- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – Gold continues slide, USD bid ahead of CPI, JPY dumps

- Home

- News & Analysis

- Forex

- FX Analysis – Gold continues slide, USD bid ahead of CPI, JPY dumps

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – Gold continues slide, USD bid ahead of CPI, JPY dumps

12 December 2023 By Lachlan MeakinUSD was mildly bid on Monday ahead of a very busy calendar starting with US CPI later today. The US Dollar Index (DXY) rose to a high of 104.26, testing its trendline resistance before paring back to finish the session modestly in the green. DXY continuing to trade in the tight range between its 200-Day MA to the downside and resistance at around 104.25 to the upside. USD traders have a busy week ahead, along with CPI today, PPI and the FOMC rate announcement are ahead tomorrow.

The Japanese Yen dumped after a Bloomberg report citing BoJ sources that said the BoJ sees little need to end negative rates in their December meeting. This saw rates markets rapidly reprice what was a 20% chance of a rate hike, down to just 5%. This translated to a short squeeze on USDJPY as carry traders flooded back in and saw the pair rally to a high of 146.46.

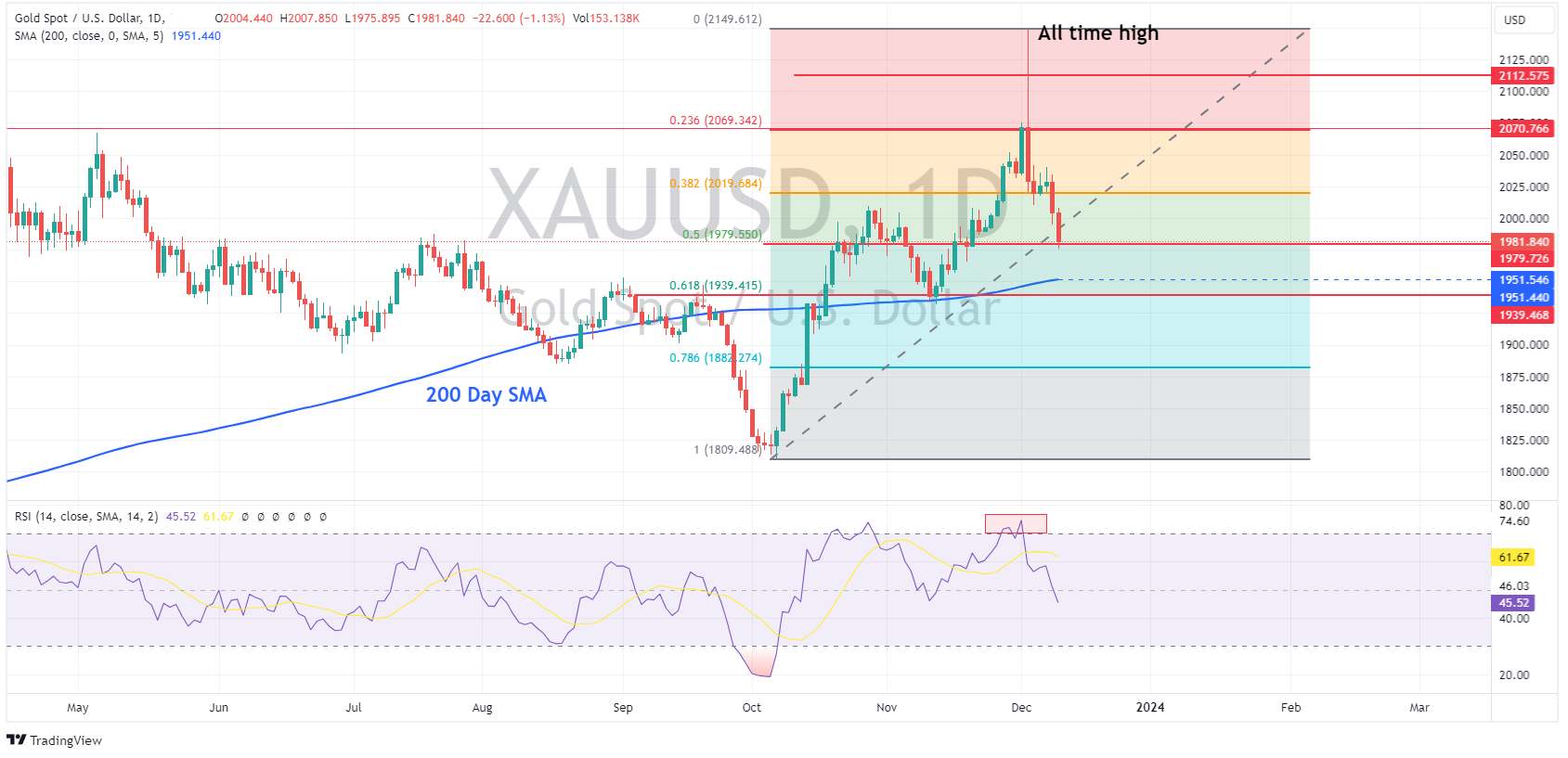

Gold saw another large decline, with XAUUSD dropping almost $30 USD an ounce, breaking through the psychological 2000 level and hitting 3-week lows. XAUUSD now sitting on its 50% Fib retracement support, with the next support lower around the 1950-52 level at the 200-day MA and 61.8 fib level.

Ahead today, the real data starts, headlining will be US CPI where the Y/Y figure is expected to moderate to 3.1% vs 3.2% previous.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Johnson Controls International results announced – the stock is down

On Monday, Citigroup raised its target price for the Irish multinational conglomerate, Johnson Controls International plc (NYSE: JCI), from $58 to $61 a share. On Tuesday, Johnson Controls announced its latest financial results for its fiscal fourth 2023. Let’s see how it performed. Company overview Founded: 1885 Headquarters: Cork,...

December 13, 2023Read More >Previous Article

Oracle revenue falls short of Wall Street estimates – the stock is falling

US software and hardware manufacturer, Oracle Corporation (NYSE: ORCL), announced results for its fiscal 2024 second quarter after the market close on...

December 12, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.