- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Preview: The European Central Bank Rate Decision

- Previous: 0.25%

- Forecast: 0.25%

- Previous: -0.40%

- Forecast: -0.40%

News & Analysis

On Thursday, the European Central Bank will announce its first policy decision of the year on whether to increase, decrease or maintain the interest rates. The decision is scheduled to be announced at 12:45 PM UK time.

Why Is The Announcement Important?

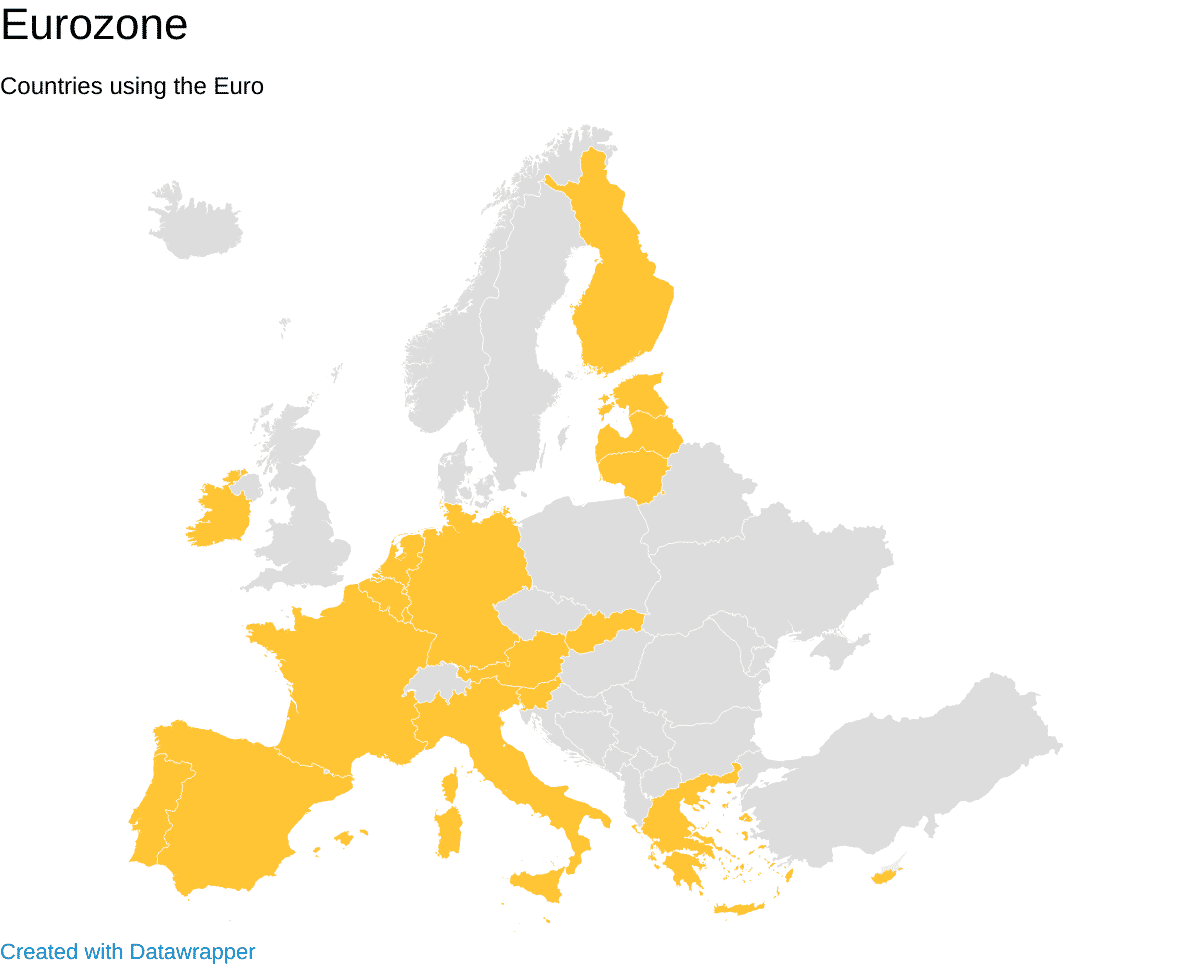

The European Central Bank is the central bank for the Eurozone, the countries which have adopted the Euro. The countries include Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, and Spain. ECB’s decision to increase, decrease or maintain the interest rate has a significant impact on the financial markets because changes in interest rates affect the exchange rate of the Euro, so it is one of the must-watch economic events in the calendar.

