- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- FX Analysis – Euro softens on cool CPI readings, Gold rallies again, NZD surges on RBNZ

- Home

- News & Analysis

- FX Analysis – Euro softens on cool CPI readings, Gold rallies again, NZD surges on RBNZ

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – Euro softens on cool CPI readings, Gold rallies again, NZD surges on RBNZ

30 November 2023 By Lachlan MeakinThe Euro was softer In Wednesdays US session with EURUSD failing to hold above the psychological 1.10 level with cooler than expected inflation readings out of Spain and Germany weighing on the single currency. EURGBP dropped for the fifth straight session and setting new November lows. Comments from ECB member Stournaras pushing back on April rate cut bets failing to offer much support.

Chart Source: TradingView.com

JPY firmed against the USD, USDJPY still playing catch up with US – JP rate differentials. US yields were again lower across the curve putting downward pressure on USDJPY. The Yen did give up some gains after some dovish comments from the BoJ’s Adachi regarding the BoJ’s easy money policies.

Chart Source: TradingView.com

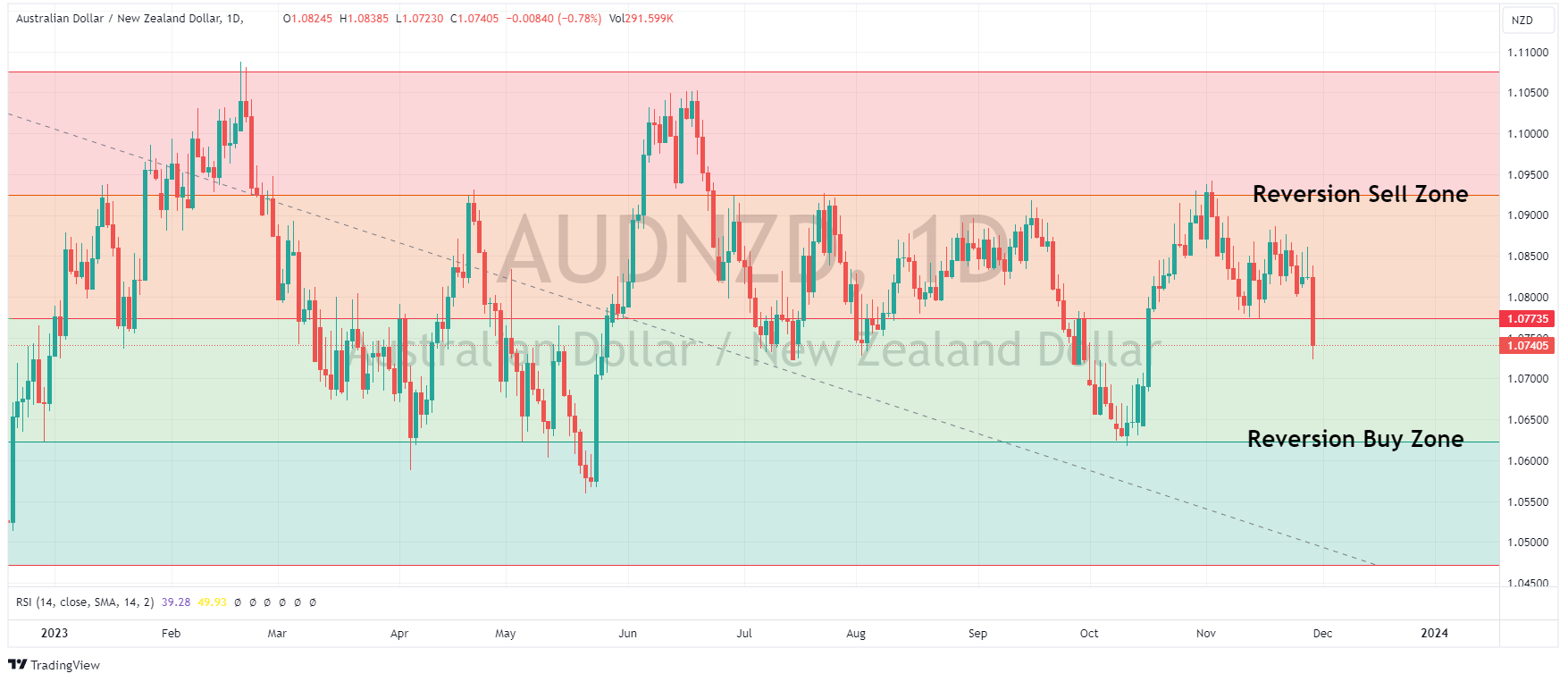

After a recent tear higher AUD was the G10 underperformer while across the ditch NZD was one of the outperformers. NZDUSD spiking higher following a hawkish hold from the RBNZ where the Central bank left rates on hold as expected, but it raised both its OCR and CPI forecasts and left the door wide open for future hikes if needed. AUDNZD tumbling through its 2023 range midpoint support at 1.07735 and setting new November lows.

Chart Source: TradingView.com

Gold rallied for the fifth straight session, despite a bounce in the USD. XAUUSD poking it’s head above 20250 USD an ounce and entering the resistance zone set in April – May before paring some of its gains. The 2047-2067 zone looking a key area to test the rampant gold bull run of the last two weeks.

Chart Source: TradingView.com

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Salesforce shares rise in after-hours as earnings results top estimates

Salesforce Inc. (NYSE: CRM) reported its latest financial results after the closing bell in the US on Wednesday. World’s leading customer relationship management company topped both revenue and earnings per share estimates (EPS) for the third quarter of fiscal 2024. Company overview Founded: February 3, 1999 Headquarters: Salesforce...

November 30, 2023Read More >Previous Article

FX Analysis – USD continues decline on dovish Fedspeak, JPY outperforms, AUD and NZD breakout

USD continued its recent decline on Tuesday with the US dollar index (DXY) hitting its lowest level since mid-August at 102.60 before finding some sup...

November 29, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.