- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – USD dips, USDJPY holds above 150, EURUSD rallies

- Home

- News & Analysis

- Forex

- FX Analysis – USD dips, USDJPY holds above 150, EURUSD rallies

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – USD dips, USDJPY holds above 150, EURUSD rallies

27 February 2024 By Lachlan MeakinUSD sold off on Monday with DXY failing to hold above 104 after finding some resistance at the 100 DAY SMA and dipping from a high of 104.20 to a low of 103.70 where the 200 Day SMA held as support. The move lower in USD came despite higher UST yields, which would normally support the USD.

EURUSD was supported by the weaker USD with EURUSD rising above its 100 Day SMA at 1.0814, the 200 Day SMA at 1.0826 and briefly above the 1.0850 level. There was little in the way of Euro data although ECB President Lagarde did speak where she stated the ECB is not there yet on inflation and noting wage pressures remain strong, supporting the EUR somewhat.

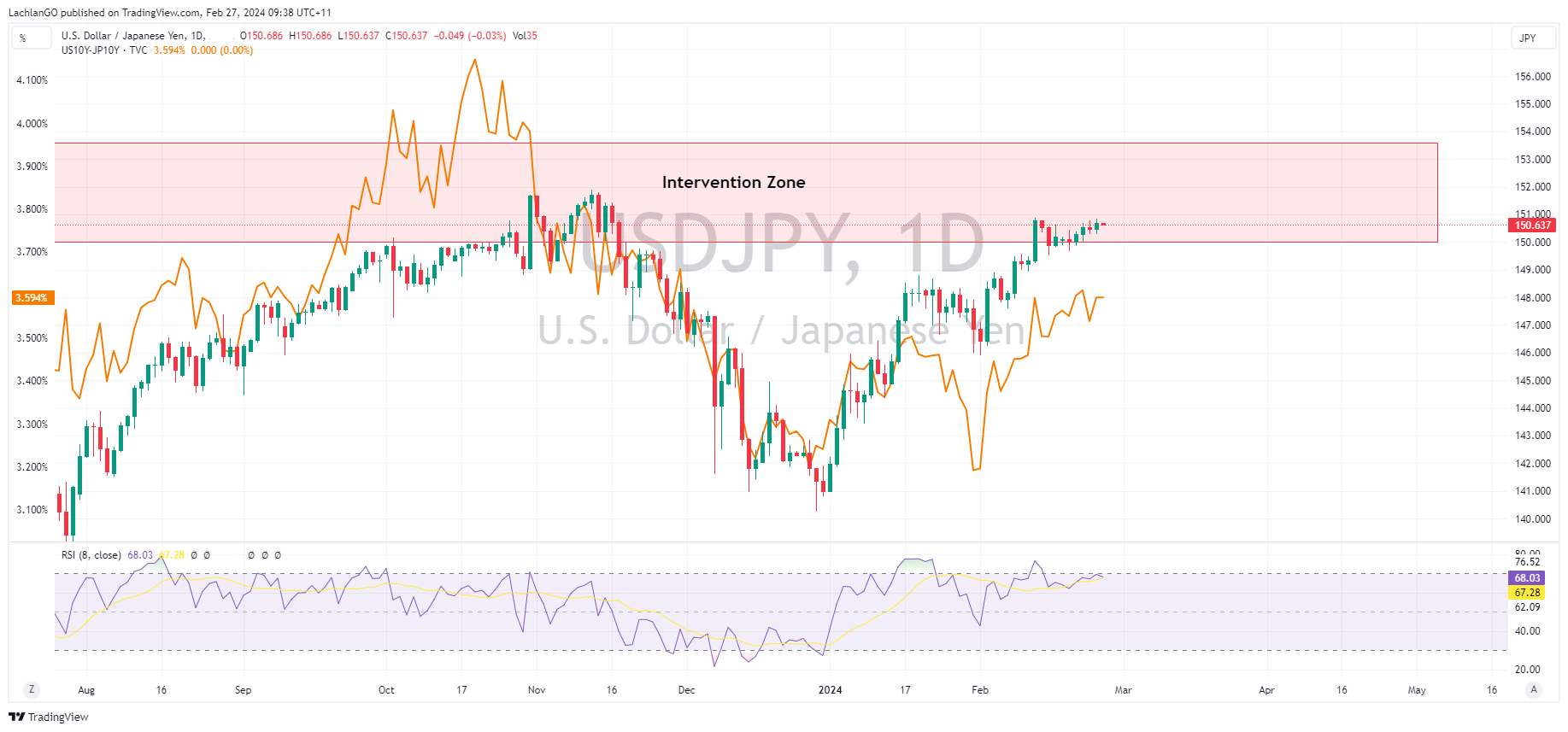

JPY was softer vs the USD keeping USDJPY above the short erm support at the psychological 150 level. Higher UST yields supporting the pair seeing it test resistance at the 2024 high of 150.8. JPY traders’ attention turning to Japanese inflation data today where the National Core CPI is expected to drop to 1.9% from the previous reading of 2.3%.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

AutoZone stock hits an all-time high after earnings beat

AutoZone Inc. (NYSE: AZO) announced Q2 fiscal 2024 results before the US opening bell on Tuesday. The largest US retailer of aftermarket automotive parts and accessories achieved revenue of $3.859 billion in the quarter, which topped analyst estimate of $3.846 billion. Earnings per share (EPS) reached $28.89 vs. $26.296 per share expected. ...

February 28, 2024Read More >Previous Article

Zoom beats expectations – shares rally in the after-hours

Zoom Video Communications Inc. (NASDAQ: ZM) reported the latest financial results after the closing bell on Wall Street on Monday. American communi...

February 27, 2024Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.