Expectations

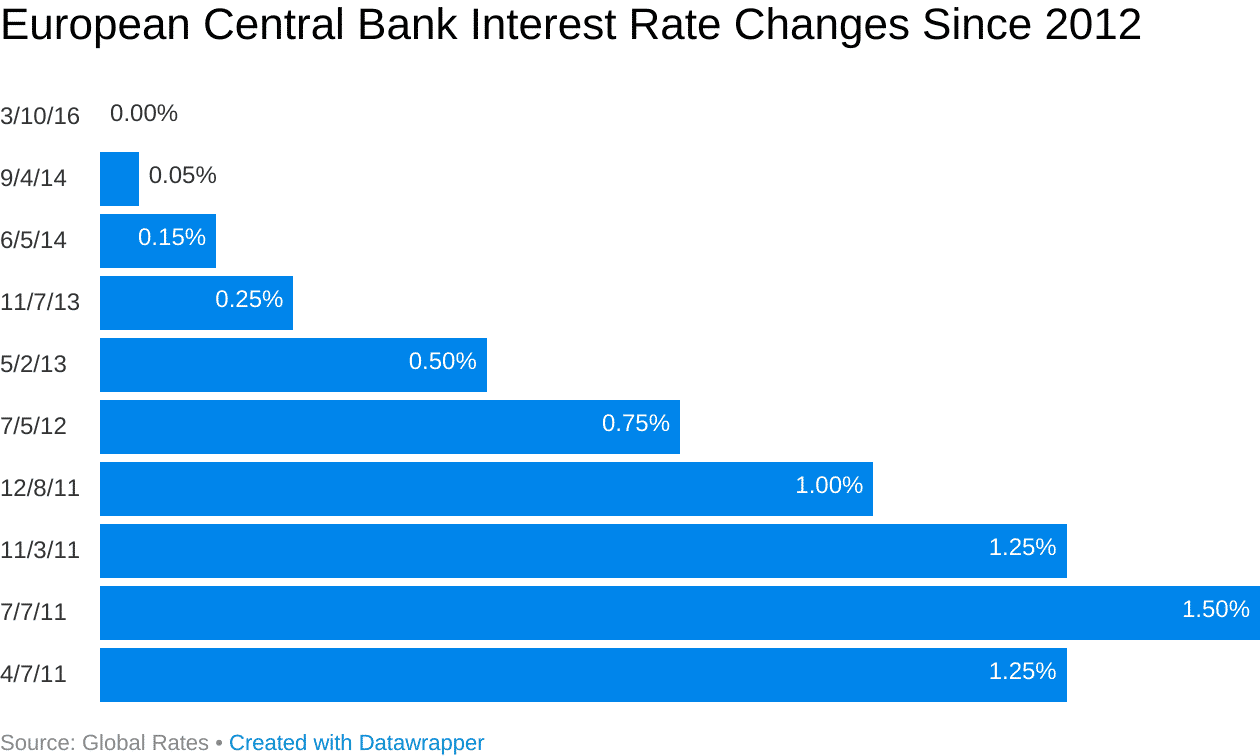

The European Central Bank has not changed its interest rates since March 2016 and analysts are forecasting that the rates will also remain unchanged in the upcoming policy meeting.

Even though an interest rate change is not expected, it will be worth keeping an eye on the European Central Banks President, Mario Draghi’s speech shortly after the announcement being made because we may hear some clues about future rate policy, Brexit, China slowdown, Italian budget and the ”yellow vest” protests in France.

