- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Central Banks

- Australian CPI figures increase to 6.1%

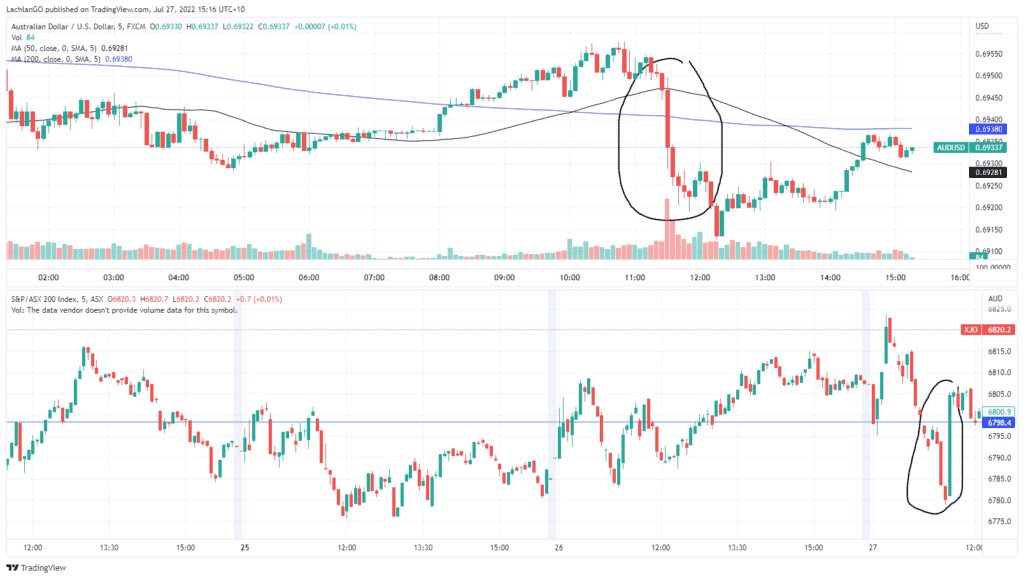

News & AnalysisThe Australian Consumer data was released today with Consumer Price Index rising to 6.1% over the past 12 months. For the quarter, the CPI rose by 1.8% which was 0.1% lower then what analysts expected the figure to be. This was also lower then the 2.1% jump seen in the previous March quarter. The most significant contributors to the increase were new dwellings, +5.6%, and automotive fuel +4.2%. Whilst the overall numbers were only slightly off what was expected, the update provided some small relief to a market that has been dealing with record high-inflation.

Australian Treasurer, Jim Chalmers stated that “Inflation is high and rising. It will get tougher before it gets easier.” In response the XJO, (ASX200) saw a big spike, shooting up by 0.36% in the 5-minutes post the announcement. Conversely, the AUDUSD dropped from $0.6946 to $0.6913 in the half hour after the announcement as the market adjusts the value of the AUD to the likely lower interest rates.

Bond Market responds

The bond market responded by lowering its predicted interest rate hike next Tuesday by the Reserve bank of Australia. The interbank futures were implying a 16% chance for a 75-basis point shift before the announcement. However, now the bond market is pricing in a 92% chance of 50 basis point move. Commonwealth Bank of Australia has also confirmed its expectation of a 50-point hike at the next meeting. The bond futures market is also adjusted its prediction of a cash rate of 3.18% by the end of the year against the 3.38% that was forecast before the meeting.

With important data to come out of the USA tonight including Q/Q advance GDP figures as well as the Federal Reserve’s Cash Rate announcement, the end of the week may very well continue to be volatile.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Meta earnings results are in – the stock falls in the after-hours

Meta Platforms (META) announced its Q2 financial results after the closing bell in the US on Wednesday. The social media giant fell short of analyst expectations for the quarter. Revenue reported at $28.822 billion in Q2 (down by 1% year-over-year), vs. analyst estimate of $28.908 billion. Earnings per share at $2.46 per share (down by 32%...

July 28, 2022Read More >Previous Article

Wheat Trading Opportunities

Wheat Trading Opportunities Wheat is a well-known soft commodity that is vital for any kind of bread product. It also has important uses fo...

July 26, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.