- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Market Analysis – Gold, USDCHF, Crude Oil

News & AnalysisWednesday’s session saw another drift higher in equities with volumes still in holiday mode and few major catalysts to drive market action.

There were some big moves in safe haven assets with USDCHF tanking and Gold breaking a key resistance level, a big build in inventories also saw Crude Oil take a tumble.

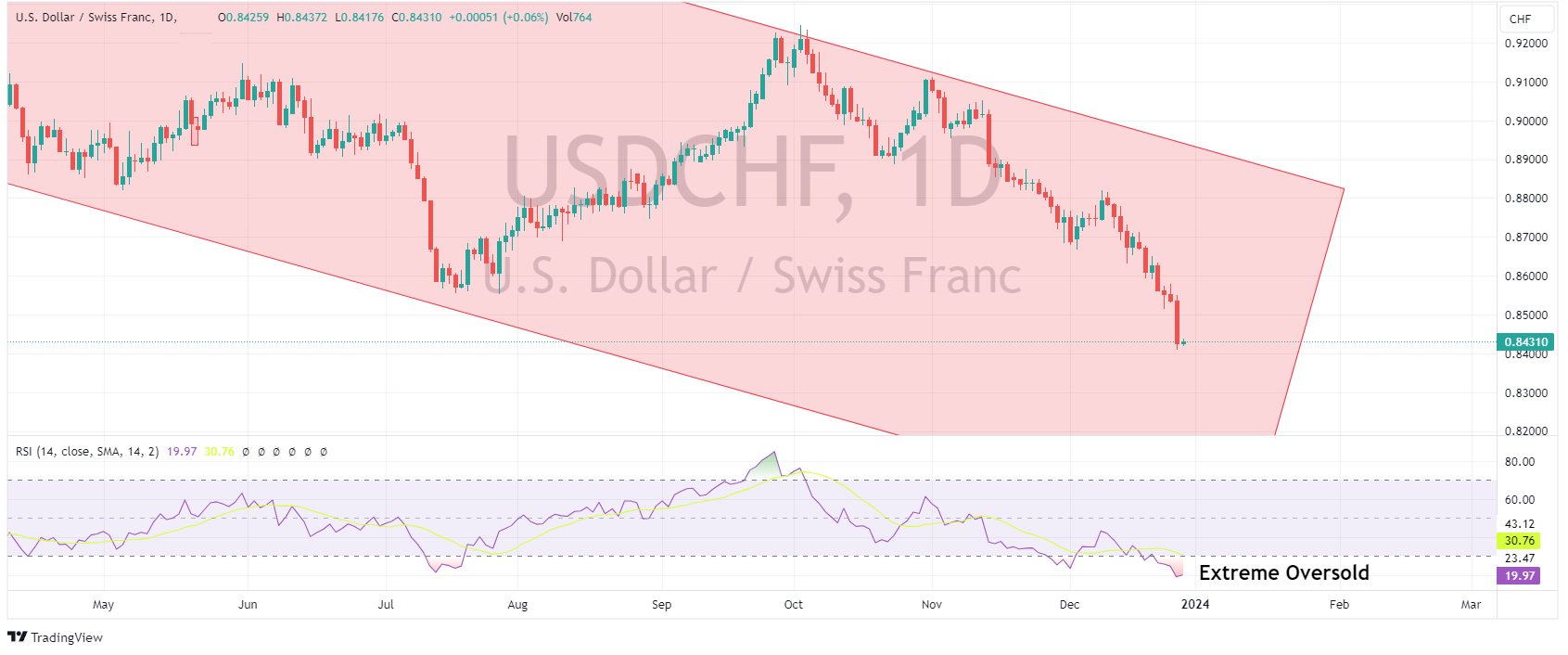

USDCHF

The Swiss Franc surged over 1% against the USD, one of its biggest session gains of 2023 and seeing USDCHF hit lows not seen since SNB intervention back in 2015. Price action seemed to be more CHF strength rather the USD weakness as CHF handily outperformed all other G10 currencies.

USDCHF RSI reading also hit the most oversold level since the safe haven flows of the pandemic panic of March 2020.

