- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- “Will China Dump US Treasuries?”

News & Analysis“Will China Dump US Treasuries?”

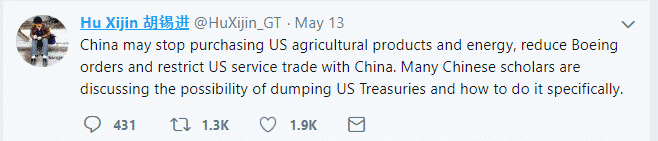

A tweet from Hu Xijin, editor-in-chief of the Global Times grasped attention on Tuesday morning, and even Bloomberg reported that it had triggered a readership surge on its Terminal.

It came at a time when China responded to the additional tariffs by increasing duties on $60 billion worth of US goods. The tweet was controversial as it raises questions on whether China is threatening the US on its debt through the media.

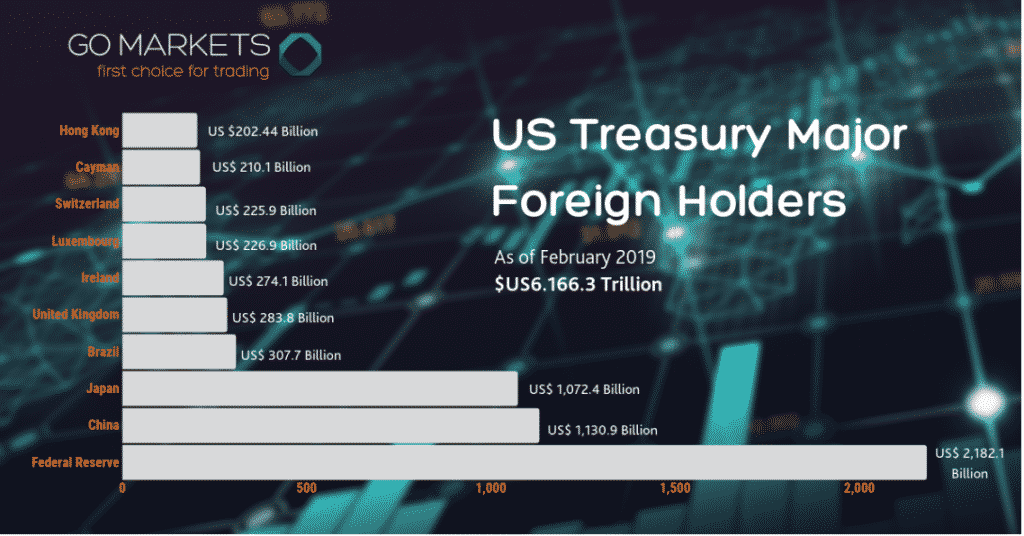

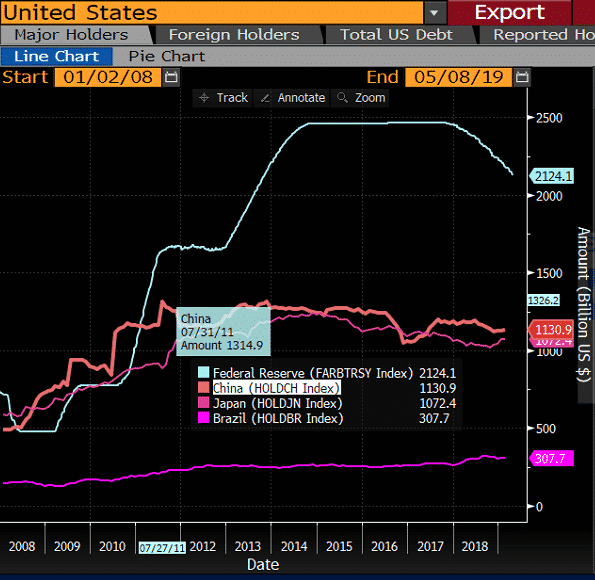

As of 02/2019, China remains the major foreign holder of US Treasuries. In the graph below, the trend is showing that China is not actively buying US Treasuries and has trimmed its exposure over the years. However, it is important to highlight that they are also not aggressively selling US Treasuries. After reaching a peak in 2011 with $1.31 trillion, their holdings dropped to $1.13 trillion.

