- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Asia Morning FX – AUD and EUR surge, USD takes a hit post FOMC, BoJ ahead

- Home

- News & Analysis

- Forex

- Asia Morning FX – AUD and EUR surge, USD takes a hit post FOMC, BoJ ahead

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAsia Morning FX – AUD and EUR surge, USD takes a hit post FOMC, BoJ ahead

16 June 2023 By Lachlan MeakinUSD tumbled in Thursday’s session in the wake of a dovish Powell presser (relative to statement/dot plots) saw the Dollar bears in charge. This, coupled with a hawkish ECB and mixed US data saw DXY fall from highs of 103.38 in the European morning to a low of 102.08, with the psychological 102 level the next obvious support. A hawkish ECB, where they hiked rates by 25bp and signaled more to come, saw the sell off accelerate. A risk on equity session and US data causing US Treasury yields to tumble, also weighing on the Dollar.

EUR rallied in wake of the ECB 25bp hike and the accompanying hawkish statement and presser where ECB President Lagarde strongly suggested another hike is likely in July, saw EURUSD pushing through the 1.0950 level to the upside and entering the April/May “chop zone” where some volatility could be expected.

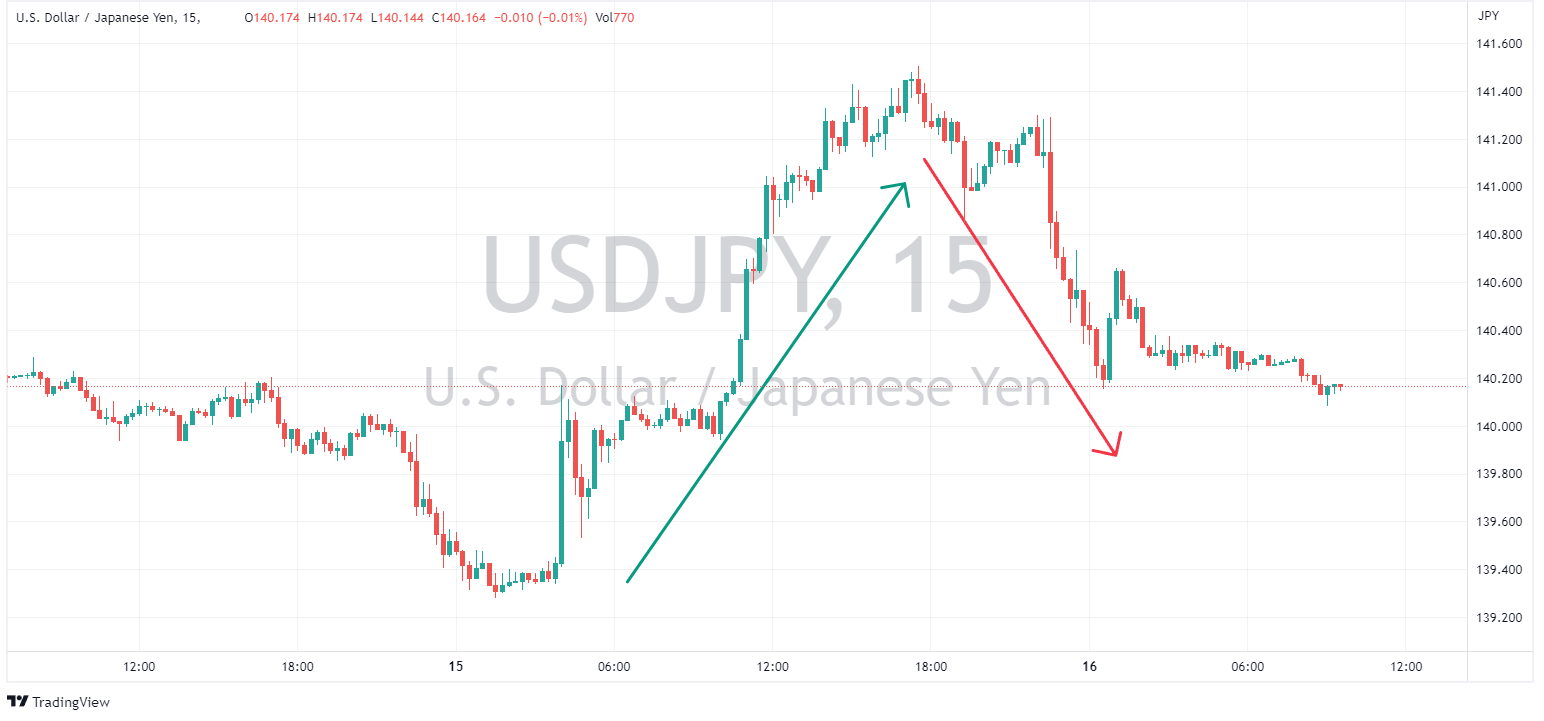

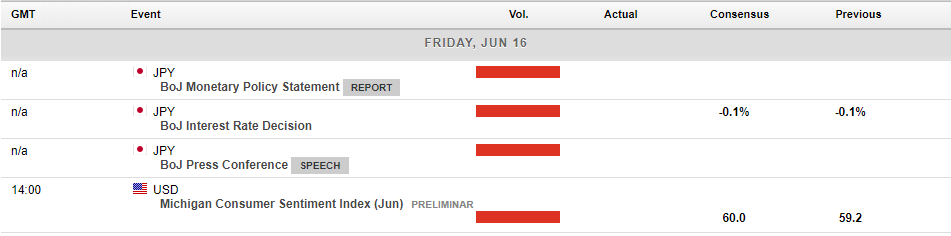

JPY was marginally lower against the USD in a volatile session, despite overall Dollar weakness and lower UST yields. Risk on sentiment seeing haven outflows as well as traders positioning themselves for today’s possibly interesting BoJ meeting saw the USDJPY perform an impressive (almost) round trip from highs of 141.50 in the European morning back to 140.08 at the start of the Asian session. Today’s BoJ meeting could be the usual non-event, but there is a chance of a BoJ surprise in their Yield curve control policy as they did in December ’22 which would see some big moves in the JPY.

Against a market risk on background AUD and NZD both saw impressive gains with AUD being the clear outperformer. AUDUSD surging through resistance to test the big level at 0.6900 from lows of 0.6768. A blowout Australian employment report along with continued talk of Chinese stimulus buoying AUD. NZDUSD was also firmer on the day but with NZD hampered by weak GDP data on Thursday the AUDNZD cross pushed decisively higher to hit a high of 1.1043, within a whisker of June highs.

Gold prices surged off their post-FOMC lows after breaching the 1938 support level, lower yields and a weak USD seeing XAUUSD firmly back into its trading range after the false breakout to the downside.

Today’s main risk event will be the Bank of Japan monetary policy statement, it could be a fizzer or it could be fireworks, there will be no in-between in my opinion. If the status quo is maintained as far as monetary policy is concerned there should be minimal market impact, if the BoJ does surprise by tinkering with any of their policies then some extreme volatility in Japanese bonds and the JPY is a probability.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

AUDUSD testing key support after RBA minutes

The RBA minutes of their June meeting where another surprise hike had most of the market off side were released today, and they were surprisingly dovish. The board made clear the decision between a hike and hold was finely balanced and seems to suggest further hikes may require a high bar for inflation readings to sway them. AUD reaction was swift ...

June 20, 2023Read More >Previous Article

AUDUSD Soars on RBA Hike, EURUSD underperforms, CAD, GBP, JPY wrap

USD was firmer on Tuesday amid a light news calendar sparse in any key risk events. The US Dollar index again having a choppy session in a tight range...

June 7, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.