- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – USDJPY surges post BoJ, AUDUSD drops on dovish RBA, USD bid ahead of FOMC

- Home

- News & Analysis

- Forex

- FX Analysis – USDJPY surges post BoJ, AUDUSD drops on dovish RBA, USD bid ahead of FOMC

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – USDJPY surges post BoJ, AUDUSD drops on dovish RBA, USD bid ahead of FOMC

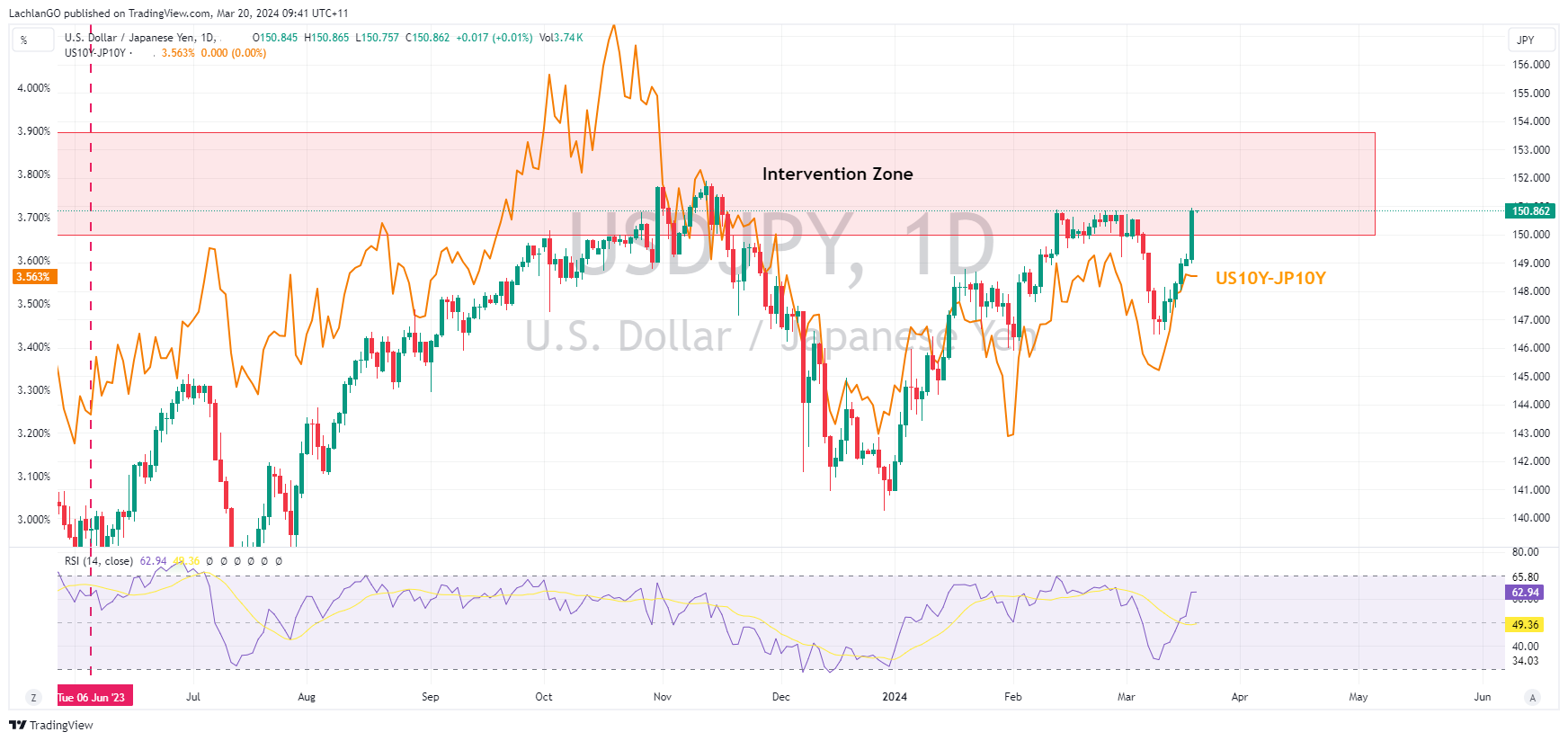

20 March 2024 By Lachlan MeakinJPY was the currency everyone was watching coming into the pivotal BoJ meeting on Tuesday. The BoJ, as widely telegraphed, ended 17 years of negative interest rates, ETF purchases and their yield curve control policy. While a big move from the central bank there was no real surprise, with USDJPY surging to touch on 151, well into the “intervention zone” above 150.

