- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Is the SP500 ready for next move down?

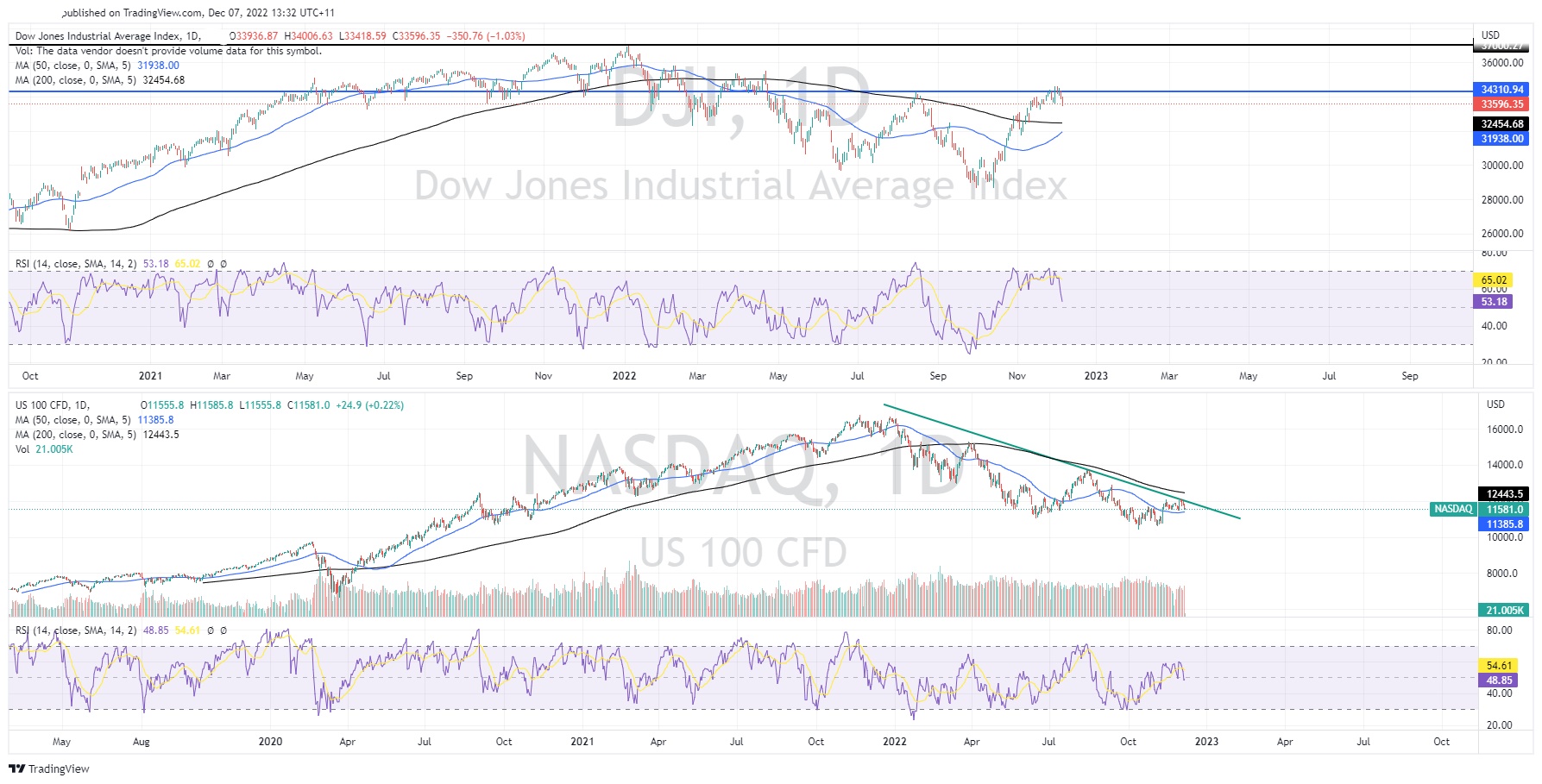

News & AnalysisThe major American Indices have begun the last month of the year with in an extremely bearish state as recessionary fears rise to the surface again. With the positive sentiment relating to a potential pivot from the federal reserve seemingly disappearing, thoughts of a hard landing have become increasingly prominent. Even with an expected slowdown in interest rate hikes many analysts fear that it won’t be enough to pull the economy out of a recession or even a soft landing.

Technical Analysis

The S&P500 has seen a major pivot off its long term down trend. The index has fallen by nearly 4.5% too begin the month and is showing a very similar price action to the three last downward moves. In addition, the 200-day moving average has once again acted as significant resistance for the index as it tried to reverse out of the down trend. The RSI has also seen a break of its upward trend adding to the confirmation of the overall breakdown as buying has become exhausted. Moving forward, there is likely to be some potential support in the short term near 3900. However, if this support fails then the secondary target or support levels is a 3800 and then 3504 after that. Therefore, there is potentially a large swing to the downside if the sentiment becomes worse and selling continues.

The NASDAQ in particular has been following a similar trend to the S&P500 whilst the Dow Jones Index has been the more resilient of the US Indices. However, both of them have also felt the selling pressure from the S&P500 and the negative sentiment trickle down. The NASDAQ in particular has faced a difficult time as the growth and technology sectors are smashed with the recessionary talk and inflationary pressures.

With the end of the year fast approaching, the prospect of a Santa rally looks less promising with the sentiment in the market at the moment.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Oil continues to fall amid news of price cap

The primary reason for the drop in price is the economic slowdown that has become prevalent in the global market. As fears of a recession continue to grow, the price of Oil has continued to drop. To make matters worse, the G7 have set a $60 per barrel price cap. This price cap was created to restrict Russia’s ability generate revenue from its oil...

December 8, 2022Read More >Previous Article

AutoZone results beat expectations

AutoZone Inc. (NYSE: AZO) reported the latest financial results for its first quarter of fiscal 2022 (12 weeks) that ended on November 19, 2022. Th...

December 7, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.