- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – USD bounces, Hot CPI fails to lift AUD, JPY softer on rising US yields

- Home

- News & Analysis

- Forex

- FX Analysis – USD bounces, Hot CPI fails to lift AUD, JPY softer on rising US yields

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – USD bounces, Hot CPI fails to lift AUD, JPY softer on rising US yields

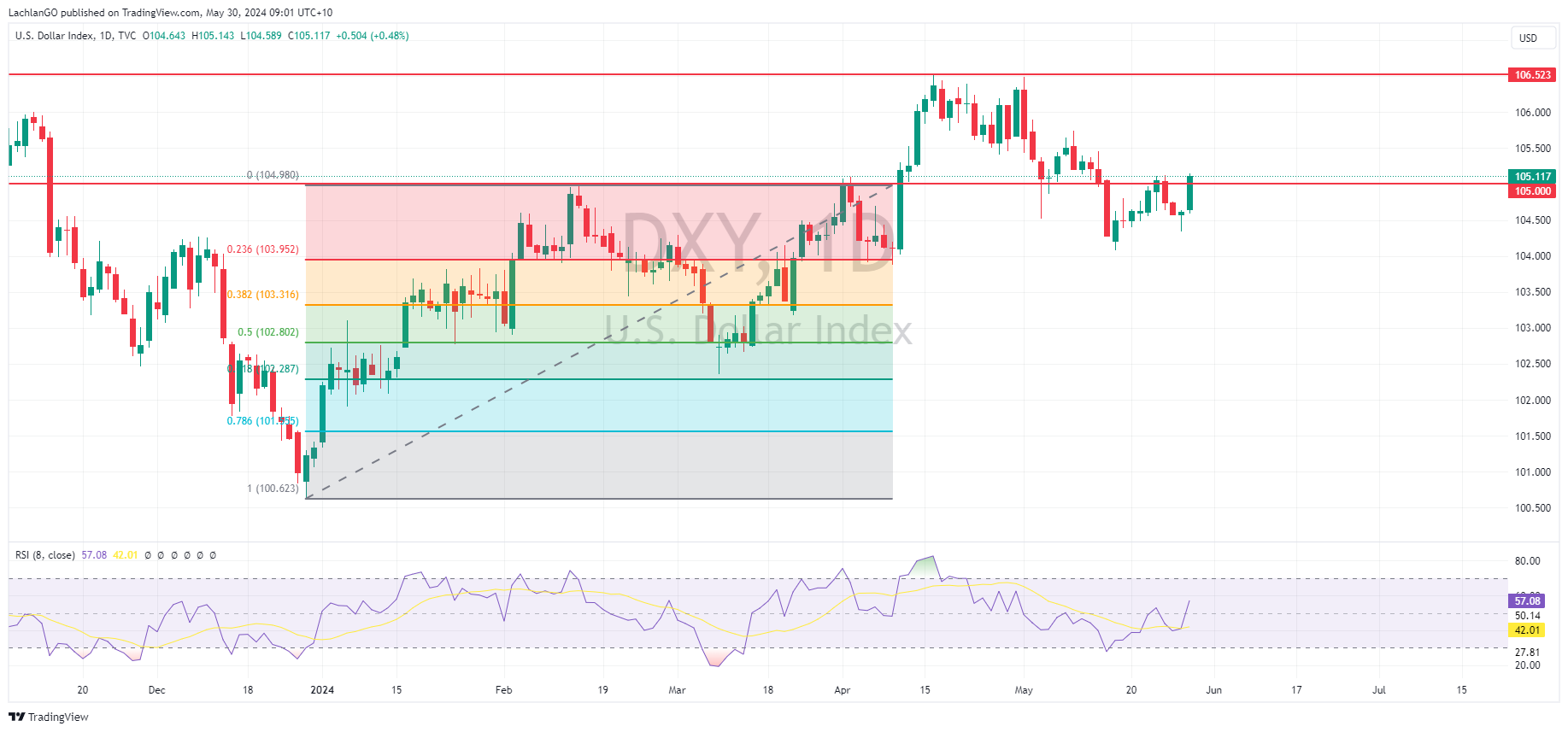

30 May 2024 By Lachlan MeakinThe USD saw decent strength in Wednesdays session, with The US Dollar Index (DXY) rising from an open of 104.67, pushing through the resistance at 105 to hit a high of 105.14 on the back of firmer US Treasury yields. Despite this rally DXY is heading into the end of the month looking to have its first monthly decline since December 2023. Ahead today we have US GDP as well as several Fed speakers, including Williams at the Economic Club of NY.

