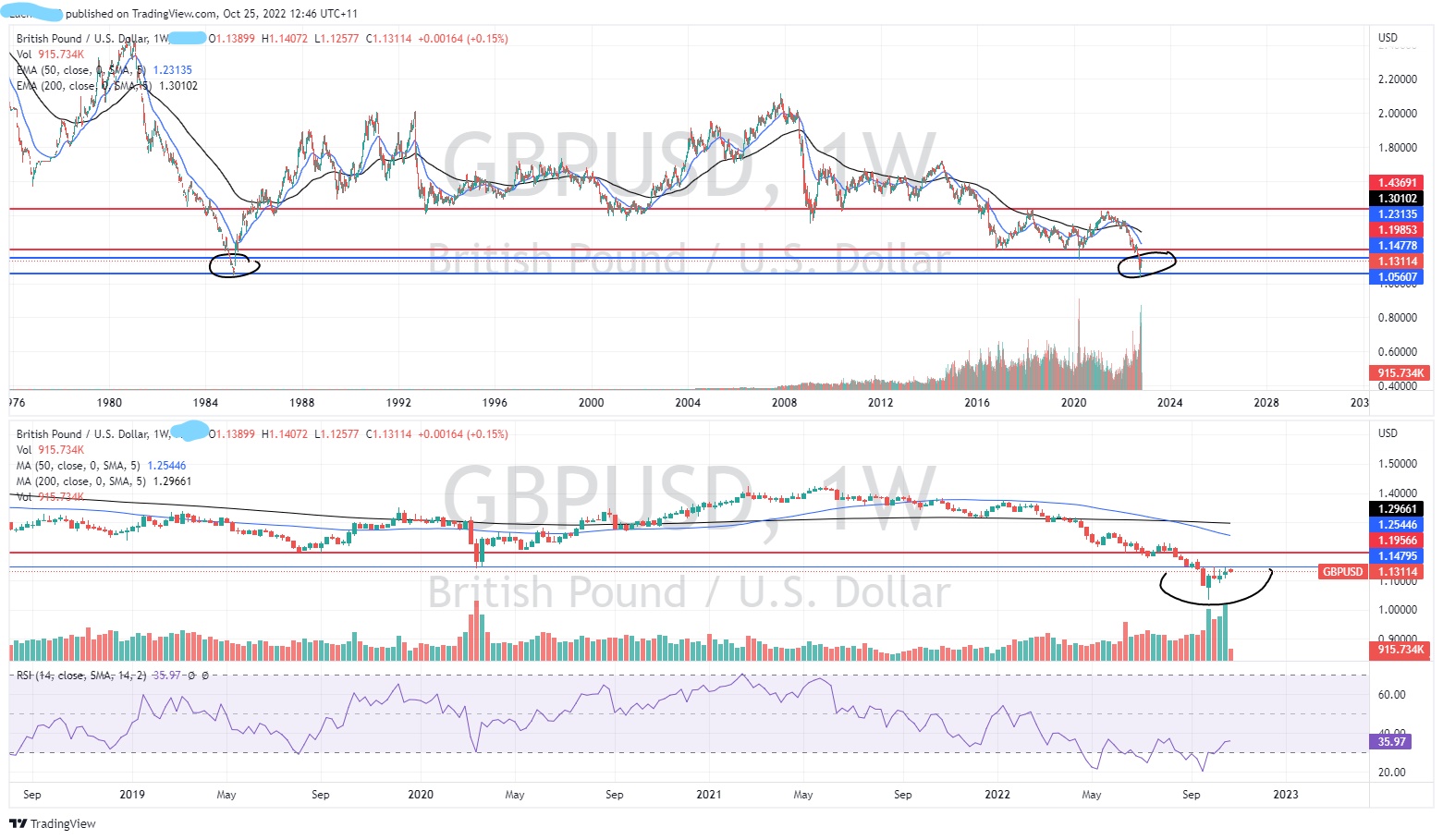

News & AnalysisThe UK has had to deal with recessionary fears, sky high energy prices, a cost-of-living crisis, and a breakdown in political leadership. This has caused the GBP to fall to lows not seen since the last century.

The British economy has also had to deal with a potential liquidity crisis caused by some of the large UK retirement funds almost bringing down the UK economy however with some support from the Bank of England the situation has in the short term been resolved. The political pressures have also eased somewhat with Liz Truss stepping down and Rishi Sunak taking over the role of Prime Minister, which may further support the potential for a reversal and show o strength in the pound.

With the price so beaten down at some stage it will have to turn around. The question is this reversal about to occur?

Technical Analysis

On the weekly chart, the price has been ranging between 1.4369 and 1.1985. Earlier this year the price dropped below the bottom of the range for second time with the only other time being the initial stages of the pandemic. The lower bounds of the range present a potential target if the reversal is validated. The price has finally started higher and the strength of the weekly candles and the volume supporting the price action indicates that supply is being depleted. The risk for a potential reversal is just how aggressive the long-term moving averages are to the sell side. Both the 50- and 200-week moving averages are still pushing to the downside.

The daily chart shows an interesting picture. The price of the pair is clearly coiling and almost ready to break out of its consolidation. If the price can break out it may provide a short-term target of 1.19853 may provide a potential price to take profit.

With volatility seemingly settling around the UK’s economy, the potential for a reversal remains, which may only improve the prospects for the Pound.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Coca-Cola tops Wall Street Q3 estimates

Coca-Cola tops Wall Street Q3 estimates The Coca-Cola Company (NYSE:KO) reported Q3 financial results before the market open on Tuesday. The US beverage company posted solid results for the quarter, beating Wall Street analyst estimates for both revenue and earnings per share (EPS). Revenue reported at $11.063 billion (up by 10% year-over-...

October 26, 2022Read More >Previous Article

Understanding CFDs: An introductory guide to CFDs

What are CFDs? A contract for differences (CFD) is an agreement between a buyer and a seller that the buyer will pay the seller the difference be...

October 23, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.