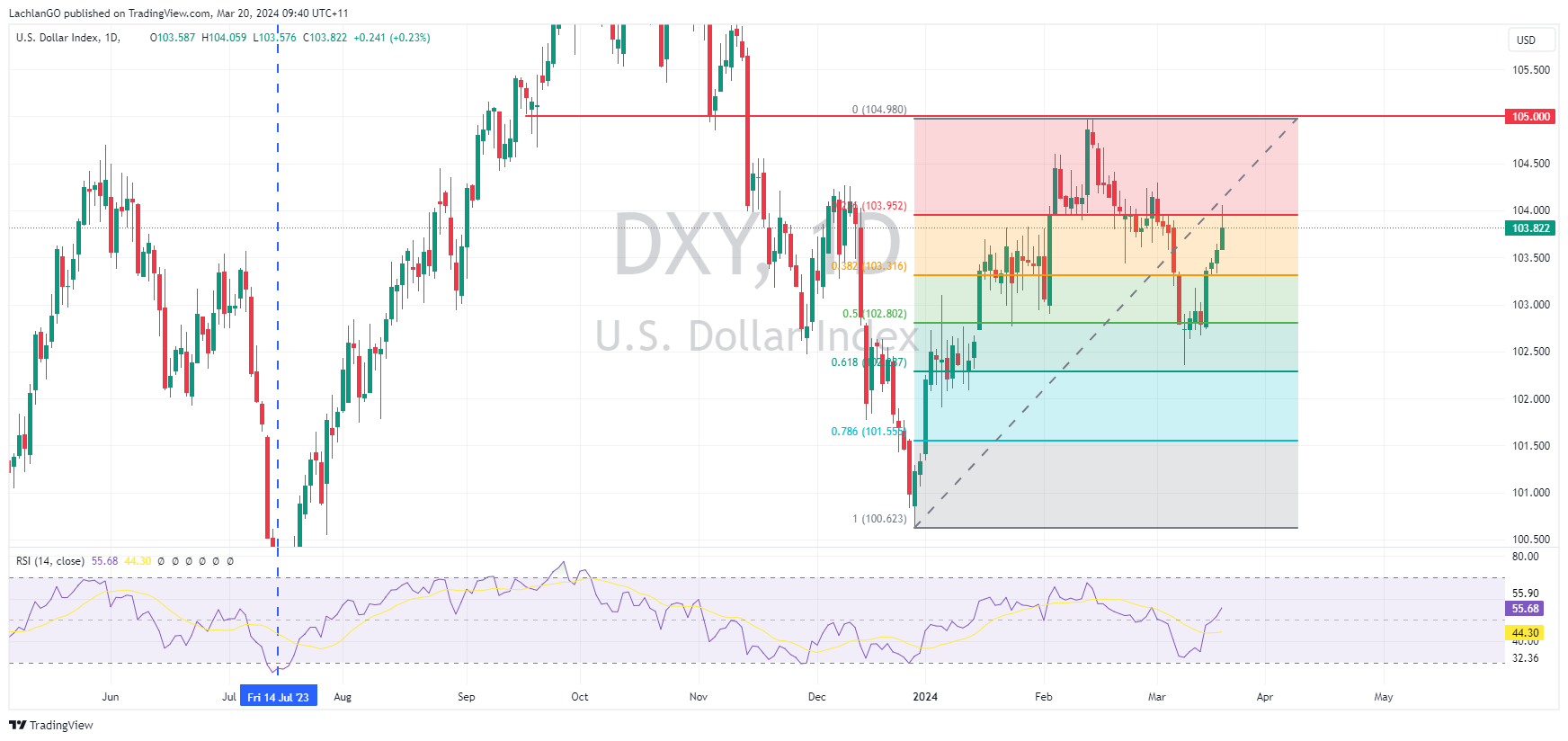

The US Dollar Index was bid on JPY weakness, seeing DXY briefly rise above 104.00 to a peak of 104.06 in the UK session before paring some gains head of today’s closely watched FOMC meeting.