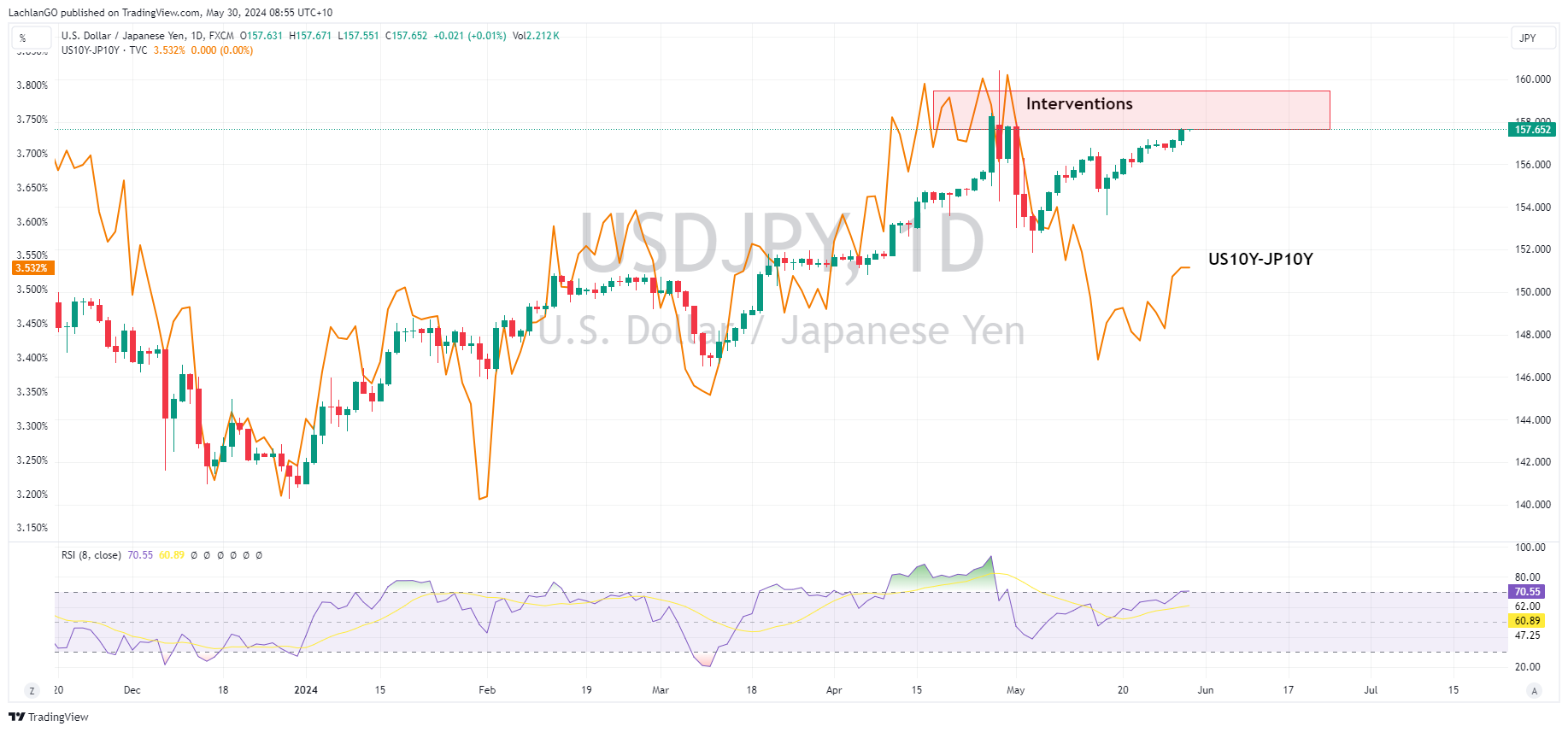

JPY declines against a resurgent USD with rising US yields pushing the US10Y-JP10y rate differential higher. USDJPY remained above 157.00 and pushing to a high of 157.74 and back in the April intervention zone. Remarks from BoJ Board Member Adachi, who stated that if excessive Yen falls are prolonged and expected to affect the achievement of the BoJ’s price target, responding with monetary policy becomes an option, failing to help the Yen significantly.

AUD, and to some extent NZD, saw some short lived strength after a hotter than expected Aussie CPI reading in the APAC session. This strength did fade in the UK and US session with both the AUD and NZD currencies resuming their weakness, tracking risk appetite. AUDUSD just holing above the psychological 0.66 level heading into Thursdays APAC session.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Plateauing is just another way of saying ‘stuck’

Let’s make things very clear – Australia’s inflation rate is plateauing in fact I would argue it’s starting to reaccelerate in areas Australia can least afford. From a trading and momentum perspective this needs explaining. Stronger Than Expected Print April's CPI data exceeded expectations and was at the very top of the surveyed ra...

May 30, 2024Read More >Previous Article

Reading between the lines for the USD

Last week I highlighted Governor Chris Waller’s speech – however the more I look into his talk the more it needs greater emphasis as it contained ...

May 28, 2024Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.