- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Dynamic margin

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Signal Centre

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Dynamic margin

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Signal Centre

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Central Banks

- Trading the inflation bumps Part 2: Narrow to non-existent

- Home

- News & Analysis

- Articles

- Central Banks

- Trading the inflation bumps Part 2: Narrow to non-existent

News & AnalysisNews & Analysis

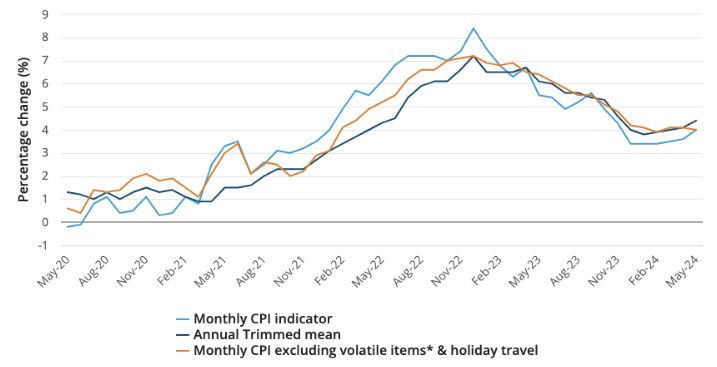

News & AnalysisNews & AnalysisFirst – let us just say that as we suspected the AUD jolted all over the place on the release of the May CPI – the read was much stronger than consensus and the fallout from the read ongoing. But, and it’s a but, we predicted the AUD’s initial bullish reaction was counted by once again point to the fact parts of the monthly read can be explained away by changes made in May 2023.

With that trade taken care of – we need to look to how things might transpire over the next period. And that means digging through the monthly read for what matters and what doesn’t and thus start to assess an environment where the ‘frighten hawk’ that is the RBA moves on rates.

May CPI 4.0% year on year – highest read since November 2023

So where are we? The non-seasonally adjusted monthly CPI indicator for May 2024 came in at 4.0% year-on-year smashing market consensus 3.8%, marking the highest rate since November 2023, the third consecutive monthly rise and marking 5 months since inflation was on a downward trajectory.

This jump needs to be put into context too April 2024 CPI was 3.6% year on year, the trough of 3.4% year on year observed from December to February feels like a distant memory.

However as we mentioned above the market has found reason to back track on its initial bullishness most likely due to the month-over-month CPI in May 2024 decreased by -0.1% aligning with the ‘seasonal average’ of -0.1% since 2017. Compare that to the +0.7% month on month increase in April 2024, well above the seasonal average of +0.3%.

However the RBA doesn’t use headline CPI seasonally adjusted or not – it cares about core inflation which strips out the top and bottom 15%. And that means looking at trimmed mean CPI.

The trimmed mean CPI, spiked to 4.4% year on year, also the highest reading since November 2023. This marks a significant reacceleration from the 3.8% year on year low in January and the 4.1% year on year rate seen last month.

As has been the case for most of 2024 goods inflation has remained steady holding around 3.3% year on year. The issue is services inflation which has surged to 4.8% year on year.

Another part of the inflation ‘story’ as to why inflation is so high has been global supply. However, the data has proven this to be false. Tradables (inflation that has international exposure) although rebounding in May to 1.6% from 1.1% is well below current inflation issues. Non-tradables (domestic only facing inflation) remains well above target at 5.2% in May from 5.0% in April. This is a domestic-led spending issue and why the RBA is in play.

Key Date: 31 July

Second quarter CPI is out July 31 – as mentioned in Part 1 there is still some inputs that will be released in the coming 4 weeks that will shift expectation and consensus. But in the main the consensus read now are pretty close to the final reads. The headline CPI is now expected to rise by 1.0% quarter on quarter (range 0.7% – 1.2) and 3.9% year on year (range 3.6% to 4.1%), above the RBA’s May 2024 Statement on Monetary Policy (SOMP) forecast of 3.8% but possibly ‘tolerable’ but only just. A caveat to this figure is fuel price expectations for June, which sits at a decline of -1% month on month, which would subtract approximately ~4 basis points from the headline CPI.