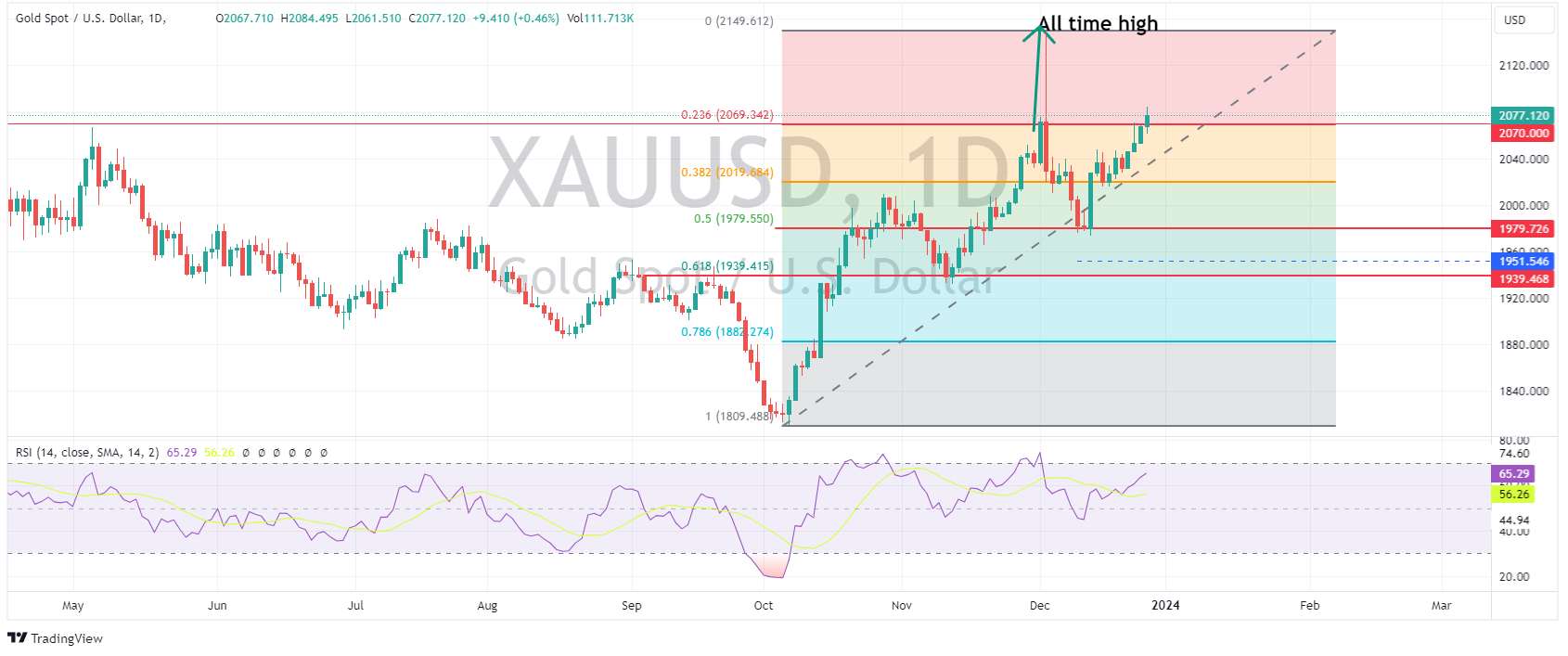

XAUUSD – Gold

Safe haven flows also gave Gold a tailwind with XAUUSD breaching the major resistance at 2070 USD an ounce, which had held the Gold price in check for the last week. A weaker USD, falling yields also bolstering the precious metal. 2070 remains the key level for now, if the bulls can establish this level as support, another run higher to test the all-time highs could be on the cards.

