- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Central Bank Interest Rates

News & AnalysisCentral Bank Interest Rates

By Klavs Valters

A central bank’s interest rate is a rate at which it typically lends money to local banks. This interest rate is charged by nations’ central or federal banks on loan advances to control the money supply in the economy and the banking sector.

Each central bank has its own annual schedule when announcing its rates. In the trading world, it’s prudent to keep a tab on these announcements as it impacts market volatility if there is a sudden interest rate rise or fall.

These rates also have an impact on everyday life, as they often determine what you pay for borrowing money, as well as what the bank will pay you for saving money.

Recent Rate Hikes

The most recent rate hike came from the US Federal Reserve back in March 2018, when it increased its rates from 1.5% to 1.75%. Additionally, the Federal Reserve also signalled its intention to further raise this rate in the future. This has been the sixth time the US Federal Reserve has raised its interest rates since the 2008 financial crisis.

Bank of Canada increased its key interest rates back in January by 0.25% to 1.25% while quoting a number of upbeat news stories, including an economy that is running flat-out, healthy job gains, and the lowest unemployment rate in over 40 years. This has been Bank of Canada’s third rate hike since the summer of 2017, and the first time the overnight rate has been above 1% since 2009.

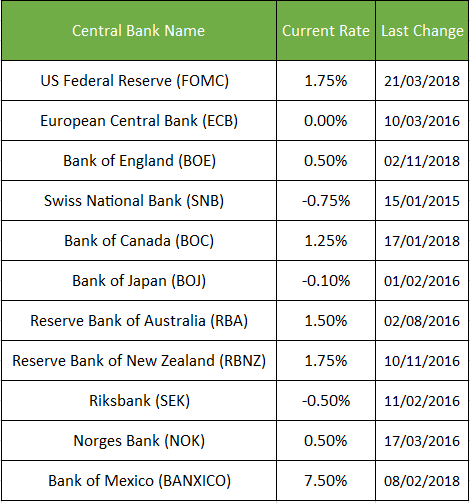

Current Bank Interest Rates

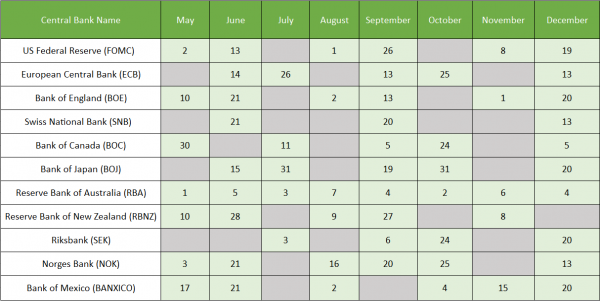

Central Bank Interest Rate Announcement Timetable for 2018

To keep up to date with other news announcements, visit our ‘Economic Calendar’ section on our website – https://www.gomarkets.com/economic-calendar/Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Premium MT4 Trading Tools

As a pioneer of providing MetaTrader 4 in Australia since 2006, our premium MT4 trading tools help provide you with real time trading alerts and a suite of MT4 add-ons to help improve your trading experience when trading the global markets. Whether you prefer to trade Forex, Indices or Commodities, our choice of premium MT4 trading tools will provi...

June 1, 2018Read More >Previous Article

Federal Budget 2018: A Mixed Reaction

Federal Budget 2018: A Mixed Reaction By Deepta Bolaky Treasurer Scott Morrison handed down his third incorporating tax cuts, superannuation benefit...

May 14, 2018Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.