Source: Bloomberg TerminalA large sale of US treasuries will be painful for both the US and China.

US Treasuries are risk-free assets that China might need to keep as a cushion for its economy rather than using it as a fighting tool in a trade war. It will also strengthen its currency which will be bad for its imports and economy. Overall, the effect will be harmful to China which is why the chances are selling US Treasuries are low.

Markets are calling it the “nuclear weapon or self-destructive nuclear option” as its effects will be disastrous, but it is being used as a weapon to threaten the other party.

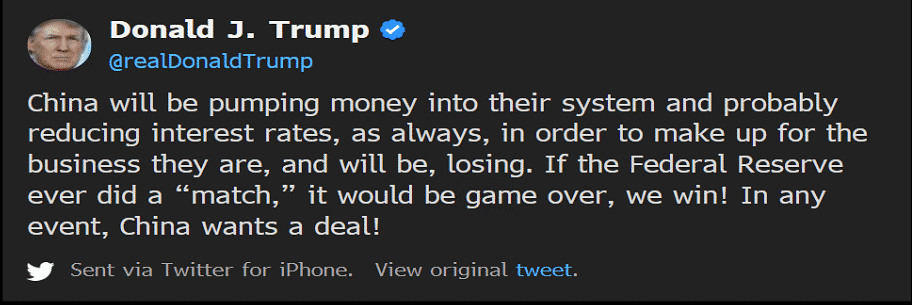

President Trump did not remain silent and tweeted that it would be “game over” if the Federal Reserve steps in. The latter will go back to quantitative easing and buy Treasuries to bring down yields and curb an upward move in the interest rate.

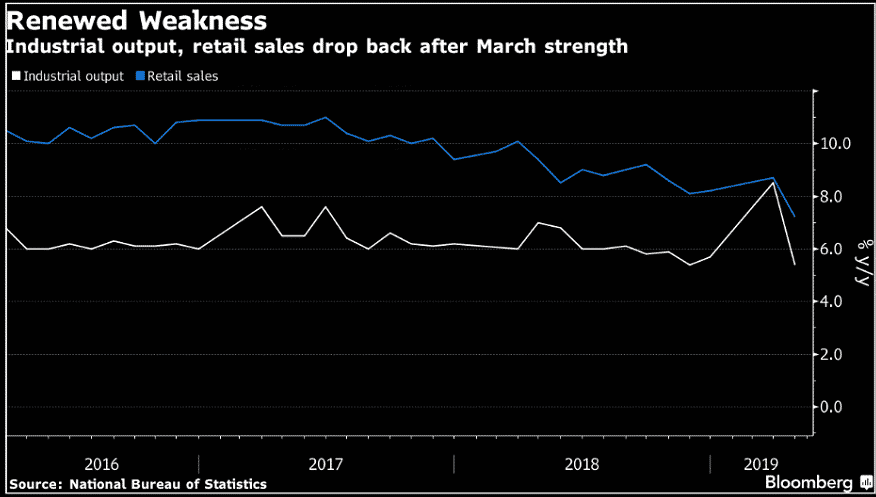

The reality of trade tariffs is scary and the tit-for-tat actions are putting the global markets on edge. On the economic data front, Chinese data released this morning are darkening the outlook for the latter. Both Industrial Production and Retail Sales took a dip and came way below expectations.

Source: Bloomberg Terminal

Similarly, there are also some signs of weakness in the American economy as per key economic indicators. There is a lot at stake, and even if both countries have access to policy tools to withstand the negative impact of the trade tensions, the long-term costs are not reassuring.

See our introduction to forex for more information, including ‘how to trade forex for beginners‘ here.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Option traders – Time to Hedge your Currency Risk?

Many traders utilise options amongst their investment strategies either for income or capital growth. As with Forex and CFD trading, options offer an opportunity to get into a leveraged position giving exposure to the movement of an underlying instrument. One of the key factors that options traders may consider in their choice of specific mar...

May 17, 2019Read More >Previous Article

Position Sizing for ASX Share CFDs ( Free calculator download )

Position sizing is simply the number of contracts that you choose to enter for any specific trade. It is this, combined with the movement in price ...

May 15, 2019Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.