- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX – The Uncertain Peak: Assessing the Current State of Inflation and Interest Rates

- Home

- News & Analysis

- Forex

- FX – The Uncertain Peak: Assessing the Current State of Inflation and Interest Rates

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX – The Uncertain Peak: Assessing the Current State of Inflation and Interest Rates

30 April 2024 By Evan LucasAs April draws to a close, the global economy stands at a pivotal juncture, grappling with the resurgence of inflationary pressures that refuse to retreat. In fact, it feels as though the inflation genie has re-emerged, asking, “Oh, you want more?”

This resurgence prompts a crucial question: have we truly witnessed the peak of inflation, and consequently, the peak in interest rates, or are we merely witnessing a temporary lull before central banks are compelled to escalate interest rates further?

The market has become entangled in this debate over the past few weeks, and it’s far from reaching a resolution.

At the heart of the matter lies ‘sticky’ inflation. Economies such as Australia, the United States, and New Zealand are grappling with persistent price increases in essential fixed goods and services, including insurance, rent, housing costs, and utilities. The resilience of inflation in these sectors underscores the enduring impact of global economic forces on household budgets.

Remarkably, despite facing a post-COVID landscape fraught with challenges, households in these nations have displayed remarkable resilience. They have weathered the storm of rising interest rates while managing to maintain or marginally adjust their spending habits. Such resilience would typically be viewed as a positive narrative in a conventional economic cycle, signaling prudent financial management and adaptability.

However, the current economic landscape is anything but conventional. Against the backdrop of a global interest rate cycle reaching decade-high levels, the resilience of households and the absence of significant spending contractions raise concerns. Will tentative central banks be forced to raise rates again, rather than enact the forecasted rate cuts that were almost certain just eight weeks ago?

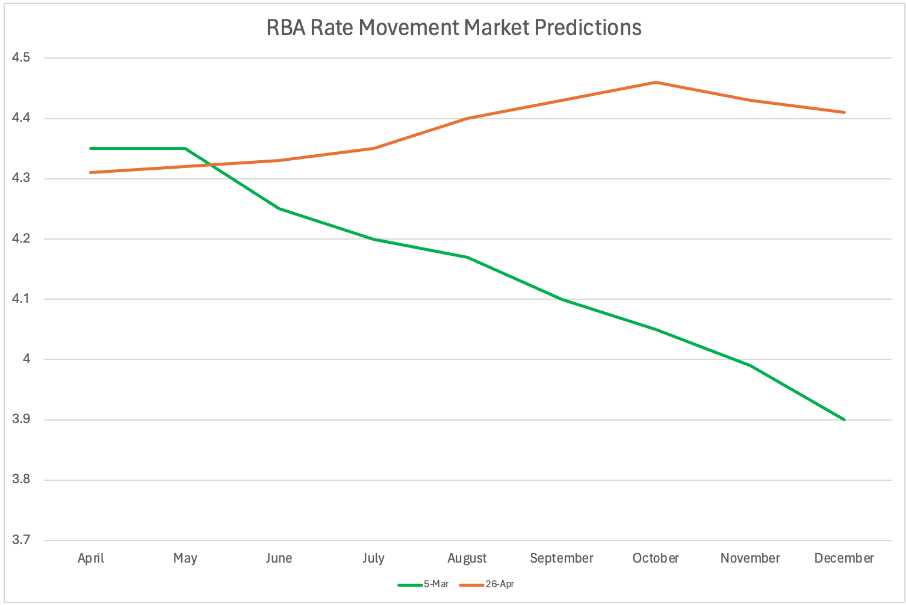

The chart depicting the change in the 30-day interbank cash rate implied yield curve from the start of March to the end of April vividly illustrates this shift. The difference is staggering.

The resurgence of inflationary pressures threatens to upend optimistic projections. It challenges the notion that the peak of the current economic cycle has already been reached. Instead, it suggests that the trajectory of interest rates may continue to trend upward, defying earlier forecasts and unsettling financial markets.

From and FX perspective this is creating and interesting situation in the policy divergences of other central banks.

The US is facing a similar issue to that of the RBA – market pricing for the Federal Funds rate has gone from a fully pricing in 3 rate cuts with the real possibility of a 4th in 2024 too just 1 rate cut in 2024 and only 2 cuts in 2025. Both are facing much higher rate situations in 2024.

Compare that to the likes of European Central Bank (ECB), Swiss National Bank (SNB), Bank of Canada (BoC), and the Riksbank. All are signalling potential rate cuts in upcoming meetings. In the case of the ECB it looks like being as early as June.

This policy divergence creates significant implications for FX markets. Bullish bets in the AUD have been coming thick and fast as interest rate differentials has seen crosses moving firmly in the AUD’s favour. EURAUD, AUDCAD, AUDJPY and the likes

In the case of the AUDUSD this pair is hard to read as both have similar dynamics. The rule of thumb in a scenario like this is ‘all roads lead to the USD’ and explains why the AUD is lagging in this pair but not elsewhere.

On the USD – the clearest example of the pressure it is putting on the rest of its peers is USDJPY.

For the first time since 1990 USDJPY passed Y160. It would appear this is a market test for the Bank of Japan. Does it defend its falling currency? Does it lose its authority due to it losing control of its control mechanism? The economic fundamentals make this a very interesting question indeed.

MELBOURNE, AUSTRALIA – JULY 26, 2018: Reserve Bank of Australia name on black granite wall in Melbourne Australia with a reflection of high-rise buildings. The RBA building is located at 60 Collins St, Melbourne VIC 3000 Australia. Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Inside the Fed

Let us open with this: “It’s unlikely that the next policy rate move will be a hike. I’d say it’s unlikely,” – US Chair Jay Powell This verbatim quote puts a lid on the movements seen in bond and interbank markets that might have overacted to recent data that has been above expectations and has led some to price hikes. The let u...

May 2, 2024Read More >Previous Article

FX Analysis – EUR Rate divergence rhetoric fading?

With an ECB June cut looking likely, FX traders will start looking at the policy path beyond June. Most analysists are calling that the European Centr...

April 26, 2024Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.