- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – USDJPY, and GOLD reaction after a surge in the Dollar

- Home

- News & Analysis

- Forex

- FX Analysis – USDJPY, and GOLD reaction after a surge in the Dollar

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – USDJPY, and GOLD reaction after a surge in the Dollar

10 November 2023 By Lachlan MeakinUSD rallied strongly in Thursday’s session after a quiet start following dismal demand for US 30 year-treasuries at a scheduled bond auction, seeing yields surge and taking the USD with them. The push higher was later given an extra boost by Fed Chair Powell’s hawkish statements during a panel organized by the IMF.

In a scheduled panel chat the FOMC head said that “policymakers are not confident that they have achieved a sufficiently restrictive stance to return inflation to the 2.0% target in a sustained manner.” That was enough to see the USD bulls take charge with DXY up 0.4% for the day, while yields also spiked, this saw some volatility in USD cross pairs and gold we’ll look at the highlights in the charts below.

USDJPY TECHNICAL ANALYSIS

USDJPY pulled back last week after the BoJ tweak to their YCC saw Japanese bond yields rise, giving the Yen a boost. However, as has been the case with this pair in the last 12 months the uptrend quickly resumed, with USDJPY breaking back above the key 151 level and heading towards its 2022 and 2023 high of 151.72. At these levels there is always the threat of a BoJ currency intervention, so traders will need to keep an ear out for any jawboning from BoJ members telegraphing such a move.

If the BoJ steps aside a test of the upper trend line at 154 could be a possibility. If they do step in we could see a decline to a 146 handle and lower trendline before finding any technical support.

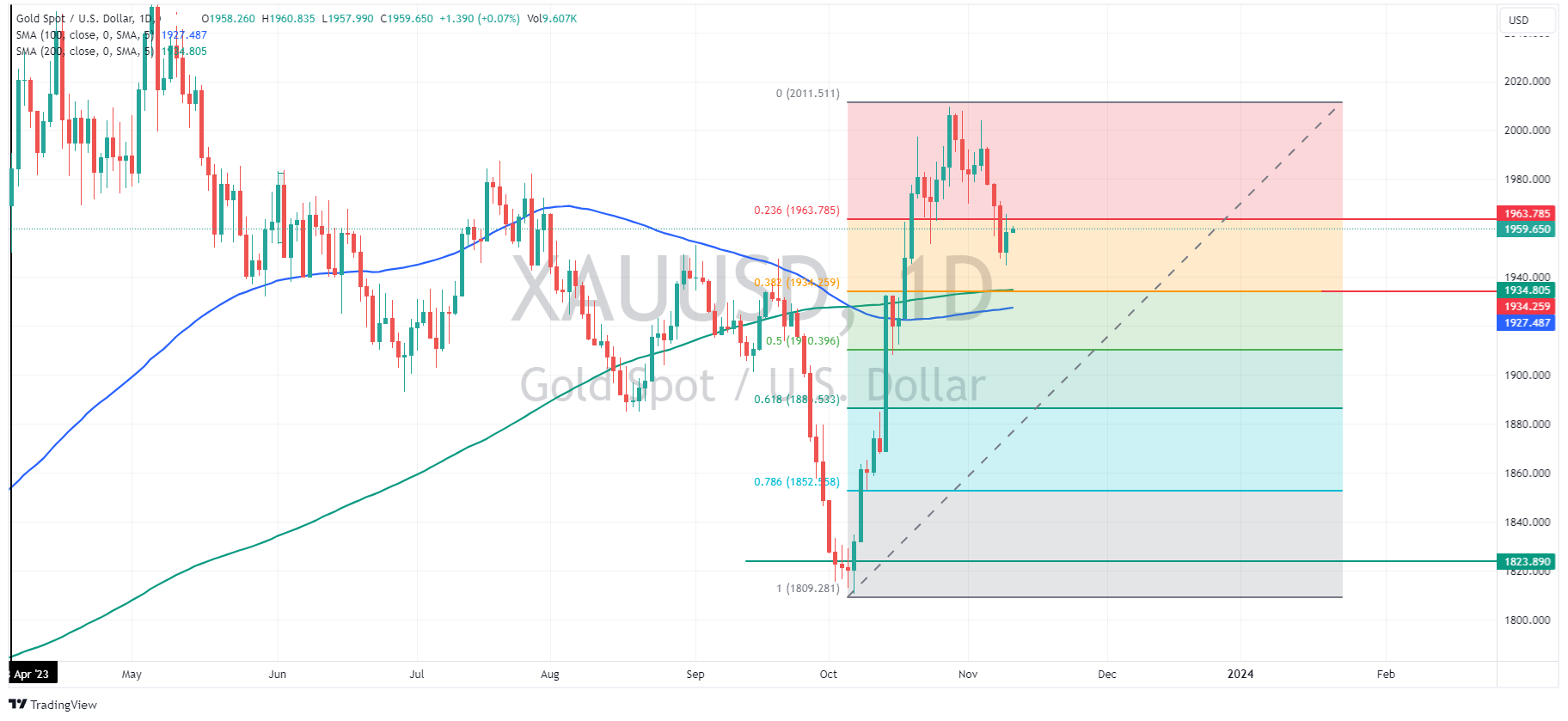

GOLD TECHNICAL ANALYSIS

Gold has reversed lower this week after the upward momentum failed at the key 2010 resistance level. Risk premium priced into gold also started to unwind after gaza conflict haven flows pushed the price rapidly higher from early October. Thursday session did see a modest bounce, despite a rampant USD which could give the bulls some hope, however the 23.6 Fib level, which acted as short-term support on the way down now seems to have switched to resistance. This will be the level on the upside to watch (1963.78), the next resistance from a technical point of view will be the 2010 level. To the downside the 38.2 Fib at 1934.79, which also matches up with the 200 day SMA looks to be the first real support level.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Charts to watch in the week ahead – AUDUSD, USDOLLAR, GBPUSD

Last week’s action in the FX markets was shaped by a pushback by the Fed chair Jerome Powell and assorted other Fed members on markets pricing in a less hawkish Fed going forward. What was seen as a dovish FOMC and a big miss in NFP the week before saw traders piling back into risk assets with traders hoping for a less aggressive Fed, it seemed p...

November 13, 2023Read More >Previous Article

Global market recap: Asian-Pacific futures edge up after Wall Street’s decline.

The Asian-Pacific financial markets are bracing for a potentially modest opening on Friday, undeterred by the negative performance witnessed in US ind...

November 10, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.