- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrency

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Dynamic margin

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Signal Centre

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrency

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Dynamic margin

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Signal Centre

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- When less is more – Why one cut in 2024 was good news?

- Home

- News & Analysis

- Central Banks

- When less is more – Why one cut in 2024 was good news?

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisWe have been scratching our heads as to what exactly drove some of the strong price action in pairs, equities and bonds off the back of a further hawkish turn from the Fed at its June meeting.

So, what exactly has promoted the moves on markets and what else should we as traders acknowledge from the Fed meeting

First Powell has pointed to a positive change in the latest CPI inflation report. The 3.3% year on year rate was better than expected and is finally moving back in the right direction after the first quarter saw raises rather than declines.

Chair Powell’s comments at the press conference leaned more dovish, emphasising “broad” labour market data indicating that the labour market had returned to a pre-pandemic balance. He noted that further loosening might be seen as unnecessary and expressed no concern about an overly strong labour market despite recent robust payroll readings.

Here is a decent chunk of his message:

“If the economy remains solid and inflation persists we’re prepared to maintain the target range for the federal funds rate as long as appropriate. If the labour market were to weaken unexpectedly or if inflation were to fall more quickly than anticipated, we’re prepared to respond. Policy is well positioned to deal with the risks and uncertainties that we face in pursuing both sides of our dual mandate. We’ll continue to make our decisions meeting by meeting based on the totality of the data and its implications for the economic outlook and the balance of risks,”

However, he cautioned that there are clearly big areas of concern namely, owner’s equivalent rent (OER) did not decelerate (again) and with an 5.3% annual rate in the latest release it is eons away from where the board needs it to be.

If OER continues at this pace, it will be challenging for the FOMC to bring inflation sustainably back to 2% or gain confidence that it is heading there. Chair Powell emphasised the need for consistent structural data reasoning to move – clear in this quote “One reading isn’t enough. You don’t want to be too motivated by any single data point.”

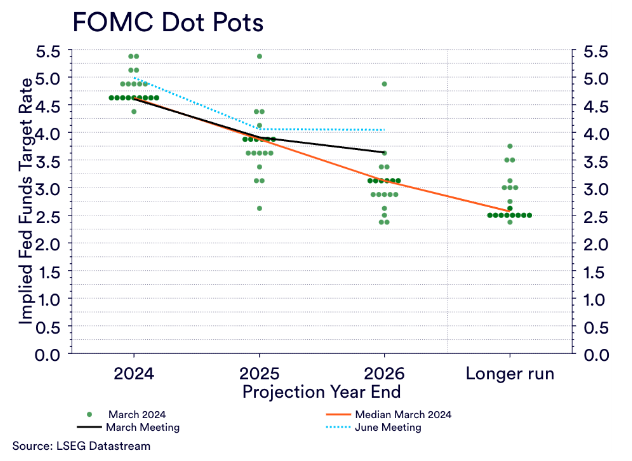

This is pretty clearly reflected in the latest Dot Plot, which is now signalling only cut in 2024 down from 3 at the March meeting. We have highlighted that in the orange and blue lines that shows the marked difference between the two.

The critical question now is whether there is sufficient data for the September FOMC meeting to justify starting the rate cut cycle in 2024. You only have to look at the record highs in US indices and the collapse in US yields to think September is near enough to a certainty.

Is this the view of the FOMC? The Committee will receive three more employment reports and three more CPI reports before the September meeting. Given their preference for communicating actions ahead of time, the timing of the first-rate cut will be significant and well flagged.

If you look back at the dot plots there is something clearly communicated there. Currently, 11 out of 19 board members expect to hold rates until December or even into 2025. Thus, as the majority see a holding pattern you could even argue that waiting for the fourth CPI and employment report plus 2 quarterly GDP reports if the board was to wait until November would be a more likely outcome.

Of the eight participants who favour two rate cuts this year, it’s estimated that this includes three to five regional Fed Presidents that are non-voting members and have minimal influence on policy.

All things being equal and judging by his public comments and history Powell is likely among those favouring a single cut, he will need to build consensus among the board members that are voting members and that appears easier said than done considering several of these players are hawks and will sit in the group that is holding rates out to 2025. To realistically consider a rate cut in September, a significant shift in data is needed in the next two months.

This is why we are asking the market – is less more? Less cuts, less clarity on inflation but clear drive into bullish positions? We know not to ‘fight momentum and the trend’. But it is also prudent to stop and ask if a swing back is likely. Unless there is a substantial weakening in growth and employment the prospects of a September cut look poor. And, given the FOMC’s cautious approach over the past 18 months and substantial lead time required for such decisions.

The consensus forecast in the labour market, sees moderation not a rapid decline, which does not support a rate cut in September. Thus mind the blow back as this concept builds momentum and shoves markets back the other way.

So, what exactly has moved the dial in markets to be so positive?

We think it’s the comments he made during his press conference that somewhat poured cold water on what have traditionally been seen as bedrock data.

First – Powell downplayed the importance of the Fed’s summary of economic projections (SEP) and the “dots,” describing them as mere possibilities. This feels like the good old days of the Yellen era where she too would remind everyone that forecasts are just that forecasts not actuals.

Will point to something that might have been missed – he also stated that officials could revise forecasts and dots after the release of CPI data, though “most don’t.”

Here are some of the key revisions in the SEP – an expected increase in core PCE inflation from 2.6% to 2.8%, reflecting higher-than-expected inflation in Q1 remembering that this is the measure the Fed needs to at or around 2%. The unemployment rate and GDP growth were left unchanged at 4.0% and 2.1%, respectively.

Second – The dot plot projections showed an upward revision of 25 basis points for 2025. Really this is just a push back of the rate expectation for this year. But and it is a large and consistent but – The dot plots suggest once the cuts begin the path of quarterly rate cuts once they begin cuts will be rather consistent. This view has not changed since reaching the peak of the hike cycle.

So if this is indeed the case – market positioning is banking on this time next year being the ‘middle’ of a significant rate cutting cycle.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

A frightened Hawk – The RBA needs to come clean

We know that this is slightly contrary to the consensus views but we think it needs to be said. The communication from the RBA (Reserve Bank of Australia) is unusually unclear, confusing and conflicted. The view conveyed in statement, press conference and minutes currently we would argue counter each other. And the reason for this we believe i...

June 20, 2024Read More >Previous Article

The Tricky trade of Oil

Never has the oil been trickier than it is right now. The influences on the price are complex, varied and time dependent. It’s even trickier when ...

June 12, 2024Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.