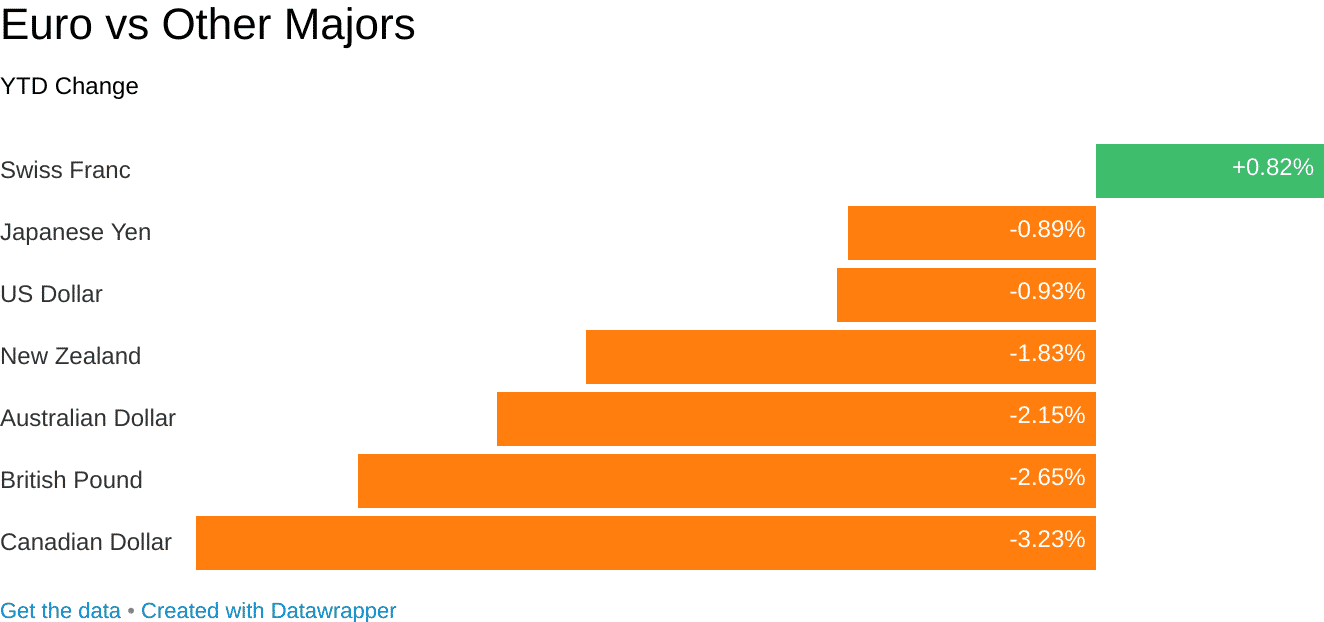

All eyes on the Euro ahead of the announcement.

20th Anniversary

The Euro turned 20 years old this month. On 1st January 1991, 11 countries of the European Union launched the Euro and introduced a shared monetary policy under the European Central Bank. Fast forward 20 years, the currency is used by around 340 million Europeans in 19 of the member states. The Euro also the second most traded currency in the world behind the US Dollar.

“The euro was a logical and necessary consequence of the single market. It makes it easier to travel, trade and transact within the euro area and beyond. After 20 years, there is now a generation who knows no other domestic currency. During that time, the ECB has delivered on its main task of maintaining price stability. But we also contribute to the well-being of euro area citizens by developing safe, innovative banknotes, promoting secure payment systems, supervising banks to ensure they are resilient and overseeing financial stability in the euro area” Mario Draghi, President of the European Central Bank, said on the anniversary of the Euro.

Other ECB data releases to keep an eye out:

ECB Marginal Lending Facility (12:45 PM London time)

ECB Deposit Facility Rate (12:45 PM London time)

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: Go Markets MT4, Google, Datawrapper, ECB

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Margin Call Podcast – S1 E2: Tom Williams | GO Markets Head of Trading

Tom Williams (@TomW_GOMarkets) is the GO Markets Head of Trading. He started out as a dealer and broker in the excitement-driven city of London across equities, fixed income and foreign exchange. Learning the technical aspects of what is now a software-driven business has allowed Tom to lead all trading operations at GO Markets, literally keepi...

January 25, 2019Read More >Previous Article

International Monetary Fund (IMF): Growth Warnings

The World Economic Outlook has further shifted to the downside. The growth estimates for 2019 and 2020 were downgraded in October 2018 mainly due...

January 22, 2019Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.