- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- RBA cut interest rates

News & AnalysisUpcoming News

» 6:30pm Construction PMI – GBP

» No release time, GDT Price Index – NZD

As expected the RBA cut interest rates by 25 basis points. The AUDUSD dropped on the news but has retraced most of its drop. The AUDUSD lost 54 pips to .7488, buyers have come back in taking it back above .7500. The AUS200 lost ground after the disappointing building approvals and trade balance figures. It found some buying support post rates release but is currently still trading lower by 23 points. The USD and JPY have seen quiet trade so far today with small Asain session ranges. Signs did come in we might be some JPY selling but currently, it’s very choppy with little direction.

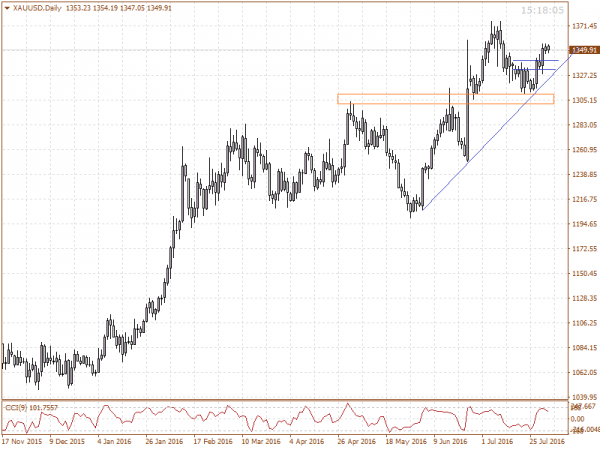

Tonight I’m looking for weaker opens in Europe with strong selling on the GER30 and UK100 overnight. The UK100 has broken out of a trend channel and is sitting around a support base. Gold is showing active sellers at 1354 this could come in as short term resistance off 1355. Price is still in a short-term trend up but I would like to see 1354.20 closed above to show a continuation towards 1366 highs.

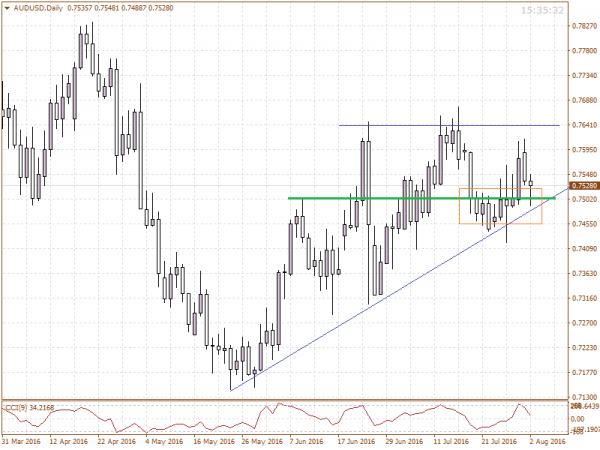

AUDUSD – Considering the negative influences today the AUD has held up very well. The rate cut took prices down to .7490, this area has shown support and indecision previously. We have seen this area reconfirm today. I’d be paying attention to this level for the near term. Continued buying could set up a failed low if buying holds out tonight.

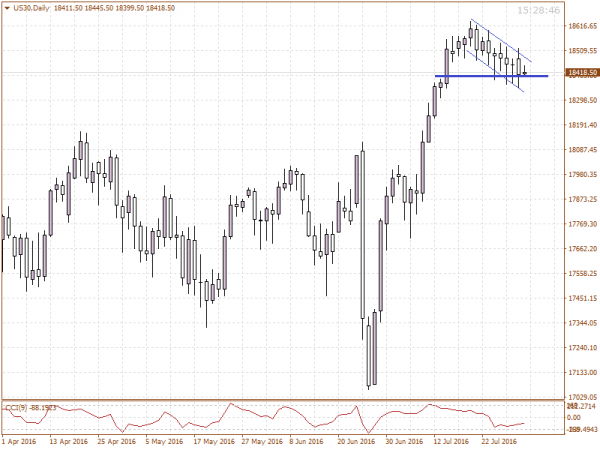

US30 – Today’s price is sitting on a key short-term level. Overall we have a bearish channel. The key level 18395 has seen 5 tests holding up so far. To the top, we have a lot of downward pressure. A break lower set’s in new prices not seen since mid-July. A break above the channel sets up a continuation of the current trend which could offer a buy idea. If we see a break lower, I’d be looking for a test down to 18235.

XAUUSD – Gold is showing a normal trend formation with the current retracement not overlapping its previous high. 1355 is showing short-term resistance. Overall the picture still looks good on the Med term for continued higher prices. I would like to see any short term pull back to find support from 1333 to 1341. A break and close below 1333 could be indicating a lower high is coming in and confirming.

Good Trading.

Please note that trading Forex and Derivatives carries a high level of risk, including the risk of losing substantially more than your initial investment. Also, you do not own or have any rights to the underlying assets. You should only trade if you can afford to carry these risks. Our offer is not designed to alter or modify any individual’s risk preference or encourage individuals to trade in a manner inconsistent with their own trading strategies.

All times are in AEST.

Written by Joseph Jeffriess, GO Markets Market StrategistReady to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Eyes are on the BOE tonight for the rate decision

Upcoming News » 9:00pm BOE Inflation Report - GBP » 9:00pm MPC Official Bank Rate Votes - GBP » 9:00pm Monetary Policy Summary - GBP » 9:00pm Official Bank Rate - GBP » 9:30pm BOE Gov Carney Speaks - GBP » 10:30pm Unemployment Claims - USD » 11:30am RBA Monetary Policy Statement - AUD Eye’s are on the BOE tonight for the rate dec...

August 4, 2016Read More >Previous Article

JPY sees a wild trading session

Upcoming News » 10:30pm GDP - CAD » 10:30pm Advance GDP - USD » Sat 6:00am EBA Bank Stress Test Results - EUR, USD, JPY The JPY saw a wi...

July 29, 2016Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.