But we digress as the trimmed mean consensus forecasts however are a concern and might not be tolerable for the RBA.

Consensus forecasts for trimmed mean sits at 1.0% quarter on quarter (range 0.8 to 1.1%) and for a year on year increase of 3.9% year on year rise (range: 3.7% to 4.1%) also above the RBA’s forecast of 3.8% year on year. Any slip into 4% on the trimmed mean figure and Augst 6 will be green lit.

The trade

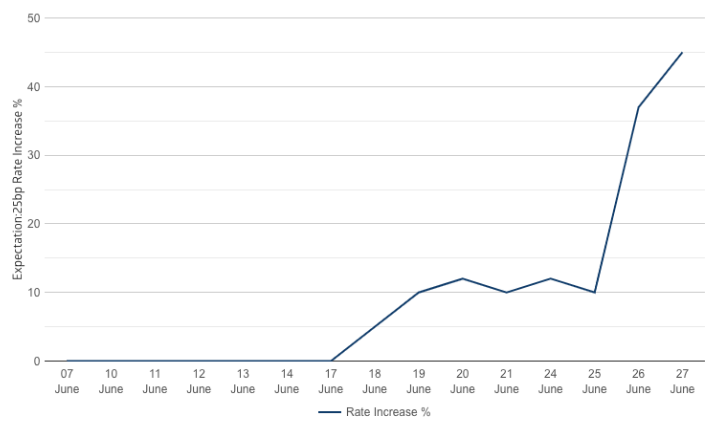

So how to position for the coming 5 weeks ahead of the August 6 meeting. Firstly understand that consensus amongst the economic world is the August meeting has a 35% risk of seeing a hike.

The market is stronger at 45% – however it was as high as 61% at the peak of the bullishness post the inflation drop.

We should also point out that pre-June 5 the pricing in the market was for cuts not hikes. Showing just how fast and hard the interbank and bond markets have swung around.

We also need to return to Governor Bullock’s hawkish June press conference where the Board considered a rate hike and did not entertain a rate cut. We also pointed out that every time the Board has added this sentence to the statement: The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome. It has seen a rise in the preceding meeting.

We believe this give the upside potential more impetus and that will positively push the AUD higher over the coming weeks something we think is not fully factored into trading to date.

Then there are the other asset classes. Hikes complicates the outlook for equities, particularly as inflation remains sticky, especially in the services. Thus which sectors and areas of the equity market sure we be on the look to for signs of stress?

A prolong period of weakness in domestic trading conditions and the likely rise of frugal consumer behaviour will present challenging earnings for first half of fiscal year 2025 for discretionary and service sector stocks. Couple this with evidence of a slowdown in housing activity, material handling, product and construction stock are also likely to face pressure in early FY25.

Need to also address Banks – which have been one of the best trades in FY24 with CBA leading the pack here, the question that remains however is that bank price growth in FY24 has been due to rate cut expectations and optimistic credit-quality risks. This explains the elevated bank trading multiples. Weakening housing activity, will likely see investors questioning multiples of this nature in the near future.

Trading the inflation story over the coming 5 weeks will be fascinating.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

An oldie but a goodie – Why central bank differentials still work

2024 continues to be an interesting year for FX. Even more now that the starters gun has been fired with the European Central Bank (ECB) and Bank of Canada as well as the likes of the Riksbank and SNB all starting to their respective cash rates from COVID peaks. This brings us to the next stage – who is next, who is going the other way and whe...

July 3, 2024Read More >Previous Article

Trading the Inflation bumps – The May surprises and what to do with it

The consensus for the monthly Consumer Price Index (CPI) is for a rise to 3.8% annually in May, the range being 3.6% to 4.0%. This would be the fourth...

June 25, 2024Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.