- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- AUD hits $0.71 for first time since August 2022

News & AnalysisThe Australian dollar has continued its rise against the USD reaching the highest level in almost 3 months. With risk on assets receiving a boost and the USD weakening the Australian dollar has been a big beneficiary. As hopes for a Federal Reserve pivot increase the greenback has seen aa pullback and growth assets have seen an influx of money. With the FOMC meeting scheduled for next week the decision by the Federal Reserve and its accompanying statement may provide more of a direction for the next movement of the USD.

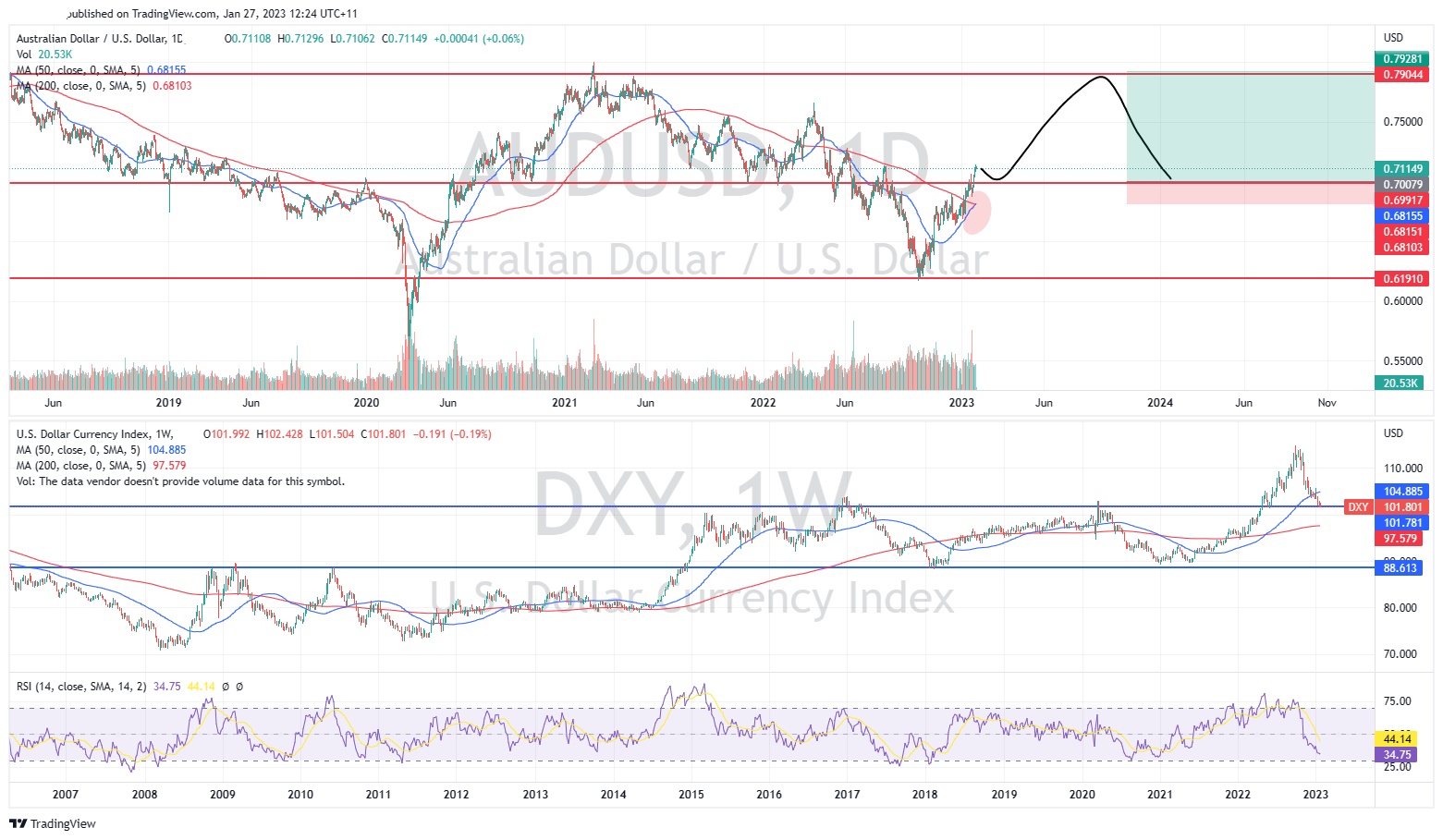

Since its peak in September 2022, the DXY has seen a retracement of nearly 12%. Since that time the DXY has fallen back to its major support level at 101. At this stage it has been unable to break down through this point. However, if it does, it will likely fall back into its long-term range which it sustained for more than 5 years. This range is between 88 – 100. This overall drop in the DXY may support a move in the AUD to top of its own channel.

More specifically, the AUDUSD chart shows that the price has broken back into its own long-term range of which it has sustained for 7 years, excluding the outbreak of the Covid pandemic. The price is also about to perform a golden cross in which the short term 50 day moving average will crossover the 200-day moving average which is a very bullish signal. The price may still retest the lower bounds of the long term of the range at 0.70 again, before potentially climbing higher. A potential trade long trade on the AUDUSD may originate with an upside of almost 5:1 risk reward.

Ultimately, the direction of AUDUSD will largely be dictated by the sentiment surrounding growth assets and the USD. However, in the short term the price of action of the AUD is positive and bullish.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

US Dollar Index Testing Key Level

US Dollar Fundamental Analysis Recent data indicated that the U.S. economy grew strongly in the fourth quarter which has boosted the Dollar against the Euro. This has supported the Federal Reserve's hawkish stance in spite of reports that US consumer spending has fallen, and inflation has cooled. According to the Commerce Department, the Consumer ...

January 31, 2023Read More >Previous Article

Mastercard Q4 results announced

Mastercard Inc. (NYSE: MA) announced the latest financial results for the previous quarter before the market open on Thursday. World’s third larg...

January 27, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.