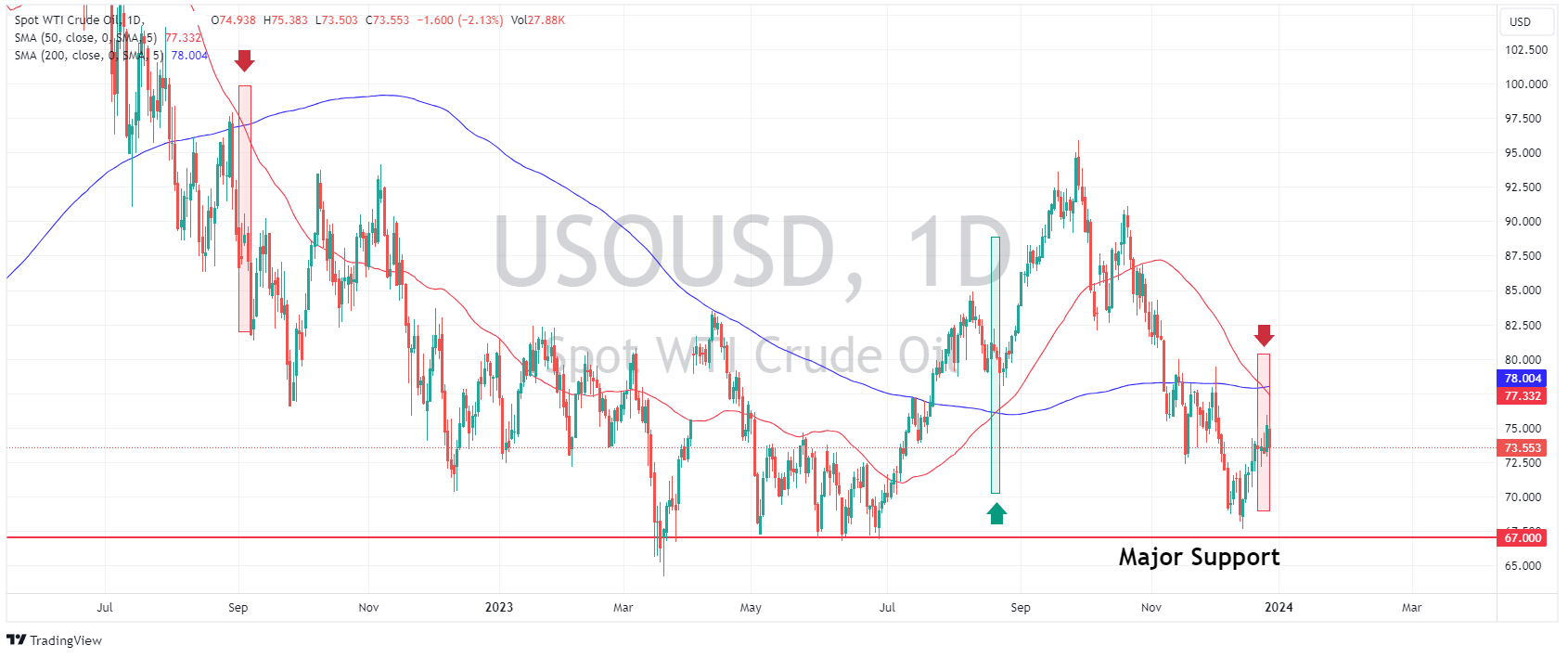

USOUSD – Crude Oil

WTI Crude Oil started Wednesday’s session with a rally after further attacks on tankers in the Red Sea sparked supply concerns. The rally fizzled later in the session demand fears after the weekly API report showed an unexpected build in crude inventories.

USOUSD forming a “death cross” (where the 50-day SMA crosses below the 200 day SMA) for the first time since September 2022, last time We saw this a significant decline in Oil Prices took place.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX Analysis – Fed pivot bets to be tested this week

FX markets enter the new year with a continuing backdrop of a weaker USD as traders bet on a Fed pivot in the first half of the year. That narrative could be tested later in the week with some key US manufacturing and employment data, including the monthly Non-farm payrolls. Key levels look to be tested this week in different FX pairs with AUDUS...

January 2, 2024Read More >Previous Article

FX Analysis – AUDUSD, XAUUSD – Testing Key Levels

The US Dollar has continued its year end decline after the holiday break in thin volume. Traders still holding onto the view of a dovish Fed come 2024...

December 27, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.