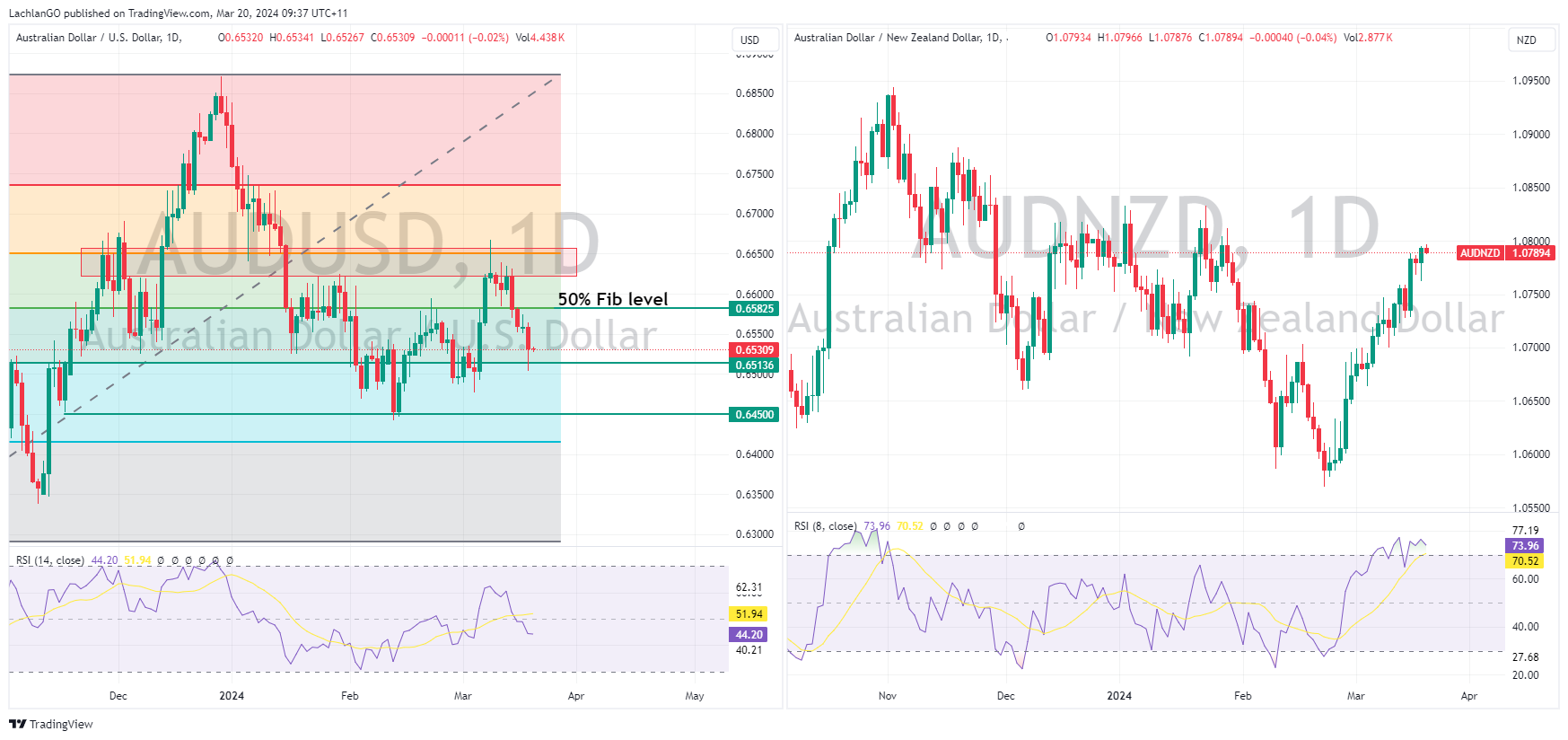

AUDUSD dropped to 1 week lows after the RBA rate decision which left rates on hold as expected, but pulled back slightly on the tightening bias namely a language change from “further increase in interest rates cannot be ruled out “ to “not ruling anything in or out on interest rates” . NZD saw weakness in sympathy of the Aussie although AUDNZD saw marginal gains but failed to breach 1.08 with a high of 1.0793.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

PDD Holdings posts better-than-expected earnings – the stock is up

World’s 3rd largest e-commerce company PDD Holdings Inc. (NASDAQ: PDD) reported Q4 2023 before the US market opened on Wednesday. The Chinese company achieved revenue of $12.519 billion in the last 3 months of 2023 vs. $11.202 billion expected. Revenue was up by 123% year-over-year. Earnings per share was reported at $2.44 vs. estimate of $...

March 21, 2024Read More >Previous Article

GO Markets victorious at the World Business Outlook Awards

The World Business Outlook Awards are among the most distinguished recognitions in the global business landscape, celebrating excellence, innovation, ...

March 20, 2024Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.